Briefing highlights

- Canada’s economic growth to slow

- Where and how we’ll pull back

- The outlook for the oil market

- The NAFTA ‘800-pound gorilla’

- Jobless rate eases to 5.7 per cent

- Trade deficit swells in November

- U.S. jobs growth cools

- Stocks, loonie at a glance

Canada may have been the economic star of the G7 in 2017. But this year we're tapped out, possibly crapped out and maybe hung out.

Tapped out because consumers will be forced to ease up on spending that has pumped economic growth.

Possibly crapped out because the oil market could be like a roll of the dice in a craps game, and Canada has already thrown a "7 out" on one count.

And maybe hung out - to dry - at the NAFTA bargaining table.

It's not that it's going to be bad. Rather, we'll see more moderate economic growth, softer employment gains, and pressure on business investment amid the angst over the fate of the North American free-trade agreement.

- Part 1, Monday: Stocks: A risky mechanical bull

- Part 2, Tuesday: Loonie (lame), interest rates (pain)

- Part 3, Wednesday: Housing, mortgages and Canada’s banks

- Part 4, Thursday: Eroding wealth and hideous finances

"A key reason for the slowdown in growth in the next two years that we forecast is our expectation that the contribution of consumer spending will decline," said David Watt, chief economist at HSBC Bank Canada.

"Canada continues to face prominent domestic risks owing to heavily indebted households, external risks owing to trade policy uncertainties, and a heavy reliance on foreign portfolio flows to fund a large current account deficit," he added in his 2018 forecast.

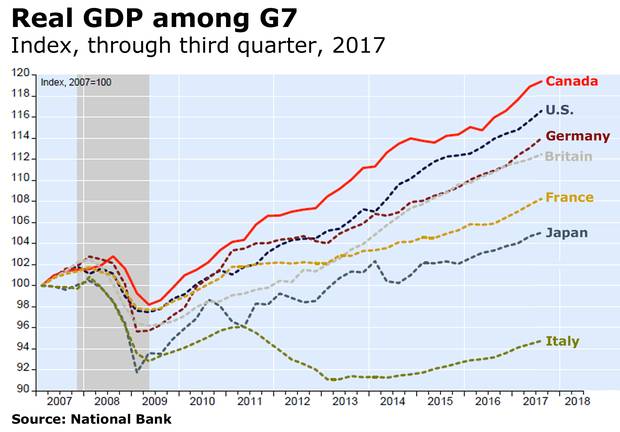

The final numbers should show Canada led the U.S., Germany, Britain, France, Japan and Italy in economic growth in 2017, at a pace of about 3 per cent after an exceptionally strong first half of the year and a weaker second six months. But that was so last year.

"Canada's economy was the envy of the G7 nations last year, but it will grow more moderately in 2018," Bank of Montreal senior economist Sal Guatieri said in a new forecast.

"Still, in the words of our central bank Governor, this is the year the economy returns 'home,' or the 'intersection' of full employment and 2-per-cent inflation."

Here's the picture at the dawn of 2018:

Economic growth

We had a nice run in 2017 - in the first half, at least -as the economy continued to rebound from the oil shock.

Indeed, Canada "has been a star performer in the last few years, suffering less than other advanced economies from the 2008 financial crisis and recovering faster," National Bank of Canada said in a review of last year.

And we're expected to hold that distinction when the books are closed on 2017.

"Canada's economy is on track to end 2017 with a G7-topping expansion of 3 per cent, the largest since 2011," National Bank economists said.

Here's where it gets a bit dicey.

Forecasts for 2018 suggest growth will downshift to about 2 per cent or slightly more as consumer spending eases and questions surround the the oil market.

Also clouding the outlook are negotiations to overhaul NAFTA amid repeated threats by the Trump administration to kill the pact unless the U.S. gets what President Trump considers a fair deal.

Negotiations aren't going well at this point, with American demands that Canada and Mexico warn are non-starters.

