Deputy Prime Minister and Minister of Finance Chrystia Freeland tables the federal budget in the House of Commons in Ottawa on April 16. The Liberal government has already unveiled significant planks of the budget, including billions of dollars to build more homes, expand child care and beef up the military.Adrian Wyld/The Canadian Press

The Liberal government unveiled a budget with billions in new spending, paid for in part by significant capital-gains tax changes, gambling that appealing to younger voters with an ambitious housing plan is worth the cost of upsetting those calling for stronger fiscal discipline.

The 2024 federal budget lays out about $53-billion in new spending over five years, with $19-billion going toward a package of housing and affordability policies that Prime Minister Justin Trudeau and Finance Minister Chrystia Freeland mostly revealed through a series of cross-country announcements in recent weeks.

The budget also includes other big-ticket items, including $10.7-billion for defence, $9.1-billion for Indigenous communities and $6.4-billion for community health and safety measures.

The new spending on housing and affordability measures is expected to be offset by the first change to capital-gains taxes in 25 years, which the budget indicates will generate about $19-billion over five years.

The housing plan was developed as public opinion polls consistently show the governing party trailing well behind the front-running Conservatives, whose Leader, Pierre Poilievre, has been campaigning for months on promises to tackle Canadians’ housing and cost-of-living concerns.

Finance Minister Chrystia Freeland's latest budget projects spending of $535 billion this year, with a deficit of $39.8 billion. She says the spending plan is aimed at creating generational fairness, which will be funded, in part, by changes to capital gains taxes. (April 16, 2024)

The Canadian Press

The minority government Liberals also need to keep delivering on NDP priorities such as pharmacare and dental care in order to maintain a parliamentary agreement between the two parties.

In her budget speech to the House of Commons, Ms. Freeland said the tax increases show the federal government is approving new spending in a prudent fashion.

“As we invest with purpose for the benefit of our younger generations and those who love them, we continue to stick to a responsible plan,” she said, portraying the government’s plan as one that takes on powerful interests in order to find the money needed to support younger generations.

“Today it is possible for a carpenter or a nurse to pay tax at a higher marginal rate than a multimillionaire. That isn’t fair. That must change, and it will,” she said, pledging that 99.87 per cent of Canadians will not be affected by the changes.

Mr. Poilievre described the budget as the Liberals doubling down on their past habits, noting that all of Mr. Trudeau’s budgets have included new programs funded by debt.

He described the spending plan as a “wasteful, inflationary budget.”

