Housing, affordability and generational fairness are the buzzwords in the 2024 federal budget, unveiled by Finance Minister Chrystia Freeland on Tuesday. But the government’s newly announced spending goes well beyond those areas, and will be paid for partly with significant tax increases on the top income earners in Canada, and corporations.

Ms. Freeland detailed $53-billion in new spending over five years, $21.9-billion of which will be funded primarily through increases to capital gains taxes and excise duties on tobacco and vaping products. Of the new spending, $19-billion is allocated to new housing and affordability measures. The next biggest spend is $10.7-billion for defence, followed by $9.1-billion in new spending for Indigenous communities and businesses. Funding for economic growth measures comes in at $7.6-billion, and $6.4-billion in new funding is allotted for community health and safety.

Those umbrella categories include things such as $2.4-billion to process asylum seekers and refugees and provide them with housing and health care. The long-awaited federal disability benefit will be funded with $6.1-billion over six years. The budget also projects that the national pharmacare plan, a key part of the minority Liberal government’s deal with the NDP for support in the House of Commons, will cost $1.5-billion over five years.

Vast majority of tax increases go beyond what Liberals promised in platform

Prime Minister Justin Trudeau’s Liberals campaigned on some tax increases in the 2021 election. But what his government announced in the Tuesday budget goes well beyond those pledges.