Many observers believe some form of NAFTA will survive. But there's always a warning with that, leaving an uncertain climate for the Bank of Canada and Canadian companies pondering how and where to invest.

"The bottom line is that, in spite of strong global growth, the risks are such that the Canadian economic environment and the Canadian dollar should remain volatile [this] year," Laurentian Bank Securities chief strategist Luc Vallée and senior economist Eric Corbeil said in a recent forecast.

"Because we expect the price of oil to increase and NAFTA to be renewed, but U.S. tax cuts to favour U.S. competitiveness, the Canadian dollar should end the year only marginally stronger than it currently is," they added.

"This should nevertheless continue to benefit large Canadian exporters at the expense of domestically-oriented businesses, more dependent on highly leveraged domestic consumers."

The fresh forecast from BMO's Mr. Guatieri suggests economic growth of 2.2 per cent this year.

"The downshift will stem from fading support from three earlier drivers: stimulative financial conditions, enhanced child benefit payments, and the sharp recovery in oil-producing regions," Mr. Guatieri said.

"In addition, higher interest rates and tougher mortgage rules will slow the housing market," he added.

"On the plus side, resource prices should remain firm as the global economy strengthens. Canadian exporters will slightly benefit from the extra dollars the U.S. government will leave in the pocketbooks and coffers of American households and companies."

Global economies

Key to Canada's fortunes, of course, are those of other countries, particularly the U.S.

And given the length of this economic expansion, Americans should enjoy it while it lasts.

"I have to wonder what it means to be heading into a new year with the global economy in sync, the [Federal Reserve] tightening policy, the U.S. treasury curve flattening, the equity markets hitting new highs, the credit cycle peaking out, extremely low volatility and investor complacency equally high, excessive valuations across most asset classes, and a U.S. labour market that is drum tight," said David Rosenberg, chief economist at Gluskin Sheff + Associates.

"As I dig into my memory bank, this backdrop is eerily similar to 1988, 1999 and 2006. And what we know about each of those years is that the one that followed was the last of the cycle."

Many economists have flagged this late-in-the-cycle issue, wondering when it ends with a thud.

"So if the past is a precedent, we had better enjoy the next 12 months," Mr. Rosenberg warned.

"The economic expansion and bull market won't necessarily end in 2018, but they will be on their last legs, nonetheless."

BMO and Toronto-Dominion Bank each forecast economic growth in the U.S. of 2.6 per cent.

Summing up U.S projections, here's TD chief economist Beata Caranci and her colleagues: "There is little doubt that we are in a mature economic cycle, but economic cycles don't have expiration dates stamped on them. Recessions are usually a by-product of policy errors.

"With [U.S.] consumers relatively light on debt and interest rates likely to rise gradually, this expansion still has life."

Outside of the U.S., BMO senior economist Jennifer Lee said "progression" will be Europe's theme in 2018, compared with "survival" last year.

French President Emmanuel Macron delivers his New Year address to the press at the Elysee Palace in Paris, on Jan. 3, 2018.

Ludovic Marin/The Associated Press

French President Emmanuel Macron "will continue to build the ranks of [his party] En Marche, and convince the country to embrace his reforms, which include cutting taxes (not just for the wealthy!), and relaxing labour laws," Ms. Lee said.

"He needs to win over his EU counterparts with his vision for a stronger and more unified Europe, or a 'Europe that protects,'" she added.

"France needs Germany's support and Germany does not want to take a back seat to France. However, Chancellor [Angela] Merkel must first strengthen her own leadership."

In Britain, of course, the big challenge is negotiating the Brexit regime for trade with the rest of the European Union.

In Japan, Ms. Lee said, "tight labour markets will hold back economic growth," though higher capital spending and central bank policies will help the cause.

China’s President Xi Jinping, centre, arrives with leaders at the Great Hall of the People on Dec. 1, 2017.

Fred Dufour/The Associated Press

And in China, "President Xi [Jinping] will wave the globalization flag, allow foreigners more access to the country's financial sector, fend off more protectionist views from the U.S., and warn of the need to reduce debt, all while trying to calm the North Korean waters," she added.

