MDA Corp.

Vancouver | Founded 1969 | 4,800 employees

Flight assemblers install components in the satellite’s bus module which will be fitted with a solar array and antennae before blast off

Justin Poulsen

Canada's eye in the sky is undergoing the equivalent of laser eye surgery. The Radarsat Constellation Mission—a satellite surveillance system developed, built and tested by MDA for the Canadian Space Agency—is taking radar imaging from 20/20 (the old Radarsat-2) to 20/15. The three identical satellites—which will orbit at an altitude of 600 kilometres when launched in 2018—are equipped with wing-like antennae, part of the synthetic aperture radar (SAR) that will deliver daily imaging of land masses, maritime data and weather patterns. The new constellation also detects signals from the automatic identification systems (AIS) required by ships under maritime law. The satellites follow one another in orbit. If the first one detects something unusual—like a vessel sailing without an AIS transmitter—a message is sent to the next one to take a closer look. When the third satellite flies over, it can get a view of the object down to three square metres. "Resources can be used more efficiently, because you can deploy aircraft to investigate only the non-AIS ships," says Norman Hannaford, general manager of surveillance and intelligence at MDA (formerly MacDonald, Dettwiler and Associates).

To enter the hyper-clean facility in Montreal where the satellites are being assembled, you're outfitted in lab coat, slippers and hairnet. A team of structural, mechanical and electrical engineers, working in two shifts, build the payload, or the "heart"—the SAR panels and components that will receive, store and send data to Earth. Then they're integrated with the "bus"—what Hannaford calls "the routine health and safety of the spacecraft, with power and propulsion, and a computer to control altitude." While each unit is only the size of a minivan, together they keep an eagle eye on 90% of the world's surface. /Susan Nerberg

- 75 kg: Amount of hydrazine fuel in each bus at liftoff, used by the thrusters to help maintain orbit

- 70,000: Square metres of

“clean space” at MDA’s Montreal

plant

A detail of theradars at Constellation Mission satellite being built at the MDA clean lab

Justin Poulsen

Pratt & Whitney Canada

Longueuil, Quebec | Founded 1928 | 8,900 employees

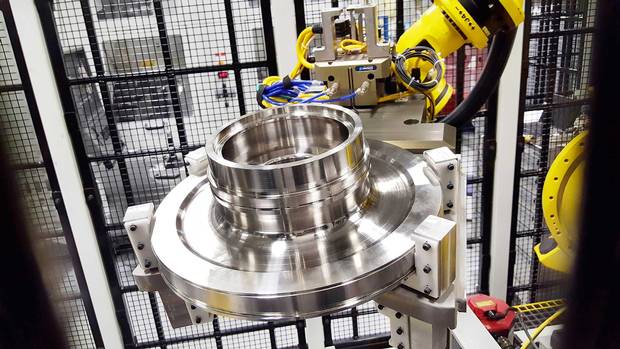

A robot used to assemble jet engine components at Pratt & Whitney.

Justin Poulsen

In a high-security cloister at the centre of Pratt & Whitney Canada's plant near Montreal, the fruit of millions of dollars in research and development spending is taking shape. Here, behind a wire cage accessible only with an electronic key pass, a yellow robot will take a hunk of preformed metal and set it on a six-hour path of intricate milling and turning to create an aircraft engine turbine disc.

A subsidiary of U.S. conglomerate United Technologies Corp., P&WC traces its origins to the late 1920s, when it began repairing engines for early bush-flying operations. It assembled and serviced engines during the Second World War. Today, it is front and centre in the battle between makers of passenger aircraft. P&WC supplies engines for luxury jets, turboprop planes and helicopters for customers including Bombardier, Embraer, Dassault and Cessna. And it's here that some of the most critical engine parts are designed and produced.

Inside a wire cage, a robot readies material to craft an engine turbine component. It looks like an ornate disc brake you might find in your car—but costs as much as an entire vehicle.

Justin Poulsen

An engine turbine disc is a highly engineered piece of equipment that costs as much as the most luxurious autos. Made of a nickel-based superalloy, the disc is a critical component of the "hot" part of aircraft engines like the PW800 turbofan powering Gulfstream's new G500/600 business jets. It helps drive the engine's compressor section, and it needs to be strong enough to withstand high pressure and temperatures topping hundreds of degrees. The disc is so complex that its manufacturing "tolerance"—the amount the finished product is allowed to deviate from its design specs—is as little as one-50th of a human hair.

"These parts have to be pristine," says Donald McIntosh, senior fellow of manufacturing technology at P&WC, noting that each machine in the plant is fitted with filters to keep particles from getting out or in. "They're like tools you use in surgery. They go into the heart of a high-performance engine. They have to be clean, and they have to be precise." /Nicolas Van Praet

- 60,000: P&WC-built engines in service, flown by 12,000 operators, including 670 airlines

- No. 1: P&WC’s projected rank in global market share among

business aviation engine makers over the next 10 years, according to consultant Jetcraft

A.F. Theriault & Son

Meteghan, Nova Scotia | Founded 1938 | 180 employees

Justin Poulsen

In 1828, 63-year-old Margaret Davis went for a long walk. Her husband had recently died, and the government was threatening to turf her family off their farm on Brier Island, Nova Scotia. So Davis rowed and strode the 200 kilometres to Halifax to make her case before the lieutenant-governor, who agreed the Davises could stay put.

