Briefing highlights

- Loonie spikes on strong jobs report

- Markets count on rate increase

- Unemployment dips to 6.5 per cent

- Measuring housing froth …

- … where Canada doesn’t look as bad

- Global markets at a glance

Loonie spikes

The loonie is spiking as markets bet that the Bank of Canada will raise interest rates next week.

Next stop: One rate hike, and a 78-cent Canadian dollar, and possibly more after that.

The loonie has traded today as low as 76.96 cents (U.S.) and as high as 77.76 cents, the latter following a solid Canadian jobs report that heightened the speculation of an increase in the central bank's benchmark overnight rate next Wednesday.

"Yields and the C$ were both up in the wake of today's figures, which likely cement a rate move next week," said Nick Exarhos of CIBC World Markets.

Royal Bank of Canada is already forecasting a 79-cent loonie. And today, Bank of Nova Scotia also changed its projections, for above 78 cents by the end of this year and 80 cents by the end of 2018.

"A major change in our broader forecasts supports a more constructive view on the CAD as we now expect the Bank of Canada (BoC) to start raising interest rates in the second half of this year (two increases in 2017) and to raise interest rates once more in 2018," said Scotiabank chief currency strategist Shaun Osborne, referring to the loonie by its symbol.

"A much earlier start and slightly more aggressive profile to anticipated BoC rate hikes will support the CAD in the next few months (and offset sluggish crude oil prices), we think," he added in a report.

Of course, much will depend on how Bank of Canada Governor Stephen Poloz and his colleagues signal the timing of tighter policy.

"A lot depends on how the bank communicates the rate outlook next week, assuming we get a rate hike next week," Mr. Osborne said in an interview.

Read more

Jobless rate dips

Canada's unemployment rate is down to 6.5 per cent after the economy churned out a better-than-expected 45,000 jobs in June.

Most of those gains, however, were in part-time positions.

Still, over the course of 12 months, Canada has created 351,000 jobs, most of them full-time.

And notably, Statistics Canada said Friday, employment gains in the second quarter, of 103,000, mark the strongest quarterly showing since 2010.

The jobless rate dipped one notch, from 6.6 per cent in May,

Particularly strong were Quebec and B.C., the latter pumping out 20,000 new jobs as unemployment declined by a hefty half of a percentage point to 5.1 per cent.

By sector, professional, scientific and technical services led the charge.

"June's job gains were widely spread across goods and services, split evenly between paid jobs and self-employment, with the only disappointment being a leaning to part-time jobs, although full-time jobs are still up a heady 1.7 per cent in the past year," said Nick Exarhos of CIBC.

"In sum, the jobs market is tightening, and not far from what historically has been judged as full employment. Over to you, Governor Poloz."

Read more

Markets at a glance

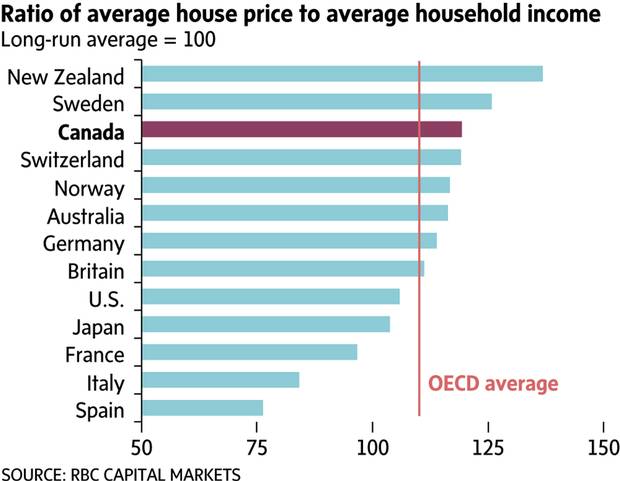

Measuring froth

The Vancouver and Toronto areas are frothy, to be sure, but there other ways to look at bubbly housing and mortgage markets, ones where Canada doesn't look quite as bad.

A Royal Bank of Canada study puts it all in perspective.