"We still look for economic growth to slow, from about 6.8 per cent in 2017 to a still-healthy 6.6 per cent in 2018."

The provinces

Remember when, in crude's heyday, Alberta ruled the country before the oil shock?

Alberta has bounced back, doing well last year. And, according to TD's latest forecast, it will lead the country in economic growth this year, at 3 per cent. The heart of Canada's oil industry would be followed by B.C., Ontario and Quebec.

"Given that the recent surge in economic activity has absorbed much of the existing economic slack - the oil-producing provinces are an exception - our view that economic growth will decelerate across nearly all regions in 2018-19 remains intact," TD's Ms. Caranci, senior economist Michael Dolega and economist Dina Ignjatovic said in their forecast.

BMO, in turn, is still betting on B.C.

"British Columbia is expected to reclaim its title as the fastest-growing province for the third time in four years, after likely losing it to a resurgent Alberta last year," said Mr. Guatieri.

"Still, like most regions, it will grow more moderately in 2018. The good news is that many provinces are already nearing full employment, with Quebec's jobless rate the lowest since at least 1976 and Ontario's taking aim at this feat."

Areas of growth

The mighty Canadian consumer, buoyed to this point by mighty consumer borrowing, is expected to pull back as interest rates rise. And we're going to feel it.

Consider these statistics from Royal Bank of Canada senior economist Nathan Janzen: In 2016, consumer spending as a share of gross domestic product reached its highest level since 1965. And in the first three quarters of last year, the average quarterly rise in spending, at 4.2 per cent, marked the best showing since before the financial crisis and recession.

In a report on how inflation slowed amid such strong economic growth last year, Mr. Janzen said a lack of demand clearly was not the reason.

"Given rising household debt levels, the larger concern is that households are spending too much, not too little," he said.

That shouldn't be the larger concern this year, though, because tapped-out consumers are going to have to spend less to juggle their payments as interest rates rise.

"With employment growth also expected to slow (13,000 per month on average), the consumer is expected to contribute much less to overall growth - just 1.2 percentage points in 2018," Mark Chandler, head of Canadian rates strategy at RBC Dominion Securities, and RBC rates strategist Simon Deeley said in a forecast.

The Bank of Canada, of course, has been hoping for a shift from the consumer to the exporter, but the trade sector "will struggle to get back on track" this year, as Matthew Stewart, director of national forecasting at The Conference Board of Canada, put it.

"As was the case in 2017, activity in Canada's export sector will continue to be uneven in 2018, with growth being fuelled largely by the energy and service sectors," Mr. Stewart said.

"While the non-energy merchandise export sector will contribute to overall export growth in 2018 … several sectors continue to face hurdles and will expand at only a sluggish pace," he added.

TD projects imports will rise 4.9 per cent this year, eclipsing the 4.7-per-cent gain in exports.

The latest numbers, reported today, show Canada's trade deficit swelling in November to $2.5-billion from $1.6-billion in October. Exports climbed 3.7 per cent but that was eclipsed by a 5.8-per-cent rise in imports.

Business investment is yet another crucial area of uncertainty as NAFTA negotiations lumber on. How do you plan where to invest when you can't gauge the relationship with your biggest trading partner?

"Trade uncertainty is already weighing on business investment, with firms examining foreign investment opportunities as opposed to domestic opportunities," HSBC's Mr. Watt warned. "This trend could be exacerbated if NAFTA is terminated."

As Mr. Stewart noted, business investment finally perked up in 2017 after "two dismal years" that saw non-energy investment sink by 8.9 per cent, cumulatively.

"The financial performance and investment intentions of Canadian businesses rose significantly throughout the summer but then fell back again in the fall as the economy slowed," Mr. Stewart said.

"Nonetheless, business sentiment still appears to be more positive overall than it has been at any time in the last few years. Many firms are also operating close to full capacity, and with sales expected to continue to grow, they will have little choice but to go ahead with overdue investments."