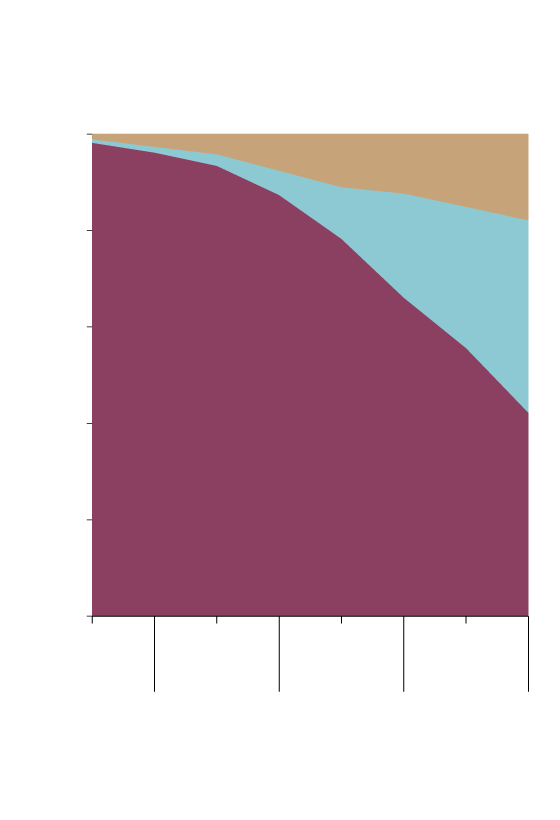

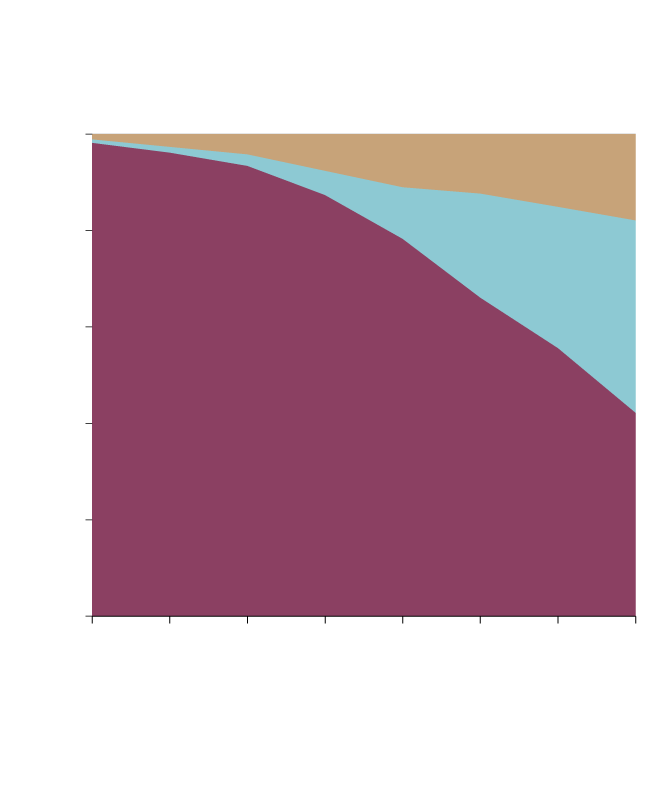

The government will raise $19.4-billion in revenue through changes to capital gains tax rules. For corporations, the government will increase the taxable portion of capital gains from one half to two thirds. For individuals, the taxable portion will go up the same amount on capital gains above $250,000.

