“I said when we began that there would be moments of drama,” Foreign Affairs Minister Chrystia Freeland said Sept. 30, 2018, after a 14-month battle to renegotiate the North American free-trade agreement. “And there have been.”

For 24 years, the North American free-trade agreement tied the continent’s economy together – until Donald Trump, the “America First” president, promised to unravel it. For 14 months of dramatic negotiations, the U.S. argued with Canada and Mexico about what a new deal would look like. Mr. Trump threatened several times to rip up the deal altogether, or cut separate deals with the other countries. Finally, Canadian and U.S. officials reached an agreement just before Mr. Trump’s latest of several deadlines. The new deal – dubbed the United States-Mexico-Canada Agreement, or USMCA – still needs to be finalized by the three countries' legislatures, but Mr. Trump and Mr. Trudeau are hailing it as a major breakthrough.

Starting in January, 2017, The Globe and Mail kept a rolling guide to the trade file and the issues at stake. Here’s a full recap of the events leading up to the USMCA announcement.

What is NAFTA?

The 1994 agreement – an expanded version of a Canada-U.S. free-trade deal from 1988 – created what was then the biggest free-trade area in the world. It removed barriers to the flow of goods and labour between Canada, the United States and Mexico, under the oversight of an independent dispute-settlement process.

Flashback: President Clinton’s original signing of NAFTA into law in 1993

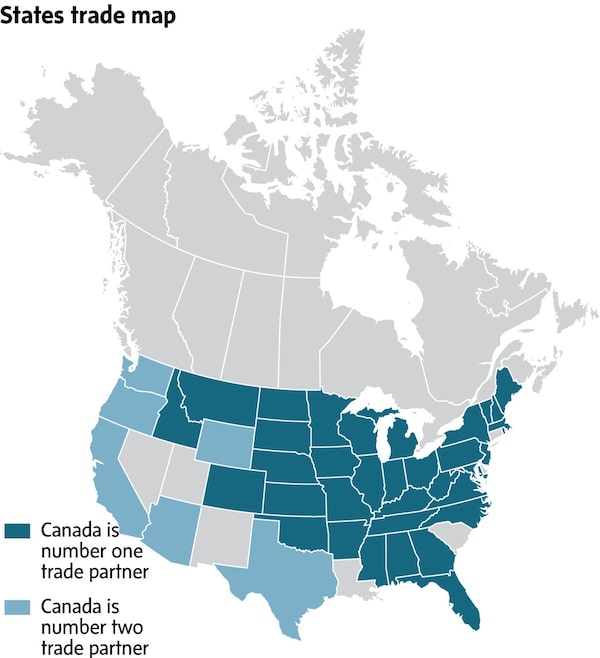

Canada – the world’s largest purchaser of U.S. goods – saw its exports to U.S. markets soar. The Americans are less dependent on NAFTA than Canada is, The Globe’s Steven Chase explains: Trevor Tombe, a University of Calgary economist, calculates that there are only two American states – Michigan and Vermont – where trade with Canada exceeds 10 per cent of their annual economic output.

There are only two U.S. states – Michigan and Vermont – where trade with Canada exceeds 10 per cent of their annual economic output, according to University of Calgary economist Trevor Tombe.MURAT YÜKSELIR/THE GLOBE AND MAIL (SOURCE: TREVOR TOMBE, UNIVERSITY OF CALGARY)

For years, the Canadian government has repeated its claim that Canada is the most important foreign market for 35 U.S. states. This map is posted on a government website that promotes trade.MURAT YÜKSELIR/THE GLOBE AND MAIL (SOURCE: STATSCAN)

This map, using data retrieved from the U.S. Census Bureau, shows Canada’s share of total U.S. exports, by state. It shows that, for a majority of states, less than 30 per cent of total exports go to Canada.MURAT YÜKSELIR/THE GLOBE AND MAIL (SOURCE: U.S. CENSUS BUREAU)

What has NAFTA done for us? Four views from three countries

United States: In this Tennessee town, NAFTA’s a dirty word

United States: In red states, not everyone is anti-NAFTA

Mexico: A pivotal moment for a fragile country

Canada: Tough trade: The lessons of NAFTA

Why change NAFTA?