Buoying investment last year and in 2018 has been and will be spending on machinery and equipment and intellectual property.

"After an increase of just 0.5 per cent in 2017, we expect non-residential business investment outside the energy sector to rise by 3.4 per cent in 2018 and 2.2 per cent in 2019," Mr. Stewart said.

"While this pickup in non-energy investment will support further increases in capacity and economic growth, the levels remain depressed and are unlikely to surpass their recent 2014 highs until 2022."

Then there's the energy industry, so key to Canada's outlook amid the rebound from the oil shock.

"In 2015 and 2016, steep declines in energy investment (which includes upstream oil and gas, pipelines, exploration, and power sector investment) weighed down overall business investment across Canada," Mr. Stewart said "While oil and gas prices remain relatively weak, they have recovered from their recent lows, allowing for energy sector investment to begin to recover in 2017," he added.

"With the energy sector's financial performance set to improve in 2018, further gains in investment are expected. Nevertheless, investment volumes remain low and will stay well below their previous highs throughout the forecast period."

Unemployment

Economists tell us that the jobs market is on fire. And it is. And that unemployment has finally dipped below 6 per cent a decade after the financial crisis. Which it has.

But we shouldn't lose sight of the fact that 1.1 million people are still without work. And that economists expect last year's strong pace of job gains to slow.

TD economists forecast that unemployment will average 6 per cent this year, while BMO sees 5.8 per cent.

The latest numbers, released today by Statistics Canada, show another month of exceptional gains in December, with job creation of 79,000 and an unemployment rate down to 5.7 per cent, the lowest since at least early 1976.

Over the course of last year, employment rose by 2.3 per cent, or 423,000, with almost all of the increase in full-time work.

BMO chief economist Douglas Porter believes unemployment will ease to a "modern-day low" across the OECD this year.

"While many continue to stress over robots stealing our jobs in the future, we are rapidly running out of workers in the here and now," Mr. Porter said in his 2018 projection.

"By late 2017, jobless rates were approaching multi-decade lows in the U.S. (4.1 per cent), Canada (5.9 per cent), Japan (2.8 per cent), Germany (3.6 per cent) and even the U.K. (4.2 per cent) " he added.

"Given that we see global growth coming close to matching [last] year's solid gains in 2018, look for the job market to tighten notably further. With hiring plans remaining robust in many regions, the OECD harmonized unemployment rate will hit the lowest level in almost 50 years."

Government spending

Some of us are about to hit the jackpot.

"On the fiscal front, Ontario, Quebec and British Columbia are now all running balanced budgets, and the big shift in 2018 could be toward opening the fiscal taps - we've already seen this process start," said BMO senior economist Robert Kavcic.

"Indeed, looming elections in Quebec and Ontario should prompt more tax relief and spending increases, while British Columbia's new government still has some big-dollar promises to fulfill," he added.

"On the flip side, Alberta will likely start assembling the pieces for the 2019 election campaign, and with the credit rating under further pressure this year (and a traditionally conservative voter base getting antsy), the move in that province will likely be toward more fiscal consolidation."

Then there's the federal fiscal program, and we've already seen some results from the child benefits scheme.

"Higher transfers for child benefits have helped support consumer spending over the past year, while total government investment in infrastructure is growing at its fastest pace since the 2009–10 stimulus spending," said The Conference Board's Mr. Stewart, projecting real infrastructure spending will rise 3.7 per cent this year.

Oil

Forecasts may differ, but observers believe crude prices should rise as long as OPEC can keep it together.

Which, of course, would be a boon to our energy-dependent provinces.

"The oil-producing regions are all benefiting from higher output, but the dynamics in each province remain quite different," TD economists said in a recent economic snapshot.

"Alberta is in the midst of a sharp rebound after contracting by 3.7 per cent in each of the last two years, with part of the bounce due to the recovery from last year's wildfires … The oil industry is providing the largest lift to economic growth, with rig counts up by 80 per cent and production up by double digits so far [in 2017]."