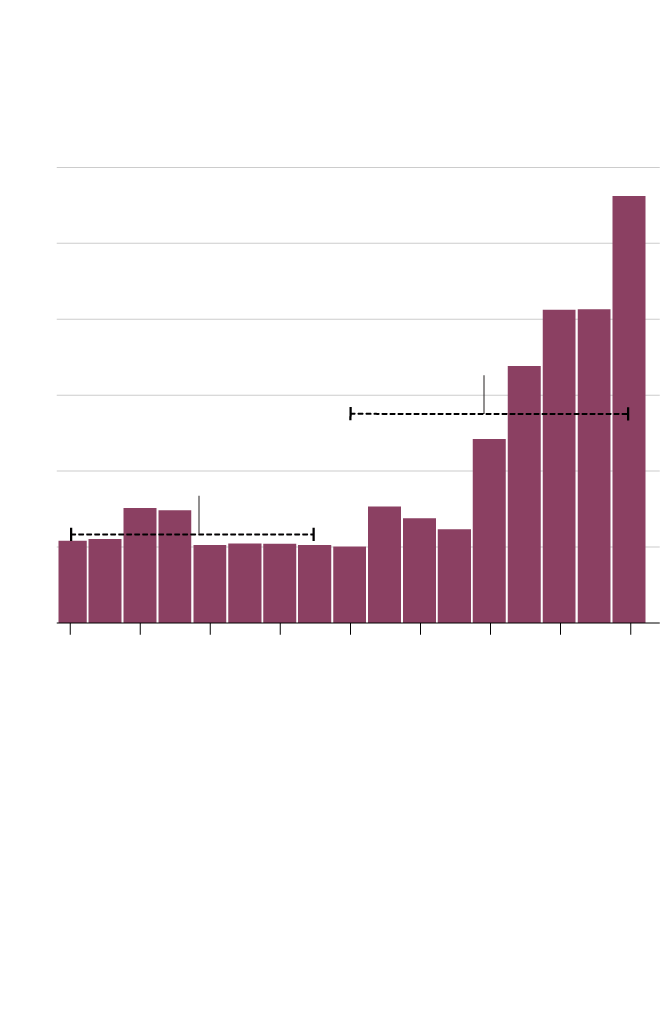

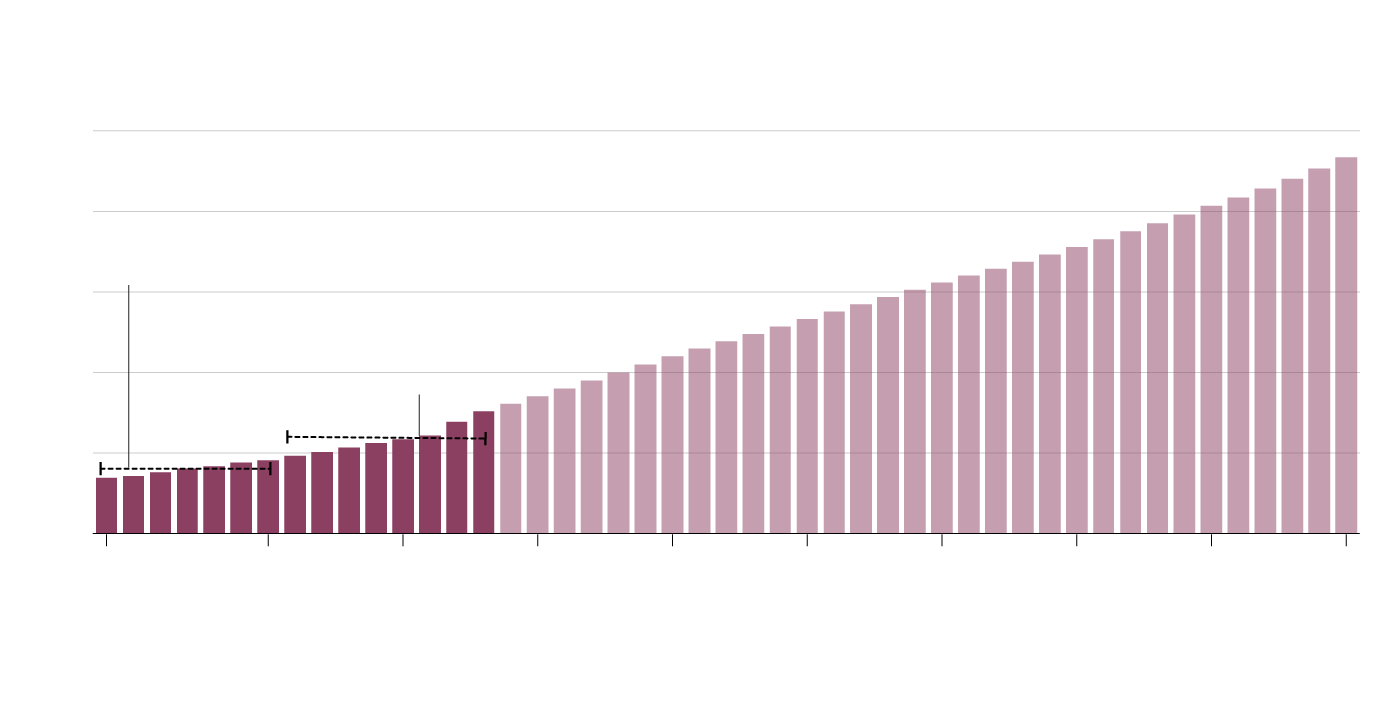

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

90-

95

99-

99.5

99.9-

99.99

50-

90

95-

99

99.5-

99.9

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

50-

90

90-

95

95-

99

99-

99.5

99.5-

99.9

99.9-

99.99

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Capital gains as a share of gross income

By income percentile

100%

Dividends

80

Capital gains

60

40

20

Wages and other income

0

Bottom

50

50-

90

90-

95

95-

99

99-

99.5

99.5-

99.9

99.9-

99.99

Top

0.01%

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Capital gains are the profits an individual or a business earns when they sell assets, such as stocks or property.

According to the budget documents, the government expects that, by 2025, the individual tax changes will apply to the top 0.13 per cent of earners – or about 40,000 people.

On the corporate side, the budget notes that 307,000 corporations reported capital gains income in 2022. About two thirds of the revenue from the tax hike on the corporate side is expected to come from the finance and investment sector, real estate and holding companies. Less than 10 per cent of the revenue increase is expected to come from private professional corporations, which are often owned by lawyers and doctors.

The budget also includes a $1.7-billion increase in excise taxes on tobacco and vaping products.

In 2021, the Liberals campaigned on a smaller increase on those products. The party did not campaign on capital gains changes.

No path to balance

This year’s budget, like other recent budgets, does not include plans to end debt-financed spending. Over the next five years, the smallest projected deficit is $20-billion in 2028-29. For the 2024-25 budget year, the government is projecting the deficit will be $39.8-billion.

In the lead-up to the budget, Ms. Freeland had said the spending plan would stay within the fiscal framework she outlined in November. At that time, she said the deficit for the year that ended March 31 would be less than $40.1-billion. The budget shows that target was met, but by the slimmest of margins: the reported deficit for the 2023-24 fiscal year was $40-billion.

The debt-to-GDP ratio, another key metric of fiscal health, is projected to improve slightly from 41.9 per cent this fiscal year to 39 per cent in 2028-29.