The politics of free trade underwent a remarkable U-turn in the decades after NAFTA came into being. In 1988, Canada had a Progressive Conservative prime minister, Brian Mulroney, who fought an election over the Canada-U.S. trade deal with the Liberals opposing it. He also had pro-free-trade Republican allies in the White House, with Ronald Reagan and later George H.W. Bush, backing him up. Contrast that with 2016, when protectionism turned into a defining theme of the U.S. election. Both presidential candidates opposed the Trans-Pacific Partnership, a trade deal even bigger than NAFTA, but the Republican Mr. Trump also singled out NAFTA and promised to erect a wall along the U.S.-Mexico border. In his inauguration speech, Mr. Trump promised an “America first” attitude to trade, immigration and foreign affairs.

What did Trump want a new NAFTA to look like?

In its initial months, Mr. Trump’s inner circle strongly disagreed about what demands to make in NAFTA renegotiations. There was a moderate camp, including Treasury Secretary Steve Mnuchin and Mr. Trump’s son-in-law Jared Kushner, that wanted to enhance NAFTA and make cross-border business easier for corporations, and a protectionist camp, including former chief strategist Steven Bannon. The protectionist camp has been more dominant in recent months, especially since the March departure of economic adviser Gary Cohn.

Out of that conversation came an initial list of 100 broad, sometimes vaguely worded demands that the U.S. Trade Representative’s Office released in July, 2017. Some highlights include:

- Reducing the U.S. trade deficit within NAFTA, which could mean increasing U.S. exports or reducing Canadian and Mexican imports.

- Scrapping NAFTA’s dispute-resolution panels, which have sometimes ruled in Canada’s favour on softwood lumber and other trade issues.

- Using “Buy American” provisions to bar Canadian or Mexican firms from seeking U.S. government contracts.

- Making Canadian and Mexican intellectual-property rules more “similar to that found in U.S. law.”

The Trump administration’s most contentious NAFTA demands began to take shape at the fourth round of talks in Arlington, Va. Demands included:

- Dairy: The U.S. wants an end to Canada’s supply-management regime for dairy and poultry products.

- Sunset clause: The U.S. wants the new NAFTA to expire in five years unless the member countries agree to renew it.

Decoding Trump’s NAFTA doctrine with The Art of the Deal

Could Trump really pull the U.S. out of NAFTA?

The metal wars

By the summer of 2018, there was no NAFTA deal in sight, so the Trump administration brought out the big guns. The U.S. Commerce Secretary hit Canada and Mexico, as well as the European Union, with the tariffs it had introduced in March but exempted Canada and Mexico from initially. The Trump administration said it was imposing the tariffs because NAFTA talks were progressing too slowly for the President’s liking. Mexico and Canada retaliated with tariffs of their own. Canada’s tariffs target $16.6-billion in U.S. imports, not just steel and aluminum, starting July 1. The full list of products includes:

- Food products: Whisky, candy, cucumbers and gherkins, pizza, quiche

- Household products and furniture: Mattresses, sleeping bags, playing cards, ballpoint pens

- Wood and paper products: Toilet paper, certain types of plywood, paper and paperboard

- Vehicles: Sailboats and motorboats

What about Mexico?

Building barriers (both physical and economic) with Mexico was Mr. Trump’s stated goal since he began running for president. In the 2015 speech announcing his campaign (the one where he said “rapists” and criminals were coming across the U.S.-Mexico border), he said Mexicans were “laughing at us” and “killing us economically.” Mr. Trump’s election put Mexico’s then-president, Enrique Pena Nieto, in a tight spot: He faced domestic pressure to stand up to Washington about the wall that Mr. Trump wants Mexico to pay for (which Mexico refuses to do), but he also had to avoid alienating a major trading partner and being shut out of the new North American trade regime.

In July, Mr. Pena Nieto’s dilemma passed on to Andres Manuel Lopez Obrador, who won a landslide victory in July 1’s presidential election. The leftist leader, popularly known as “AMLO” from his initials, promised to avoid fighting with Mr. Trump and keep NAFTA as a bilateral agreement with Canada if the United States pulled out of it. But when Mexico, along with Canada, was targeted with U.S. steel and aluminum, Mexico retaliated with tariffs on products made in pro-Trump heartland states, such as steel, pork, fruit and cheese.

