For many investors, 2022 was a year to forget. High inflation, the Russia-Ukraine war, China’s COVID-19 lockdowns, central bank policy fears and recession concerns weighed heavily on investor sentiment and led to broad declines in global equity markets. Some measures of investor sentiment fell to levels last seen during the 2007-2008 global financial crisis despite a starkly different economic backdrop. While falling markets are painful for investors, they often provide important and enduring investment lessons. In this article, we’ll explore three key investment lessons Fisher Investments Canada believes can provide valuable wisdom to long-term investors.

Safe havens aren’t always safe

During bear markets – prolonged market declines of 20 per cent or more – investors often move from equities to assets that are considered “safe havens,” including fixed-interest investments, gold and cash. However, investors who sought these safe-haven assets were likely disappointed in 2022.

Fixed interest investments are typically less volatile than equities in the short term, and can be an important component of an investor’s portfolio, depending on their goals and financial circumstances. However, fixed interest prices, which move inversely with interest rates, were also down meaningfully in 2022 as interest rates rose. As a result, the rare, but not unprecedented, scenario arose of equities and fixed interest both falling together. Historically, this scenario occurs just five per cent of the time over a 12-month period, making 2022 a particularly painful year for both equity and fixed interest investors.¹

Cash was also void of its usual safe-haven status in 2022. While cash certainly performed better than other asset classes, such as equities or fixed interest, on an absolute basis, high levels of inflation chipped away at cash’s buying power. Even after rising modestly in 2022, Fisher Investments Canada saw bank deposit interest rates remain far below inflation rates.

Gold is another popular safe haven among some investors. Given its perceived status as a hedge against inflation and declining markets, gold should have performed exceptionally well in 2022. Gold values did in fact rise in early 2022, but quickly peaked on March 8 and dropped 10.8 per cent through year-end – exceeding global equities’ 5.6-per-cent drop over the same time period.²

At Fisher Investments Canada, we believe the poor returns of the aforementioned safe havens may indicate this bear market ends without traditional “capitulation.” Investors have widely called for capitulation, which is a mass panic-selling free fall that typically accompanies bear market bottoms. However, capitulation usually only occurs when there are alternative options to equities. And in today’s world, we see very few.

A new bull market quietly starting while investors await capitulation is not without precedent. The 1966 and 1982 bear markets did not feature widespread capitulation. While it remains too early to see, Fisher Investments Canada believes it’s likely a new bull market may start in a similar fashion this time around.

Proper diversification is critical

Investing in growth equities has been popular for many years heading into 2022 because growth consistently outperformed value equities. When one category leads for a sustained stretch, it often tempts investors to abandon their discipline and “chase heat” by selling recently poorly performing investments for better-performing ones. However, 2022 was a reminder of why that strategy doesn’t work over the long term.

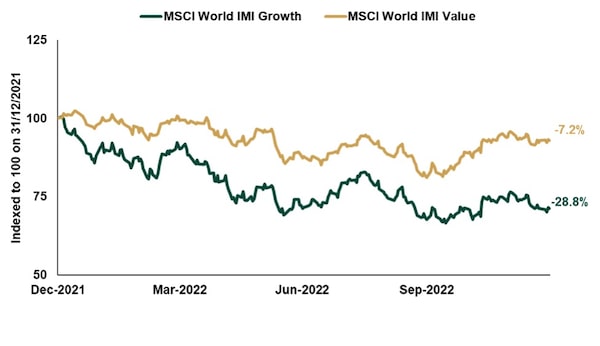

As Exhibit 1 shows, value equities, which are those considered to be trading for a lower price than their fundamentals and financial performance suggest they’re worth, outperformed in 2022 as energy boomed and other defensive sectors such as consumer staples, utilities and health care held up relatively well. Conversely, growth equities, which are those exposed to trends that allow them to grow faster than the broader economy and are common in sectors such as technology, consumer discretionary and much of communication services, were among the worst-performing in 2022.