Small businesses finally get their carbon price rebate

Small and medium sized businesses have been paying the carbon price for five years. But, unlike with individuals, who have been receiving cash payments meant to offset carbon pricing when they file their taxes, the federal government has yet to return the money to companies. After a years-long pressure campaign for the government to act, Tuesday’s budget says the money will be returned “urgently.”

An estimated 600,000 businesses will receive $2.5-billion in carbon-price rebates through the Canada Revenue Agency, but the money will be paid separately from tax refunds. The rebates will be calculated based on the province where each business is located and the number of employees it has. The program is open to businesses with 499 or fewer employees.

The rebates will be annual, the budget says. They are contingent on the businesses filing their taxes.

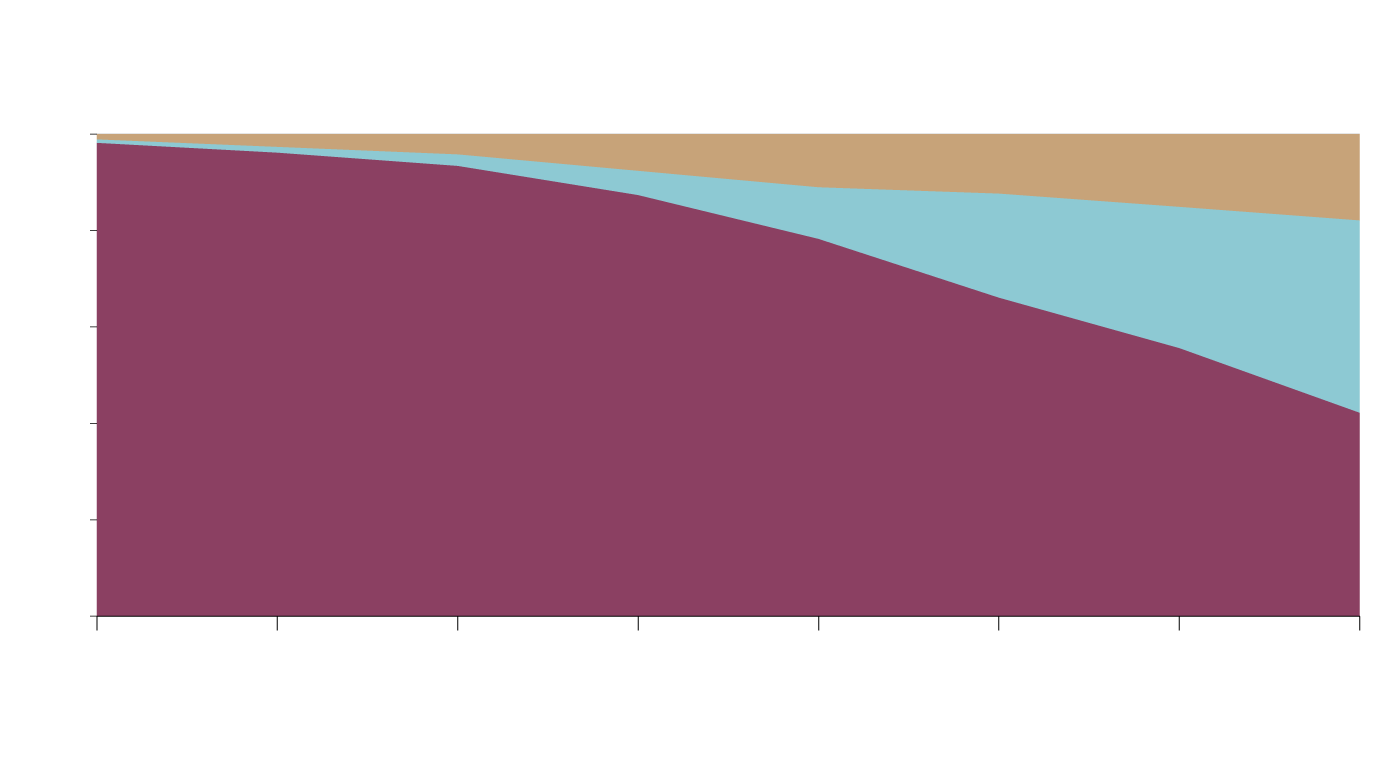

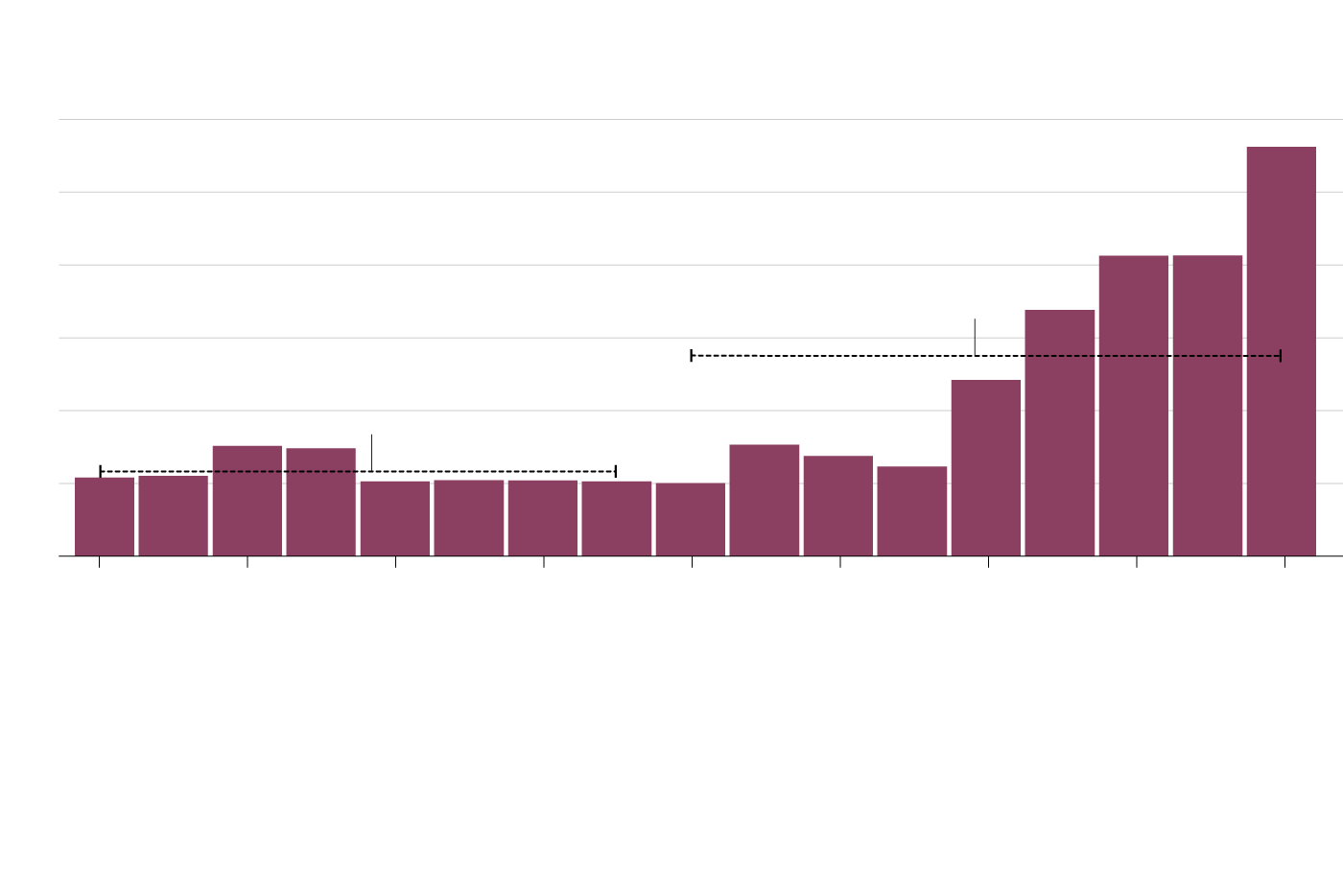

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2011-

2012

2015-

2016

2019-

2020

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Federal housing investments

since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2009-

2010

2011-

2012

2013-

2014

2015-

2016

2017-

2018

2019-

2020

2021-

2022

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Federal housing investments since the 2008 global financial crisis