For Mexico, the biggest issue of the NAFTA talks has been auto manufacturing. The United States wanted new requirements that 40 to 45 per cent of auto content in the NAFTA zone be made at factories that pay US$15 an hour or more, which is more than four times what the average Mexican worker makes. Mexico’s resistance to the auto proposal, which they fear would drive manufacturing jobs away from the country, kept the NAFTA negotiators at loggerheads for months, but on Aug. 27 Mr. Pena Nieto and Mr. Trump announced they had reached an “understanding” on the issue. It was this agreement that would get the ball rolling for a new trilateral deal with Canada.

Canada’s contentious trade issues

Dairy supply management

Canada’s dairy, egg and poultry industries are governed by a supply-management system that dates back to the 1970s. It has three parts, The Globe’s Barrie McKenna explains: Fixed prices, production quotas and tariffs to protect Canadian producers from foreign competition. The dairy tariffs – which run up to 270 per cent, and which Canada tightened in 2016 to include unfiltered milk products used to make cheese and yogurt – have been a thorn in the side of other dairy-producing nations like the United States, Australia and New Zealand.

Mr. Trump’s interest in the dairy file began with events in Wisconsin, a major dairy-producing state, The Globe’s Joanna Slater explains. Local processor Grasslands Dairy Products Inc. wrote a letter to Wisconsin farmers saying it would stop buying the farmers’milk because of new Canadian classification rules for a product used in cheese making, which would give companies an incentive to buy domestically instead of from the United States. A letter-writing campaign to Mr. Trump – who narrowly won the state in the 2016 election – and congressional efforts by Wisconsinite House Speaker Paul Ryan made the dispute into a national issue, and at an event in Kenosha, Wisc., the President vowed to challenge Ottawa on its dairy policy:

In the months that followed, the Trudeau administration spoke in strong defence of Canada’s dairy and poultry sectors. Then, in the fourth round of NAFTA renegotiation talks, the Trump administration put its demands on the table: Phase out all tariffs associated with dairy and poultry supply management over 10 years. Canada held firm for months, but by August, the Trudeau government was ready to offer some concessions. The USMCA, announced Sept. 30, gave the U.S. a percentage of the Canadian dairy market, much to the chagrin of Canadian industry groups and politicians in Quebec, who were in the midst of a provincial election at the time.

More reading

The milk war: How a letter in Wisconsin set off a trade dispute between the U.S. and Canada

How butter's surge in popularity led to Trump's attack on the Canadian dairy industry

Softwood lumber

Feuds over softwood lumber have been a recurring part of Canada-U.S. relations since the 1980s. Their root cause is U.S. industry’s contention that Canada unfairly subsidizes its lumber by providing cheap access to public land. It’s led to a cycle of American punitive action, followed by trade cases mostly won by Canada, and then a compromise settlement.

The fifth and most recent lumber war was set off on April 24, 2017, when U.S. Commerce Secretary Wilbur Ross said his agency would impose new anti-subsidy duties on Canadian softwood. The initial duties added up to about 20 per cent, but a second wave of anti-dumping duties in late June brought that total to about 27 per cent. The U.S. International Trade Commission upheld the duties in a unanimous final ruling on Dec. 7, arguing that Canadian shipments of softwood lumber were hurting American producers.

The Trudeau cabinet discussed an aid package for the softwood industry last May, but waited for provincial input from a special working group before announcing $867-million in aid on June 1. Ottawa gave the industry loan guarantees, help finding new markets for its products, employment-insurance support for workers and money for new initiatives from Indigenous forestry producers.

Last November, the government also asked for a binational panel to settle the tariff dispute, using NAFTA’s Chapter 19.

Chapter 11 vs. Chapter 19

Two of NAFTA’s dispute-resolution mechanisms were targeted for major changes. How is Chapter 11 different from Chapter 19? Here are the basics.

Chapter 11: Government vs. businesses

Imagine a scenario where Country A passes a law that a corporation based in Country B feels would hurt its business. If Country B Inc. sues Country A’s government, the case goes to arbitration by an ad-hoc panel of lawyers appointed by the NAFTA countries, in a process set out in NAFTA’s Chapter 11. The idea is that these panels would be more independent than if the case were settled by Country A’s courts. But critics say the lawyers appointed to these panels risk conflicts of interest because of their business activities back home.

Canada faced more Chapter 11 lawsuits than any other country – about 40 – most of which challenged its environmental protections and natural-resource policies. A 2015 study by the Canadian Centre for Policy Alternatives found Canada was the target of more than 70 per cent of all NAFTA investor-state claims since 2005, and study author Scott Sinclair warned that the problem was getting worse.