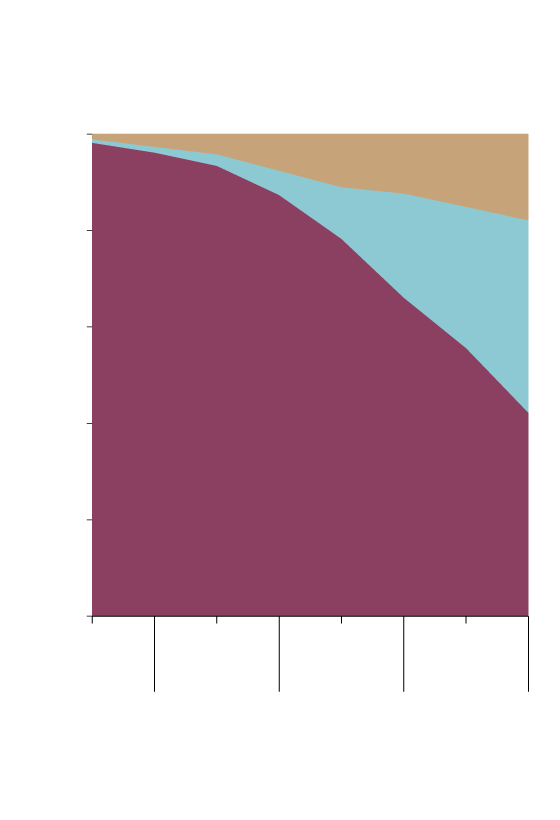

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

90-

95

99-

99.5

99.9-

99.99

50-

90

95-

99

99.5-

99.9

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

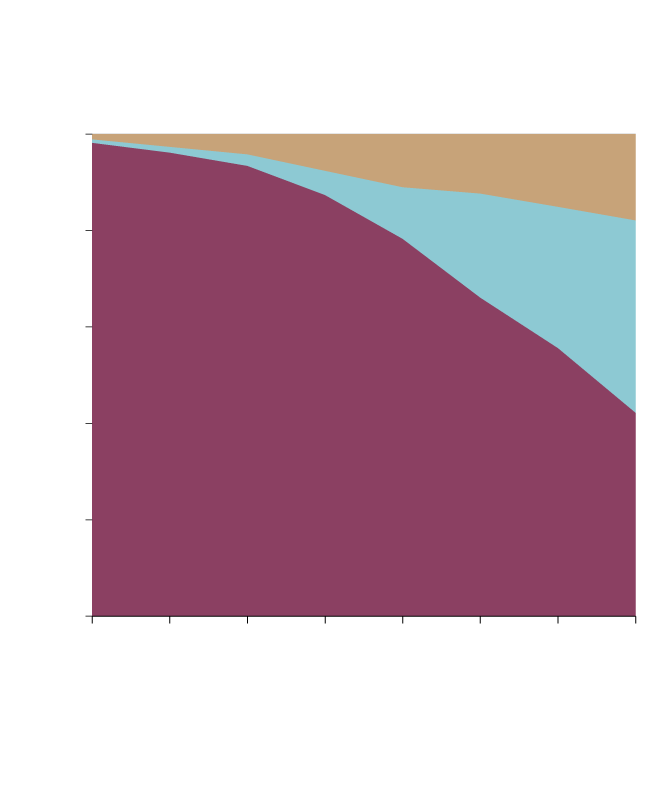

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

50-

90

90-

95

95-

99

99-

99.5

99.5-

99.9

99.9-

99.99

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

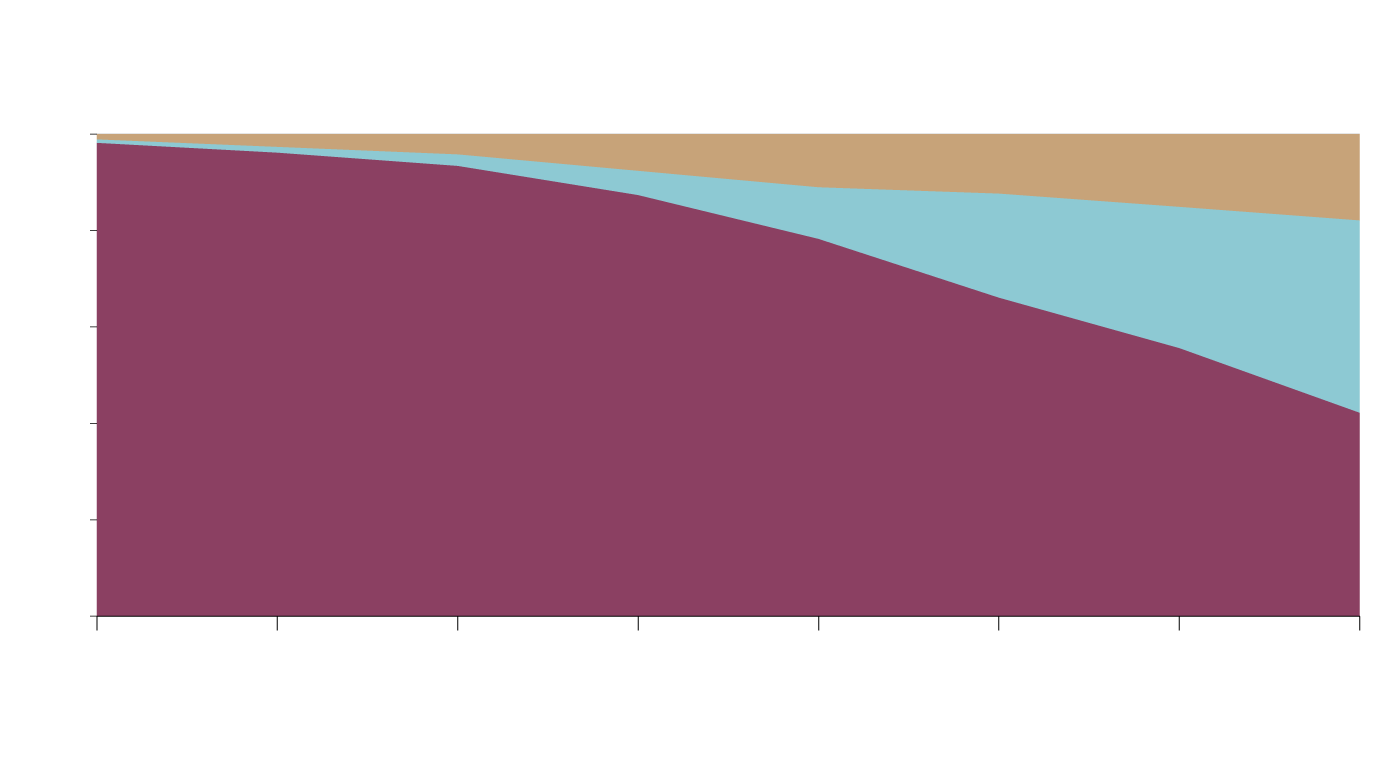

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

50-

90

90-

95

95-

99

99-

99.5

99.5-

99.9

99.9-

99.99

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

To underscore his point, Mr. Poilievre pointed out that the budget projections show debt-servicing costs will be larger than the federal share of health care costs. During this budget year, health transfers account for $52.1-billion while debt charges will rise to $54.1-billion. “That’s money for bankers and bondholders rather than doctors and nurses,” Mr. Poilievre said.

The Conservatives declined to outline their position on the capital-gains tax changes.