Billions of dollars

$12

10

2015-2024

average

$5.5

8

6

2007-2015

average

$2.3

4

2

0

2007-

2008

2009-

2010

2011-

2012

2013-

2014

2015-

2016

2017-

2018

2019-

2020

2021-

2022

2023-

2024

Note: Amounts for 2007-08 until 2022-23 are actuals, as available. Amount for 2023-24 is an estimate, and subject to change. Amounts are on a cash basis. Amounts include Canada Mortgage and Housing Corporation (CMHC) programming only, and do not include: homelessness programming; energy efficiency programs delivered through Natural Resources Canada; tax measures; cost-matching provided by provinces and territories; or investments that support distinctions-based Indigenous housing strategies.

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Selling empty and underused government buildings for housing

To address the country’s housing shortage and execute on a promise to build 3.87 million new homes by 2031, the Liberals say they will build housing on “every possible piece” of federal public land, from armouries to office buildings to post offices.

This includes, according to the budget, a $1.1-billion plan over the next 10 years to reduce the amount of federal office space by half, and prioritize that land for student or non-market housing. The budget says this equates to the 50 per cent of federal office space that is either underused or entirely vacant, and that the costs of the program will be more than offset by the sale of the buildings and operating-cost savings. The budget estimates that over 10 years the government will save $3.9-billion with the new policy.

The vast majority of the other housing policy changes detailed in Tuesday’s fiscal plan were announced by the government ahead of the budget’s release. Last week, for example, the Liberals said they would start allowing first-time homebuyers to take out 30-year mortgages for newly built homes. They also revealed plans to crack down on mortgage and real estate fraud, and to restrict the purchase of single-family homes by large, corporate investors.

Disability benefit rolls out after years of waiting

A new federal benefit designed to ensure people living with disabilities can avoid living in poverty is being launched this year with $6.1-billion in funding over six years, and then an extra $1.4-billion a year.

The government estimates that around 600,000 low-income Canadians with disabilities are each eligible for up to $2,400 a year under the program, starting from July, 2025.

The benefit would be available to Canadians between the ages of 18 and 64 who have a valid disability tax credit certificate, which requires a doctor’s note.

Funding contraceptive coverage and diabetes medication to cost $1.5-billion

The government is also allocating $1.5-billion over five years for the first phase of its national pharmacare program, which will provide individuals with cost-free contraception, including birth control pills and emergency contraceptives, as well as diabetes medication, including insulin.

Health Minister Mark Holland had previously estimated the cost at $1.5-billion, but at the time he did not specify that this would cover several years of the program.

The budget does not specify when individuals will no longer have to pay for contraceptives and diabetes medications. It says the program is subject to negotiations with the provinces. For 2024-25, the government is budgeting only $59-million for the program.

