How wily an investor are you? It’s often hard to tell the difference between a mere fad in investing strategies, a trend and a fundamental shift. Not all investing styles suit all types of markets. And you can look awfully foolish if you buy the wrong stock at the wrong time. (Is that a BlackBerry in your pocket, and in your portfolio?)

Of course, your choice is limited to what’s available on the market. As our Top 1000 ranking shows yet again this year, the selection of publicly traded Canadian companies is now very odd: a handful of banking, resource and telecom giants for traditionalists, scads of daring little oil and mining plays for risk-takers, and a hodgepodge in between.

Yet, if you search beyond the familiar names at the top of The Top 1000, you should be able to pick out at least a stock or two to suit just about any investing style. Herewith, five finds that have been big winners for five perennially popular strategies.

Growth Investing

Amaya Gaming Group Inc.

Top 1000 rank: 857

Contrary to the stereotype, not all growth investors are daredevils who’ll bet the farm on a start-up that they figure will be the next Apple, Amazon or Facebook. But almost all of them do try to find companies with earnings that they think will grow faster than average. Seasoned growth-investing pros also know they have to take risks tto do that—they may invest in, say, 10 young companies, knowing that most may fail, but one or two could hit the jackpot.

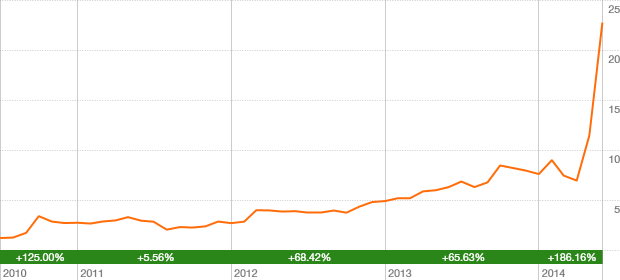

Montreal-based electronic gaming technology provider Amaya is an almost textbook case of a successful entrant in a chaotic new industry. Chairman and CEO David Baazov got his start in tech marketing during the dot-com boom, and spotted the huge potential in online poker in the 2000s. The company went public on the TSX Venture Exchange in July, 2010, at $1 a share, then graduated to the TSX last October.

Amaya’s growth has been rapid, but bumpy. The U.S. Congress banned Internet gambling in 2006, yet some states allow it. Amaya missed earnings targets in a recent quarter, but has also impressed the market with several acquisitions: Chartwell Technology in 2011, and CryptoLogic and Cadillac Jack in 2012.

Baazov is Amaya’s largest shareholder, with about a quarter of the total. The other large holders are now a who’s who of Canadian institutions. They may all cash in their chips if recent speculation about a reverse takeover by Isle of Man-based giant PokerStars pans out.

Momentum Investing

AutoCanada Inc.

Top 1000 rank: 226

The trend can be your friend, indeed, my friend. Momentum investors believe that if a company’s share price starts climbing solidly, particularly on surging trading volume, it often keeps going. Look back at Nortel Networks. Even if you bought in the autumn of 1999, the hoi polloi were still lining up behind you. You could have more than doubled your money before the bubble burst in September, 2000.

Of course, more discerning momentum investors look for more than just price gains. They also like to see solid growth in revenues, earnings and other measures of performance.

Edmonton-based AutoCanada Inc., which operates more than 30 auto dealerships in seven provinces, has been accelerating in almost every respect lately. Earnings grew by more than 20% in the first quarter compared with the same quarter in 2013, and same-store sales were up by an average of 13%. In April, 2014, the company announced it had bought eight dealerships.

AutoCanada CEO Pat Priestner is on a roll as older dealers sell out and retire. He estimates that he can buy about 20 dealerships in 2014 and 2015—maybe more, if groups of dealers come on the market. Investors clearly believe him.

Value Investing

Badger Daylighting Ltd.

Top 1000 rank: 221

Value investors basically try to buy stuff cheap: stocks that appear to be priced below their intrinsic worth relative to company earnings or other fundamental measures. To do that, value adherents often sort through unpopular or beaten-up sectors for bargains, because markets have a tendency to overreact to bad news.

Calgary-based Badger is an established Alberta oil-patch supplier. As an excavation contracting company, its key offering is the Badger Hydrovac System, a truck-mounted unit used mainly for digging carefully on sites with buried pipes and cables. Badger does about half its business with oil and gas infrastructure firms, but also works for building contractors, utilities and other industries.

When the oil patch was slammed by the 2008-2009 financial crisis, Badger was swept along, and its share price declined by half. Yet its revenues and earnings held up, and they climbed solidly coming out of the crisis. For all that, even a year ago Badger was still trading below the traditional value investor’s price-earnings (P/E) threshold of 20.

Not so now, alas. Badger’s growth prospects still look good, and the market is excited about them. You’ll have to pay more than 35 times the company’s trailing 12 months’ earnings to buy in.

Dividend Investing

Intact Financial Corp.

Top 1000 rank: 54

In investing, boring often works much better than sexy. Hot new companies usually get away without paying any dividends because their growth prospects are supposedly so juicy that they don’t need to offer a 3% or 4% annual payout to entice you to buy. Dividends are for old-fogey blue chips whose best days are behind them.

In fact, plenty of research shows that dividend-paying stocks not only provide you with regular payouts, they can also grow much more over the long term than non-dividend payers. And companies that increase their dividends steadily often grow even faster.

The trouble is that a lot of Canadian investors know this already, and they have pushed up the prices of the most obvious dividend-payers: the Big Six banks. But you don’t have to walk very far down The Top 1000 to find other candidates.

Intact is the largest home, auto and business insurance provider in the country, the former Canadian subsidiary of Dutch banking and insurance giant ING Group. The company’s shares began trading on the TSX in 2004, and it adopted the Intact name in 2009, when ING sold off its 70% stake. Intact now operates under its own name and several others, including Trafalgar, Equisure, Belairdirect and Grey Power. Over the past five years, Intact’s share price has increased more than any of the Big Six ybanks.

As Warren Buffett would say, try to control your excitement.

Technical Analysis

Boralex Inc.

Top 1000 rank: 639

Technical analysts are chart nerds. In what Paris Hilton would call the olden days, they typically pored over paper graphs looking for trends and patterns. Now they can do more of that—and more quickly—using computers.

Technical analysts believe that all publicly available financial information about a company is reflected in its share price, but so are the often-strong emotions of buyers and sellers. Technical adherents also believe that historical patterns tend to repeat themselves. That means you don’t have to spend hours analyzing the company’s finances or production totals. Concentrate on share price history and the volume of trading.

Some of the signals that technical analysts search for are relatively simple. Is the company’s current share price below its 50-day moving average? If so, it could be underpriced.

Certain complex patterns tend to recur as well. Consider Quebec-based Boralex, which operates wind, hydro, thermal and solar power stations in Canada, the northeastern United States and France.

From 2010 until late 2012, the company’s share price experienced what technical analysts call an inverse head-and-shoulders reversal. Often, a company’s share price tends to gravitate toward a “neckline.” It takes a lot of bad news to push it far below that line. After the share price hits bottom at the head, and starts to recover, it often struggles to break out and soar above the neckline.

Did the slump and recovery in Boralex’s share price have anything to do with the sharp drop in its revenue after the 2008-2009 financial crisis, and the strong global rebound in 2011? Probably yes, but the chart could have told you that.

Illustrations by R. Kikuo Johnson