Exhibit 1: Leadership shifts from growth to value in 2022

Source: FactSet, as of 02/02/2023. MSCI World Growth and MSCI World Value with net dividends, 31/12/2021 – 30/12/2022. Presented in U.S. Dollars. Indexed to 100.Provided

Shifts in market leadership among styles, sectors and countries are a common feature of equity markets and tend to ebb and flow over time. Fisher Investments Canada believes this latest shift in style leadership provides another caution against becoming overconcentrated in one sector, country or style, and a reminder of the benefits of a well-diversified portfolio.

A bear doesn’t have to derail your investment strategy

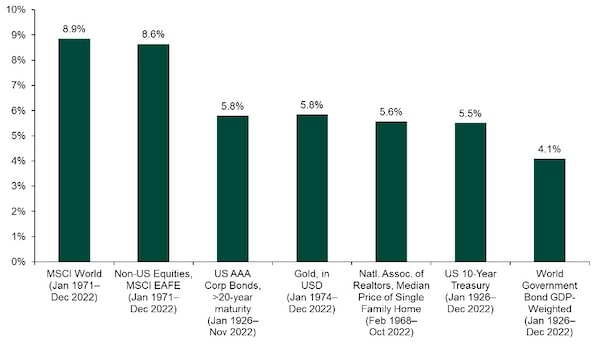

Ken Fisher, founder and executive chairman of Fisher Investments, has long referred to the equity market as “The Great Humiliator” – a force with the goal of fooling as many investors as possible for as long as possible and for as much money as possible. Bear markets can be a particularly difficult time for investors, tempting even the most steadfast among them to make dramatic changes to their strategy. At Fisher Investments Canada, we believe investors should resist this temptation and remain focused on their long-term financial goals. Staying invested through a bear market isn’t easy but, as shown in Exhibit 2, global equities’ average an annualized return of 8.9 per cent, including in bear markets, making equities the best-performing asset class historically.

Exhibit 2: Equities lead in long-term performance

Source: Global Financial Data, FactSet as of 11/01/2023. Presented in U.S. dollars. Past performance is not predictive.Provided

While it can be difficult, Fisher Investments Canada knows remaining invested in the market can help investors capture the strong initial bounce that accompanies the start of a new bull market. This bounce typically arrives when investors least expect it and can be important to long-term investing success. There is good reason to capture as much of the initial bull market return as possible. On average, nearly half of the first year’s return has occurred in the first three months of each bull market. As Exhibit 3 shows, the first three months’ average return is more than 17 per cent. Missing those big, early returns could mean a huge opportunity cost in a portfolio.

Exhibit 3: Don’t miss the bounce that new bull markets bring

Source: FactSet as of 11/01/2023. Monthly price returns 31/12/1969 – 31/12/1975, MSCI World daily price returns 01/01/1976 –10/01/2023. Presented in U.S. dollars. Past performance is not predictive.

Bull markets last longer and are stronger than bear markets. Long-term investing takes courage, but markets tend to reward investors who stay disciplined. Fisher Investments Canada believes investors who heed that advice are more likely to stay on track in their pursuit of their investment goals.

Investing in financial markets involves the risk of loss and there is no guarantee that all or any capital invested will be repaid. Past performance is no guarantee of future returns. The value of investments and the income from them will fluctuate with world financial markets and international currency exchange rates. This document constitutes the general views of Fisher Investments Canada and should not be regarded as personalized investment or tax advice or as a representation of its performance or that of its clients. No assurances are made that Fisher Investments Canada will continue to hold these views, which may change at any time based on new information, analysis or reconsideration. In addition, no assurances are made regarding the accuracy of any forecast made herein. Not all past forecasts have been, nor future forecasts will be, as accurate as any contained herein.

Fisher Investments Management, LLC does business under this name in Ontario and Newfoundland & Labrador. In all other provinces, Fisher Asset Management, LLC does business as Fisher Investments Canada and as Fisher Investments.

1Source: Global Financial Data, as of 24/01/2023. Rolling 12-month correlations between S&P 500 and US Treasury 10-Year Government Bond Yield Total Return Indexes, monthly, 31/01/1926 – 30/12/2022. Presented in U.S. dollars.

2Source: FactSet, as of 24/01/2023. MSCI World Total Returns with net dividends and Gold NYMEX Price Returns, 08/03/2022 – 31/12/2022. Presented in U.S. dollars.

This content was produced by Fisher Investments Canada. The Globe and Mail was not involved in its creation.