HIGHLIGHTS

- Low-cost production in countries like Colombia could cause Canadian LPs to divest assets

- AltaCorp pegs average marijuana cost-of-production at $3.92/g in Canada

- PharmaCielo agrees to buy Australia’s Creso Pharma for A$122-million

AltaCorp Capital Research expects that low growing costs in countries like Colombia could cause some Canadian cannabis producers to divest their cultivation assets and focus on downstream opportunities, such as branding and consumer packaged goods, to remain competitive.

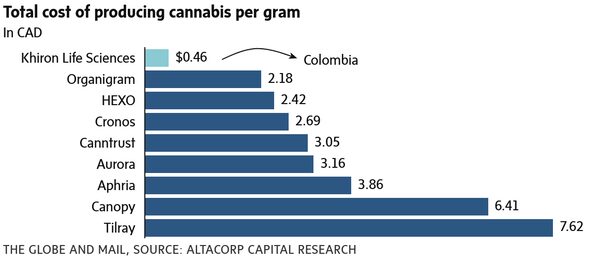

The Calgary-based investment dealer’s research team pegged the average cannabis production cost in Canada at $3.92 a gram, based on data from eight Canadian licensed producers (LPs) that ranged from $2.18 to $7.62.

This compares with Khiron Life Sciences Corp.’s estimated cost of cannabis production at 46 cents a gram in Colombia, where favourable cultivation conditions mean higher yields and lower costs.

“Moreover, the costs associated with land, construction, and labour are substantially lower in Colombia compared to those in Canada,” AltaCorp said in a note.

“Based on these factors, we expect Colombian cannabis companies, including Khiron, to maintain distinct cost advantages relative to many Canadian based cannabis LPs.”

Already, Canadian LPs have started to make moves into Latin America. Last year, Canopy Growth Corp.’s Latin American subsidiary bought Spectrum Cannabis Colombia to feed into the medical marijuana market. Aphria Inc. bought SOL Global Investments’ LATAM Holdings Inc., which included licences and government partnerships in Colombia, Argentina and Jamaica. Also in 2018, Aurora Cannabis Inc. bought ICC Labs, which had medical cannabis production licences in Colombia.

On Thursday, Toronto-based PharmaCielo Ltd. that is the parent company of its namesake in Colombia, said it entered into a scheme implementation agreement to buy Australia-based Creso Pharma Ltd – a medical cannabis company – for A$122-million ($114-million). PharmaCielo’s cannabis production facilities are in Colombia, and the closing of this purchase will expand the company’s sales reach, with expectations to expand its import and export capacity of CBD and medicinal grade cannabis, PharmaCielo said in a statement.

“As the cannabis industry matures, we believe that more LP’s will further focus their core competencies on activities that can maintain a competitive advantage,” AltaCorp said.

“We may see Canadian LPs choosing to divest cultivation assets or outsourcing cultivation activities over the long-term.”

Companies that opt to focus their businesses in Latin America “may see meaningful opportunities in the cannabis sector,” AltaCorp said.