It's a key piece of the puzzle as observers around the world point a finger at Canada. And, for that matter, as June sales and prices flow in from Vancouver and Toronto.

The Vancouver housing market is picking itself back up after a slump sparked by a provincial tax on foreign buyers. And observers are watching to see what happens in Toronto, which is now in the early stages of a similar Ontario levy on foreign speculators.

RBC foreign-exchange strategists Adam Cole and Elsa Lignos looked at housing markets amid expectations of rising interest rates in certain countries, and whether those higher rates could be negative for certain countries and, thus, their currencies.

"Canada has one of the most overvalued property markets, but that is offset by one of the most robust mortgage market structures," said Mr. Cole, RBC's chief currency strategist in London, and Ms. Lignos, the bank's global head of foreign exchange strategy.

"The countries satisfying most of our vulnerability criteria are Sweden, Norway, and Australia."

When they say satisfy in this context, that's not a good thing. It also doesn't mean Canada's off the hook, when you look at what they found.

Mr. Cole and Ms. Lignos looked first at overvaluation, in terms of the ratio of average price to average income, and then compared that ratio with its long-term average.

The ratio – or "how many years of average income it takes to buy an average house" – puts Switzerland, Sweden and Japan at the top of the list for overvaluation. Mr. Cole and Ms. Lignos noted, though, that there could be reasons for different valuations, such as supply and taxes.

When you look at that measure compared with the longer-term average, Canada is among the troubled.

"Canadian property, for example, may be 'cheap' [based on the chart above] but Canadian property prices are historically elevated," the RBC strategists said.

"Japan is the opposite – expensive in outright terms but cheap compared to its own history," they added.

"Based on [the chart below], New Zealand, Sweden, Canada and Switzerland have the clearest vulnerability to tighter policy through inflated property prices."

Mr. Cole and Ms Lignos also looked at household debt to disposable income, which in Canada has been at or near record levels for some time and is being watched by the central bank.

We don't make the top three, though that may still be small comfort.

"This time, Switzerland is joined by Norway and Australia at the top of the vulnerability rankings," said Mr. Cole and Ms. Lignos.

"All three have debt/disposable income ratios around 200 per cent (double those in the U.S., euro area, and Japan). Sweden and Canada are just behind, with Sweden overtaking Canada since the introduction of negative interest rates in 2015."

The RBC strategists also looked at debt service ratios, or the ability to juggle payments on what you've borrowed, and what could happen on that front as interest rates rise.

Norway and Australia top the list on the former, with Canada and Sweden next.

As for the latter, Canada fares well.

"Mortgage fixes are typically much shorter than in the U.S., but true variable rate borrowing is rare," said Mr. Cole and Ms. Lignos.

"The same is true of Switzerland. Most vulnerable are Australia, New Zealand, Norway, Sweden, and the U.K., where borrowing is overwhelmingly short-term in nature."

So when you wrap it all together, without including non-mortgage borrowing, which RBC couldn't compare across countries, Canada has issues but isn't the baddest of the bad.

"While Canada features on some criteria, the structure of its mortgage market means that interest rate hikes would take longer to feed through to the stock of existing mortgages and therefore longer to impact households' ability to service their (mortgage) debt," said Mr. Cole and Ms. Lignos.

Read more

- James Bradshaw: RBC hikes fixed-term mortgage rates

- James Bradshaw: OSFI eyes crackdown on mortgage rules

- Brent Jang, Josh O’Kane: Toronto housing prices drop

- Toronto housing slumps fast after move to deflate bubble

- How RBC sees your housing market. (In Toronto, you can’t afford it)

- Toronto, Vancouver: Housing bubbles or simply world-class cities?

- David Parkinson: Threat from housing, high debts growing: Poloz

- David Parkinson: OECD sees higher rates as housing remedy

- Matt Lundy: Sustained chill or Vancouver-style rebound?

- Janet McFarland: Toronto’s housing market feels chill

- Yes, a sudden chill. But look at these Toronto home prices

- Vancouver housing market heats up

- Chill, Canada isn’t 2006 America

- Citi on Canada: Solid outlook, housing correction, loonie that won’t hit par