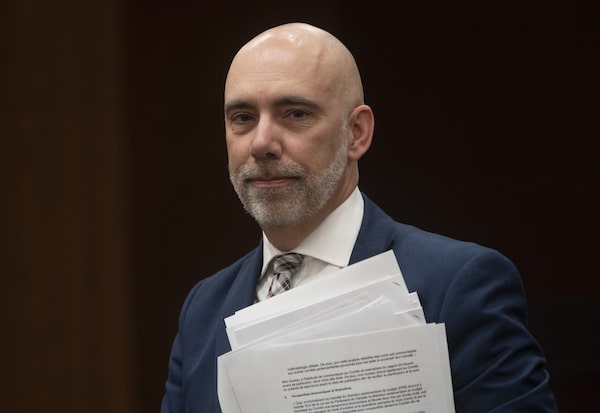

Parliamentary Budget Officer Yves Giroux waits to appear before the Commons finance committee on Parliament Hill on March 10, 2020.Adrian Wyld/The Canadian Press

A spike in work-from-home tax-credit claims resulting from the coronavirus pandemic is expected to cost the federal government $260-million, according to the Parliamentary Budget Officer.

The estimate by the PBO is $50-million higher than the federal government’s projection.

Using a mix of labour-force data and historical tax records, Thursday’s costing report attempts to estimate how many Canadians will claim the home-office expense deduction for 2020 in both the traditional way and a new simplified option the federal government announced to address the unusual circumstances created by COVID-19.

Normally, Canadians who wish to claim expenses incurred while working from home are required to fill out a detailed T2200 tax form that chronicles the eligible costs they incurred throughout the year. For context, the PBO report notes that in 2018, about 10 per cent of individuals who worked from home claimed home-office expenses, and the average deduction per claim was $1,550.

Finance Minister Chrystia Freeland announced in late November that with so many Canadians suddenly working from home in 2020, the government would approve a simplified option for deductions of up to $400.

At the time of the announcement in the November fall economic statement, the government estimated the simplified credit would cost the government $210-million.

The PBO report notes that because the cost of rent can be deducted as a home-office expense but mortgage payments cannot, renters will be more likely than home owners to use the traditional method in order to claim a larger deduction than the $400 limit available through the temporary option.

The temporary option is available to employees who worked from home more than half of the time over a period of at least four consecutive weeks in 2020 due to COVID-19. It allows eligible employees to claim a deduction of $2 for each day they worked at home in that period, plus any other days they worked from home in 2020 due to COVID-19, up to a maximum of $400.

Thursday’s report, which was prepared by PBO staff, cautions that it is difficult to predict how Canadians will address the issue when they file their 2020 taxes.

“It is assumed that not all taxpayers will complete the more complex home-office deduction filing and may simply resort to the simplified tax deduction, but the extent is unknown,” the report states. “In addition, tax fraud, claims by ineligible individuals and carry-forward of unused deductions are not considered in this estimate.”

Know what is happening in the halls of power with the day’s top political headlines and commentary as selected by Globe editors (subscribers only). Sign up today.