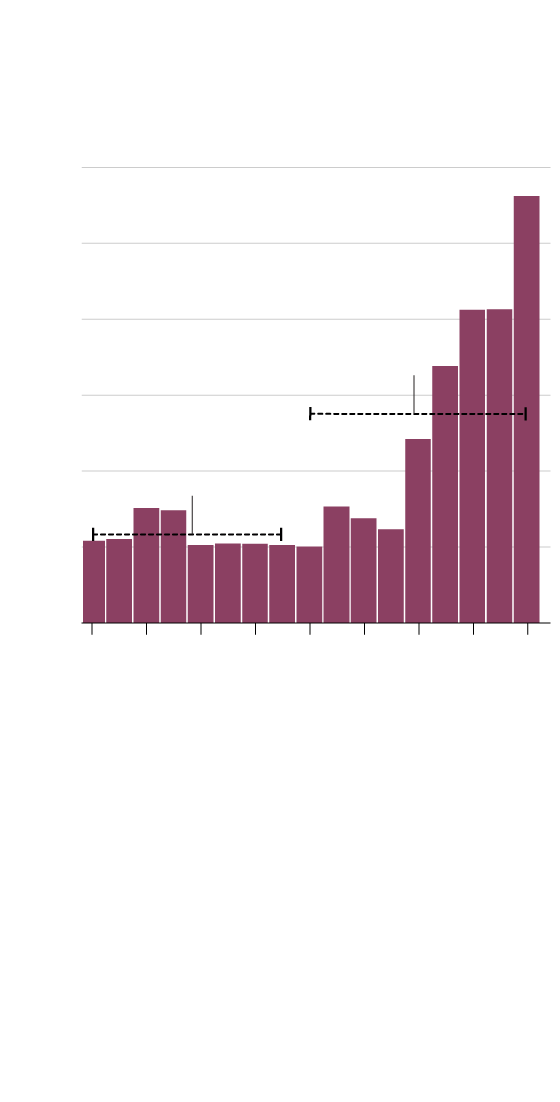

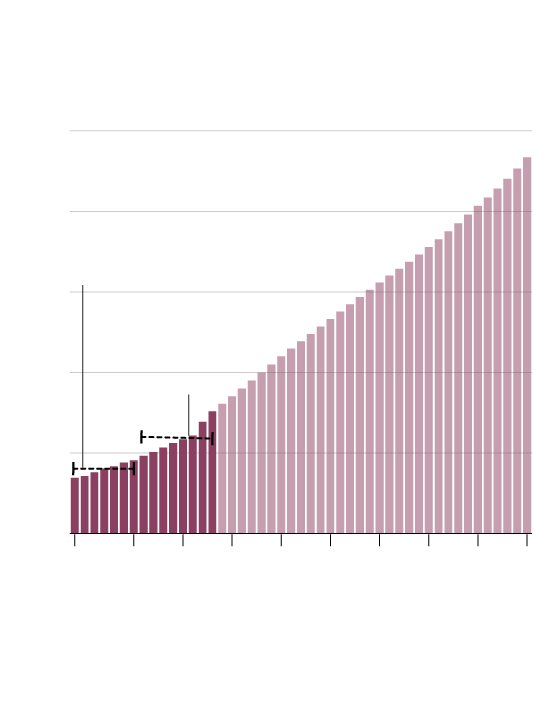

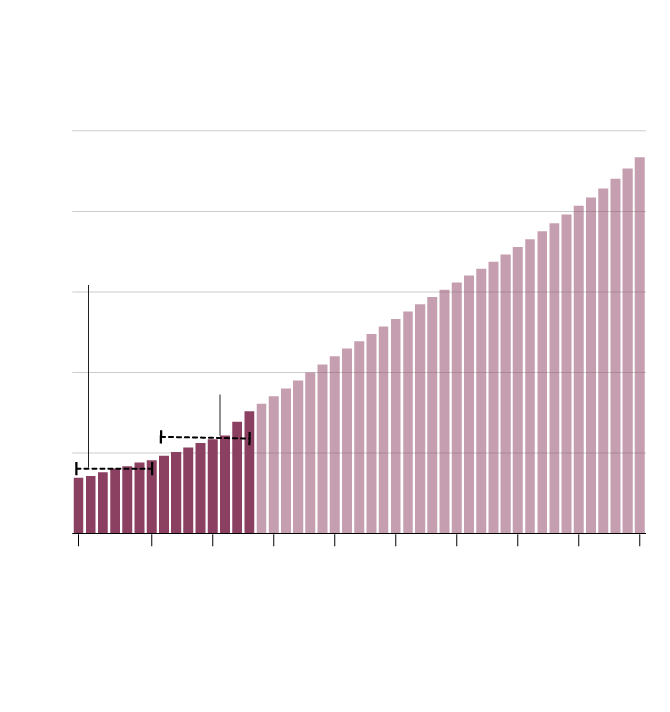

Projected seniors’ benefits

Billions of dollars

$250

2009-10 to

2015-16

average

$40

200

2016-17 to

2023-24

average

$59.1

150

100

50

0

2015-

2016

2025-

2026

2035-

2036

2045-

2046

2055-

2056

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Projected seniors’ benefits

Billions of dollars

$250

2009-10 to

2015-16

average

$40

200

2016-17 to

2023-24

average

$59.1

150

100

50

0

2009-

2010

2015-

2016

2020-

2021

2025-

2026

2030-

2031

2035-

2036

2040-

2041

2045-

2046

2050-

2051

2055-

2056

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Projected seniors’ benefits

Billions of dollars

$250

2009-10 to

2015-16

average

$40

200

2016-17 to

2023-24

average

$59.1

150

100

50

0

2009-

2010

2015-

2016

2020-

2021

2025-

2026

2030-

2031

2035-

2036

2040-

2041

2045-

2046

2050-

2051

2055-

2056

THE GLOBE AND MAIL, SOURCE: BUDGET 2024

Pension changes

Ottawa is appointing former Bank of Canada governor Stephen Poloz to lead a new federal working group that will look for ways to make it more attractive for Canadian pension funds to invest in the country, especially in areas such as digital infrastructure and airports.

The working group is being created to “explore how to catalyze greater domestic investment opportunities for Canadian pension funds,” the budget says, and will be supported by Finance Minister Chrystia Freeland and deputy minister Chris Forbes.

It will focus on priority areas, including investment in artificial intelligence, physical infrastructure and venture capital to back startup and early-stage companies. The group will also study ways of building more homes, including on public lands. There is a particular emphasis on airports – an asset that pension fund leaders have long signalled would interest them if governments made them more accessible to private investment. And the group has been asked to consider whether Canada should lift an existing rule that restricts pension funds from holding more than 30 per cent of the voting shares in a company.

The working group is Ottawa’s answer to a debate that flared up in recent months about whether Canada’s largest pension funds are investing sufficiently in their home country.

In the latest budget, housing and affordability measures make up $19-billion of the $53-billion in new spending over five years.Sean Kilpatrick/The Canadian Press

Other highlights