Davis's name and exploits will live on in the form of Margaret's Justice, a 36-metre, 99-passenger ferry being built by a company that perfectly reflects her devotion to rural Nova Scotia. A.F. Theriault & Son started in 1938 with one Acadian man, Augustin Theriault, fashioning wooden boats for local fishermen. Nearly eight decades later, the company focuses on steel, aluminum and composite boats for a varied group of clients, including the RCMP, the Massachusetts Port Authority and Windcat Workboats, a Dutch firm that services offshore windfarms in Europe.

Margaret’s Justice being hand-painted.

Justin Poulsen

"If it floats and it can pay our bills, then we can build it," says Augustin's grandson Gilles Theriault, who worked his way up from painting hulls and sweeping floors in his teens to being general manager. A.F. Theriault employs 180 locals as draftsmen, engineers, marine welders, fibreglassers, millwrights and every other trade needed to build a ship from blueprints up.

The $7.7-million Margaret's Justice is scheduled to ply the route connecting Brier Island to Digby Neck before the new year. Powered by two 450-horsepower Caterpillar diesels and twin Voith Schneider propellers from Germany, it's capable of nine knots. That's hardly speedy, but it surely beats the rowboat Davis used to get off the island 188 years ago. /Patrick White

- 360+: Number of Hammerhead boats that A.F. Theriault has built. Its most popular product is an unmanned vessel designed to be blown out of the water during military exercises

- $7 million: Cost of the 25-metre Hayfu II, a custom luxury catamaran that took three years to build

Watch: This Nova Scotian shipbuilder goes back nearly 80 years

Exco Technologies Ltd.

Markham, Ontario | Founded 1952 | 6,515 employees

The six-axis drill cuts a part for a V6 engine-block tool. The drill is sluiced with fluid to prevent overheating.

Justin Poulsen

Brian Robbins has been running Exco Technologies for 44 years, but he still gets as excited as a kid about new gadgetry. Exco makes dies, moulds and other tools for automotive manufacturers. Founded by Robbins's father in a garage north of Toronto, Exco now has 18 factories in 10 countries. But its heart and leading edge is a 130,000-square-foot facility in Newmarket, Ontario.

"We have some very cool new stuff," says Robbins. On the shop floor are three circular, room-sized booths. Each houses a robotic drill that can dart in and out of a block of metal, cutting holes and spraying fluid to cool and lubricate the drill bits. Today, one is cutting an engine-block tool for a parts-maker in Mexico. Exco is expecting to install another three machines, at a cost of $1.6 million (U.S.) apiece. The drills align themselves on six axes, rather than three, for faster and more accurate cutting of angles and curves.

The largest 3-D printer in North America to use tool steel.

Justin Poulsen

Beside the machines is what Exco expects will be the largest automated tool library in the auto industry—a wall holding 4,000 cutting tools, each with an RFID chip. A robotic arm moves along a rail and plucks tools from the slots, then delivers them to whichever machine needs them. As the self-monitoring machines drill and cut, they constantly make microscopic adjustments for tool wear.

Exco's other new gizmo doesn't look as impressive—sort of like a five-metre-square microwave. But it's the largest 3-D printer in North America to use tool steel, building up intricately curved components by spraying thin layers of steel powder.

Only about 500 of Exco's employees are in Canada, and just 150 of them work in Newmarket. A few machinists in their 70s—from the generation that expanded Canada's parts sector in the 1970s and 1980s—are still on staff, but much of their work has shifted to more than two dozen computer-savvy engineers, designers and programmers. "We have the geeks," says Robbins. "To be competitive, we need to do things differently." /John Daly

- 2.5 minutes: Time required to produce an aluminium engine block in the high-pressure die-casting process

- 700 degrees Celsius: Temperature at which molten aluminium is injected into the tooling

Samuel, Son & Co.

Mississauga | Founded 1855 | 4,800 employees

Welders fasten door frames to the jambs.

Justin Poulsen

Even though rail is one of the most established industries in North America, the market for new railcars is highly cyclical. At a factory in Cambridge, Ontario, two dozen employees of Samuel, Son & Co.'s Roll Form Group are manufacturing about 100 steel doors a week for boxcars. The group's president, Lou Sartor, says this is a good year for boxcars—about 4,000 will be produced in North America. In a bad year, he says, "it can be zero."

Roll Form Group makes several boxcar parts, including floors, uncoupling levers and roofs. But it can shift quickly to producing parts for other types of railcars, including auto racks and hoppers. It then ships those components to railcar manufacturers, including National Steel Car in Hamilton and a handful of U.S. giants. The key to remaining profitable, Sartor says, is to fulfill specific needs. That means not just producing generic steel, but to keep "moving downstream to add more value."

Samuel is one of Canada's oldest and largest corporations, but it hasn't got a lot of publicity because it's not publicly traded. Brothers Mark and Lewis Samuel opened a hardware and metals-import business in Toronto 160 years ago. Now based in Mississauga and led by fifth-generation chairman Mark Samuel, the company has 100-plus factories and metal-service centres in North America, Australia and China that supply more than a dozen sectors, including aerospace, forestry and construction.

Indeed, some of the Roll Form Group's big sellers include guardrails and sheet piling—bent steel slabs used to shore up foundation retaining walls at construction sites. "And we're just a division within a division of Samuel," says Sartor. /John Daly

- $3.7 billion: Samuel, Son & Co.’s annual revenue

- 3,600: Pieces of sheet piling used to hold back water in the Hamilton Harbour

Workers at Samuel, Son & Co are running a hydraulic press brake, to form box car doors.

Justin Poulsen