One of Canada’s goals in the NAFTA renegotiations was to overhaul Chapter 11 so that, instead of ad hoc panels, there would be set rosters of judges appointed by the NAFTA countries. The USMCA elimited Chapter 11 for Canada and the United States, but left its protections for Mexico in a limited form.

Chapter 19: Government vs. government

Whereas Chapter 11 laid out how companies can sue governments, Chapter 19 is for trade feuds between governments. If Country A imposes trade duties on Country B that B’s government thinks are unfair, B can appeal to an independent panel rather than seeking redress in Country A’s courts, which could presumably be biased in Country A’s favour.

Canada liked this arrangement because it has used it to successfully challenge American duties on softwood lumber and other products. But the Trump administration thought the independent panels were a violation of U.S. sovereignty, and it wanted U.S. courts to handle trade disputes. Canada managed to keep Chapter 19 in the USMCA.

Who was deciding NAFTA’s future?

Here’s some more reading on key people involved in the trade file.

The Canadian side

- Chrystia Freeland, Foreign Affairs Minister

- Jim Carr, Minister for International Trade Diversification

- Steve Verheul, chief NAFTA negotiator

- David MacNaughton, Canadian ambassador to the U.S.

The American side

- Robert Lighthizer, U.S. Trade Representative

- Wilbur Ross, Commerce Secretary

- Peter Navarro, White House trade adviser

- Kelly Craft, U.S. ambassador to Canada

The Mexican side

- Andres Manuel Lopez Obrador, Mexican president-elect

- Jesus Seade Kuri, Mr. Lopez Obrador's chief NAFTA negotiator

How does this affect me?

Uncertainty over NAFTA’s future had far-reaching effects on the Canadian economy, from the dollar to the energy sector – and, ultimately, to your personal finances. Here’s some more reading on what might be coming.

Economy and personal finance

Under Trump's NAFTA proposal, Canadians could see steep increase in tax-free online shopping

Canadian exporters must look to U.S. or lose business in a ‘Buy American’ world

Oil and gas

Canada gives Trump administration warning on pipeline exclusion

Premier Rachel Notley pushes Alberta as part of Canada’s broader U.S. approach

Manufacturing and technology

Auto tariffs would backfire for U.S. car prices, jobs and GDP, study finds

Michael Geist: What would a digital-economy-era NAFTA mean for Canadians?

Agriculture

The NAFTA snack: Why free trade is vital to food production

What about the rest of the world?

A new North American trade regime is only part of larger changes in America’s, and Canada’s, role in the world – and when NAFTA’s future was in question, Canada went looking for other sources of trade revenue.

- Asia-Pacific: Mr. Trump’s decision to withdraw the United States from the Trans-Pacific Partnership appeared to kill the trade deal, but 11 countries gave it a new lease on life with China’s help. In January, 2018, after months of diplomatic back-and-forth about what a new TPP should look like, high-level talks in Tokyo produced a revised version. The new deal, called the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), needs to be approved by six of the member states before it can come into effect. Canada’s legislation to do so, Bill C-79, is still in progress in Parliament.

- Europe: The European Union, Canada’s second-largest trading partner, finalized a trade deal with Canada even broader in scope than NAFTA: the Comprehensive Economic and Trade Agreement, most of which provisionally took effect on Sept. 21. But it still needs to be ratified by all 28 EU member countries, and Italy, which elected a new government in 2018, has been resistant to that.

More reading

China now the unlikely champion of free trade in the Trump era

What’s next?

Now that the text of the USMCA is apparently locked down, the legislatures of all three countries have to ratify it. Once Mr. Trump sends the text to Congress, it begins a 60-day countdown to a final signing. Prime Minister Justin Trudeau and Mexican President Enrique Pena Nieto were mobilizing their legislatures too.

Canada and the U.S. have yet to finish negotiations that would end the punitive U.S. tariffs on steel and aluminum, which the Trump administration imposed in June when it was putting pressure on Canada and Mexico to sign a new deal.

With reports from Adrian Morrow, Bill Curry, Steven Chase, Robert Fife, Greg Keenan, Barrie McKenna, Evan Annett, Reuters and The Canadian Press

Images via Reuters, Associated Press, Canadian Press, iStockphoto