More money for research: The government will increase core research funding to the Canadian Institutes of Health Research, the Natural Sciences and Engineering Research Council of Canada, and the Social Sciences and Humanities Research Council. Over the next five years, the budget says, funding will increase by $1.8-billion. After that, the organizations will get an additional $748-million annually.

Selling the government’s climate policy: The government will spend $11-million to advertise its climate change policies. No other details were released on what elements of the government’s policies the campaign will highlight. The government also says it will amend the Financial Administration Act to give Ottawa the authority to require financial institutions to use federally dictated labels for auto-deposited government payments. The measure is a response to the government’s struggle to get banks to use consistent labelling for the carbon price rebate.

Budget boost to CSIS: The budget says the Canadian Security Intelligence Service will get more than $650-million over eight years to fight foreign interference and bulk up operations at the spy agency’s regional office in Toronto, one of the cities most frequently cited in accounts of meddling in domestic affairs by foreign states.

New spending for Indigenous health and education: The budget allocates an additional $1.2-billion to primary and secondary school education for First Nations students. Also, $1.5-billion is being directed to reducing the number of Indigenous children in care, and $1.1-billion is being allocated to First Nations and Inuit health care.

Indigenous loan guarantee program: The government is launching a loan program to help facilitate Indigenous equity ownership in major natural resource and energy projects. It will include up to $5-billion in federal loan guarantees.

With reports from Erin Anderssen, Steven Chase, Robert Fife, Mark Rendell and Marie Woolf

Federal budget 2024: More from The Globe and Mail

The Decibel podcast

How does the new federal budget affect your finances? The Decibel gets the details from Globe journalists Marieke Walsh, Rachelle Younglai and Mark Rendell and personal-finance expert Rob Carrick. Subscribe for more episodes.

Commentary

Editorial: The Liberals move from borrow-and-spend to tax-and-spend

Campbell Clark: Higher taxes sold as fairness for a government that sees no other way

John Ibbitson: Budget 2024 lacks defence spending needed to meet NATO commitments

Lisa Lalande: Great budget, Ottawa, but how to execute it when Canada fails to retain talent?

William O'Connell: The budget’s tax changes on corporations and the wealthy are long overdue

Anthony Pizzino: Political interference in Canada’s pension funds is wrong