TD projects oil prices around the mid-50 mark this year, while Laurentian Bank forecasts $67 (U.S.) a barrel for West Texas intermediate by the end of 2018.

But hold that thought.

This depends on the production cap agreement holding among OPEC and non-OPEC countries.

"So far, the one-year agreement has helped reduce excess inventories by 50 per cent," said Laurentian's Mr. Vallée and Mr. Corbeil.

"Extending the agreement until the end of [2018] would be enough to swiftly eliminate the remaining excess oil inventories by next fall. This should be supportive of higher oil prices throughout the year."

Of course, the Middle East is in turmoil. There's trouble, too, in other regions, and this could, in fact, buoy prices.

"We have warned that the worsening power struggle between Saudi Arabia and Iran could upend oil markets in 2018 and provide a significant upside surprise to oil," RBC's Helima Croft, head of commodity strategy, and her colleagues, commodity strategists Michael Tran and Christopher Louney, said in a recent report.

Then there are the recent protests in Iran.

"While we see no near-term oil disruption risk stemming from the unrest, which has left over 20 people dead, we do think the protests could have important implications for the JCPOA nuclear deal," Ms. Croft said separately, referring to Iran's 2015 agreement with the U.S. and others.

The White House supports the protests, and has warned of fresh sanctions, she noted, meaning it would probably "feel emboldened" to revoke sanction waivers that ended with the Iranian agreement.

"These waivers cover investment in the Iranian upstream sector, as well as the requirement for consuming countries to make significant reductions in their Iranian crude imports every six months," she pointed out.

Ms. Croft, Mr. Tran and Mr. Louney warned of other flash points for the oil markets.

Indeed, they have done so for years, citing "stressed" producer nations "ill-equipped to endure the economic and political calamity" brought on by the oil shock.

"However, as long as the market was so well supplied, geopolitics was treated as an afterthought or in some cases entirely irrelevant in the face of short-cycle U.S. production," they said in a separate commodities outlook, noting OPEC would subsequently decide to take 1.8 million barrels a day out of the market.

"Now against the backdrop of a tightening market, a politically-driven supply disruption is deemed much more consequential," Ms. Croft, Mr. Tran and Mr. Louney added.

"In our view, 2018 looks set to be the year when several of the geopolitical stories that we have been closely monitoring migrate from being mere risks to being material market realities.

Among what they describe as a "house of cards":

Venezuela is risky business: "It is poised to see its production drop substantially once again [this] year given the depth of its economic despair and its accelerating effects on oil production. The debt crisis only worsens Venezuela's prospects, but its oil sector would likely be in a death spiral anyways."

Iran's nuclear deal appears "bleak" after President Donald Trump's decision to decertify it last year: "It is highly unlikely that Trump will be able to reconstruct the international coalition of the willing that came together to sanction Iran in 2012. However, we think that a snapback of U.S. sanctions would curb the enthusiasm of European and some Asian corporates to follow through with plans to invest in the Iranian upstream sector and could force foreign refineries to source less crude from Iran, especially if the threat of being locked out of U.S. capital markets were revived."

Over all, said Mr. Tran, "oil prices will ebb and flow over the coming months, and while we are not raging bulls with prices at current levels, our conviction in the rising floor means that dips will likely be supported in the event that prices dip back into a low- to mid-$50/barrel price environment."

The "production hiccups" in the North Sea and Libya, he added, serve as examples of how such disruptions can become "magnified" in a climate of the declining storage surplus.

"We see prices relatively rangebound this year, with WTI largely fastened to the $55-$65 a barrel mark as the tug of war continues with U.S. production pitted against an otherwise firming fundamental backdrop, but headlines from Iran, Saudi Arabia and others serve as a good reminder that geopolitical risk can quickly change the calculus," Mr. Tran said.

But Canada has its own issues and has yet to get the full benefits of the "oil party," said BMO's Mr. Guatieri, looking at the difference between Western Canada Select oil and West Texas intermediate, the U.S. benchmark.

That's where throwing a "7 out," which means you lose, comes into it.