NDP Leader Jagmeet Singh, who has long called for higher taxes on big corporations, said the tax increases don’t go far enough.

“The Liberals failed to use the opportunity they had to take on corporate greed,” said Mr. Singh, who also sought to take credit for many of the new measures, including pharmacare, a new school food program and housing policies.

The government’s major hike in revenue will come from changes to the capital-gains tax rules. A capital gain is the profit an individual or a business earns when they sell an asset, such as stocks or property.

Tuesday’s budget states that as of June 25, the inclusion rate – the portion on which tax is paid – will rise from one-half to two-thirds on capital gains realized by companies. The increase will also apply to individuals, but only on capital gains above $250,000.

The lifetime capital-gains exemption for Canadian small-business owners who sell their companies will rise from $1-million to $1.25-million. The total capital-gains exemption from the sale of a principal residence will not change.

There is also a new Canadian Entrepreneurs’ Incentive that proposes a lower lifetime capital-gains inclusion rate for qualifying businesses under certain conditions.

Canadian Federation of Independent Business president Dan Kelly said the package of changes creates winners and losers and will likely create strong pushback from business owners. He said many doctors, who operate as independent businesses, could be negatively affected.

“This is going to be an electrifying issue,” he said, comparing the coming battle with the pushback over small-business tax changes in 2017 that forced the Liberal government to water down its original plans.

Ms. Freeland acknowledged in her speech that the capital-gains changes will be controversial.

“I know there will be many voices raised in protest. No one likes paying more tax, even – or perhaps particularly – those who can afford it the most,” she said. “Tax policy is not only, or chiefly, the province of accountants or economists. It belongs to all of us – because it is how we decide what kind of country we want to live in and what kind of country we want to build.”

In the lead-up to the budget, Ms. Freeland said the spending plan would stay within the fiscal framework she outlined in November. The budget meets that by the slimmest of margins. In 2023-24 the deficit is expected to be $40-billion, just shy of the $40.1-billion ceiling set in the fall.

The budget forecasts smaller deficits each year, declining to $20-billion in 2028-29, but there is no timeline for balancing the books.

The debt-to-GDP ratio, another key metric of fiscal health, is projected to improve slightly from 41.9 per cent this fiscal year to 39 per cent in 2028-29.

“This budget is another swing of the tax-and-spend policy hammer,” Bank of Montreal senior economist Robert Kavcic said, adding the government has passed over an opportunity for fiscal consolidation in favour of more spending.

Queen’s University adjunct professor Don Drummond, a former senior Finance Department official, said it’s a “delicious irony” that the Liberals present the budget as a gift to young Canadians.

“How does piling on debt, which they’ll have to manage, help young people?” he said. “They’re the ones that are going to have to pay that bill. That’s a future tax liability on them.”

Some economists expressed surprise at the size of new revenue the federal government hopes to collect.

“I’m blown away by the magnitude of the tax increase,” said Bank of Nova Scotia economist Rebekah Young, who described the size of spending as comparable to pandemic-era budgets.

“The budget clearly makes the Bank of Canada’s job more difficult,” she added, referring to the increase in spending.

Bank of Canada Governor Tiff Macklem, who has raised interest rates in an effort to curb inflation, will be watching the budget closely as he and his team debate when rates can be reduced.

Statistics Canada reported Tuesday that the consumer price index rose 2.9 per cent in March from a year earlier, up from 2.8 per cent in February. The figures prompted market speculation that rate cuts could begin as soon as June.

David Macdonald, senior economist with the left-leaning Canadian Centre for Policy Alternatives, called it a “go big or go home housing budget” and said most Canadians will not be affected by the tax increases required to pay for the spending.

“The folks at the high end are very interested in not having it go through and so they will use all the means at their disposal through their connections with MPs, connections with accountants and tax lawyers, to do everything they can to stop this,” he said.

In addition to tax changes, the budget includes modest cost-savings efforts.

The government said it will save $3.9-billion over 10 years by selling off underused federal properties and accelerating the end of leases on rented building space. It said Ottawa has more than six million square metres of office space of which an estimated 50 per cent is underused or vacant. This initiative is expected to save $900-million on a continuing basis after the first decade of savings is over.

The budget also announced the second phase of a cost-savings exercise directed by Treasury Board President Anita Anand. It will save money by eliminating positions after public servants retire or quit and will cut 5,000 full-time equivalent positions in this manner over four years. The size of the public service has grown by more than 100,000 employees since 2015, from 257,034 to 368,000 as of March 31.

Starting on April 1, 2025, Ottawa will require federal public-service organizations to cover increased operating costs from existing resources. Together this is estimated to save $4.2-billion over four years, starting in 2025-26, as well as $1.3-billion a year afterward.

With reports from Steven Chase and Marie Woolf

Editor’s note: A previous version of this article incorrectly stated that the current tax rate on capital gains is 50 per cent. The current inclusion rate for capital gains is 50 per cent. This version has been updated.