Deloitte LLP released its third annual snapshot of the Canadian cannabis market this morning. Under the headline “Cannabis 2.0”, the consultancy has focused this report on edibles, which will become legal this fall.

Below are the key takeaways from the Deloitte online survey of 2,000 adult Canadians conducted between Feb. 26 and March 11, 2019. The sample includes representation from every Canadian province and was designed to be representative in terms of age and gender.

Deloitte estimates that the Canadian market for edibles and alternative cannabis products will be worth $2.7-billion annually – with cannabis extract-based products making up the bulk of that total at $1.6-billion. Deloitte also sees “significant opportunity” in this segment: cannabis-infused beverages ($529-million; topicals ($174-million); concentrates ($140-million); tinctures ($116-million); and capsules ($114-million).

Edibles, Deloitte predicts, “will prove to be a more successful segment in Canada, in part because the Canadian market is currently more scalable than the U.S. market.” The report says Canadians “will appreciate edibles’ discreetness and lack of surrounding stigma,” which should lead to “a more profitable product line for retailers, who will also be able to leverage a wide assortment of edibles to provide the customer experience consumers crave and differentiate themselves in the market.”

First up, here is a snapshot of U.S. cannabis sales in 2018 (all charts below are from the Deloitte study):

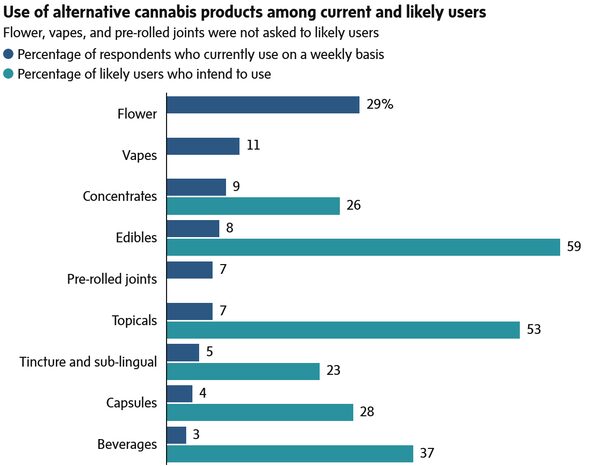

Here is a look at Canadian consumer preferences based on Deloitte’s survey:

Deloitte’s survey suggests that both current (53 per cent) and likely consumers of edibles see the products as something to be consumed socially among a small group of friends, and nearly half of likely buyers say they’d prefer to consume at home:

One of the concerns around “cannabis 2.0” is that consumers will switch their preferences away from the already legal cannabis products. But Deloitte says their research isn’t showing this – at least not yet. “Fewer than one in five current or likely respondents say their edible spending would replace spending on other products. Nearly half say they’ll buy edibles as well as the products they’re already buying ... This suggests that Canada’s domestic cannabis market has room to grow.”

The survey says about one in three (35 per cent) of likely cannabis consumers “see cannabis-infused beverages as an alternative to alcohol – perhaps seeing cannabis beverages as a way to relax, sleep, alleviate stress or anxiety, lift their mood and have fun with friends without the risk of a hangover the next day.”

Similar to its finding on edibles, Deloitte doesn’t think cannabis-infused beverages will cut significantly into sales of other cannabis products.

The Globe and Mail

Here are a few other highlights from the study:

- “Salves, gels, and creams are popular among both current and likely cannabis consumers. Thirty four per cent of likely cannabis consumers say they expect to use cannabis lotions at least every two weeks, roughly the same percentage of current consumers already do.”

- “The overwhelming majority (71 per cent of current consumers and 79 per cent of likely consumers) use or plan to use topicals to alleviate or treat specific pain.”

- “The growing use of cannabis as a wellness product or to alleviate pain isn’t surprising: Canadian cannabis industry stakeholders have worked together to create an industry-wide, globally scalable traceability framework to ensure a safe, efficient global cannabis chain that would extend to the genetic composition of the cannabis strain itself. This could be cause for concern for the traditional pharmaceutical sector, as 45 per cent of current consumers and 48 per cent of likely consumers say they see cannabis topicals as an alternative to prescription medications, not a complement.”