"OPEC's output cuts and rising social unrest in Iran have lifted crude prices for U.S. and world producers, but not Canadian drillers," Mr. Guatieri said.

"In fact, the price of Western Canada Select has actually fallen in recent months amid a supply glut (partly due to the closure of the Keystone pipeline after an oil spill) and seasonal weakness," he added this week.

"The hefty $26 discount versus the U.S. price is the largest in nearly four years. This is the worst of both worlds for Canada, as it portends higher fuel costs for households and businesses but no offsetting lift to incomes in oil-producing regions."

NAFTA

No, the world won't end if NAFTA does. But there would be an obvious upset given Canada's dependence on trade with the U.S. and the complex integration of certain industries.

"While our analysis shows that abandoning the agreement would not spark a recession in Canada, growth would slow significantly in the short run and more severely in certain provinces," warned Moody's Analytics economist Paul Matsiras.

Mr. Trump has oft threatened to kill NAFTA if he doesn't get what hea fair deal. And even though economists expect at least something to be salvaged, those threats are not to be taken lightly.

Were the deal to die, Canada would have been hit by a financial shock, an oil shock and a trade shock over the course of a decade.

"By most accounts, negotiations to this stage have been contentious ahead of the reported March, 2018, deadline, with no agreement in particular on parts content for motor vehicles or on a dispute settlement mechanism that might be agreeable to all parties," said RBC's Mr. Chandler and Mr. Deeley.

"These issues are seen as key for an agreement, and the longer they remain in limbo, the more chance there is that the U.S. administration will choose to 'tear up the agreement' ahead of mid-term elections."

If NAFTA dies, the question would be what comes next. Would Canada and the U.S. revert to their old free-trade pact? Or would the Trump administration simply adhere to the World Trade Organization regime?

RBC believes the latter scenario would erode Canadian gross domestic product by about 1 per cent over five to 10 years.

TD economists also studied that scenario, which would include Canadian retaliation amid higher tariffs.

"In a hypothetical scenario where NAFTA is terminated by the end of 2018, economic growth in the following year would be shaved by roughly 0.7 per cent from our baseline," TD said.

"This would leave GDP growth at roughly 1 per cent, which would still impart pain, but not devastation - an outright contraction in activity appears unlikely."

In fact, the bigger threat would be to corporate and consumer confidence, notably with "firm behaviour and supply chains needing time to adjust," the TD study said.

"By this token, even in the event that a new agreement is reached after some delay, the near-term uncertainty could prove a larger weight on growth than anticipated."

Of course, the Canadian dollar would plunge to compensate, and the stocks of trade-dependent companies would be roiled, further throwing the country into turmoil.

Read more

- Barrie McKenna: Bank of Canada stays cautious, keeps rates on hold

- Ian McGugan: A shift in inflation is taking shape and investors may end up paying a big price

- Canadian dollar could plunge to 72.5¢ on NAFTA ‘crash-out’

- Get your loons in a row: ‘Investors should protect themselves against NAFTA termination risk’

- Threat of Canadian financial crisis eases (but don’t take that to the bank)

- Why the world is agog over Canadian home prices and debt

- Janet McFarland: Tougher mortgage rules could shut out 50,000 potential home buyers a year: report

- Rob Carrick: Canada has a strong foundation for financial happiness. So why is the mood so dark?

- Mortgage sticker shock: Get ready to pay more on renewal, possibly through the nose

- Housing affordability: It’ll be far nastier in Toronto and Vancouver as rates rise this time

- 2018 consumer math: 2% inflation + 1.4% pay raise = you’re screwed

- Ugh, it’s getting tougher to be debt-free, particularly for seniors

- Threat of Canadian financial crisis eases (but don’t take that to the bank)

- Brent Jang, Janet McFarland: 2018 could be real estate’s year of turbulence

Markets at a glance

.

Read more

More news

- Canada’s job market blows past forecasts; jobless rate at 41-year low

- Trade deficit swells in November

- U.S. job growth cools as labour market nears full employment