How might Willy Wonka react if sky-high cocoa prices threatened to eat into his candy empire’s profits? Perhaps he’d introduce Wonka’s Tantalizingly Teeny Chocolate Bars that, although they are the size of a sugar cube, magically deliver the same amount of sweet satisfaction as a full-sized bar. That might be far-fetched fiction, but candy manufacturers in the real world are hoping to pull off something similar this Halloween.

Ingredients, labour and transport costs have all made trick-or-treat goodies more expensive to produce, and manufacturers have found a range of ways to deal with these increases, including shrinking candy bars, putting fewer gummies in each bag and reducing the number of treats in assorted multi-packs.

Suzy Martins, a Winnipeg mother of two preteens, says she remembers mini chocolate bars at Halloween being “twice the size” they are now. In recent years, she adds, she’s been shocked watching her kids open bags of Swedish Fish candies, made by Mondelēz International Inc. (which also owns Cadbury), only to find three fish inside.

She used to give out a mini chocolate bar and a small bag of chips to each child that came to her doorstep, but now feels pressure to buy twice as many bars and give each child two or three to make up for the size difference.

“You feel like you’re being tricked because there’s no warning,” she says. “It feels a bit scammy.”

This Halloween trick is yet another example of shrinkflation – when companies reduce the size or volume of products rather than raising the price of them – which has hit items in every grocery aisle, not just seasonal sweets. For example, you might notice fewer sheets on each roll of toilet paper, or 100 fewer grams of cereal in the “family-sized” box. It’s a tool companies use to increase profit margins without scaring away customers with higher prices, but has also been a response to increased costs of manufacturing products.

What is the best Halloween candy of all time? Cast your vote now

The majority of cocoa comes from West Africa, and the El Niño weather pattern has brought disease to plants, dramatically affecting crop growth and triggering high prices. This past April, the cost of cocoa beans reached $9.74 a kilogram, the highest it has been in a half-century, according to the World Bank. In 2019, by comparison, cocoa beans were $2.20 a kilogram.

The companies that produce chocolate-based Halloween candies have responded with shrinkflation, says economist Pascal Thériault, who researches agricultural economics and agri-food marketing at McGill University. “From the producers’ perspective, they’ve done their job to limit the perceived price increase to consumers,” he says.

Global chocolate titans Nestlé SA, Mondelēz International and Hershey Co. have all reported drops in sales in the last year, attributed to lower consumer demand. Earlier this year, Nestlé reported sales in Canada for the first half of 2024 were down more than 5 per cent year-over-year.

But while sales may have slumped, chocolate makers are still pulling in profits. In the global supply chain, it’s cocoa producers who are suffering most from the crop losses.

The Globe and Mail sent specific requests about product size and packaging changes in the last decade to Nestlé, Mondelēz International and Mars. Only Mars responded – and a company spokesperson said this year’s products are “consistent with what was available last year.”

Dan Beaudoin, the chief executive officer of Birdway CPG Inc., a consultancy that specializes in food and beverage product design, and has done work with M&M’s, Kind and Dr. Oetker, has seen manufacturers also tweak formulations of the treats themselves to ride the wave of soaring commodity prices – a practice economists call “skimpflation.”

For a chocolate bar, for example, a manufacturer might reduce the percentage of cocoa used in the milk chocolate blend, Mr. Beaudoin says. For a nougat-filled treat, they might choose a less expensive but subpar grade of cocoa and make up for that by adding vanilla to the nougat to enhance overall flavour. For a peanut butter-filled sweet, they might find a blend of peanut butter with slightly increased sodium that brings out more of the chocolate flavour.

“That’s the whole world of food science: How do you increase the likeability of that product while reducing the cost overall?” he said.

Even if you still have some of last year’s Halloween treats, it can be difficult to track changes year to year because manufacturers also adjust the format of a product, making up for (or distracting from) increased production costs with novelty shapes or packaging. While a Kit Kat bar in a Nestlé variety pack of 50 mini bars is 12 grams, a vampire-shaped Kit Kat in a package of 40 bars is 8.2 grams. At one Canadian retailer that sold both products, the regular bars worked out to be 23 cents each, while the vampire-shaped ones were 28 cents each.

Mr. Beaudoin said this isn’t necessarily a type of shrinkflation as it can be expensive to create the tooling to design new shapes. But it’s impossible to know the reasoning behind format changes since companies don’t report that.

In May, the antitrust regulator in South Korea introduced a requirement for manufacturers and retailers of food and household products to clearly notify consumers on product labelling and store displays that a product had been reduced in size – or else face a hefty fine. Brazil has similar regulations in place. In June, the federal NDP tabled a private member’s bill to tackle shrinkflation, which calls for greater transparency from manufacturers and retailers when they change product prices or sizes.

Consumers are hungry for that kind of clarity.

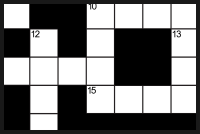

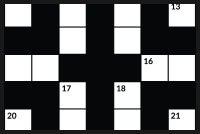

Nicole Neary, a lifelong Halloween fanatic and numbers geek who lives in Witless Bay, N.L., has tracked the way Halloween chocolate bars in particular have gotten smaller at a more rapid pace than nonseasonal sweets.

Even in cases where the price for a box of 95 chocolate bars is consistent from one year to the next, she looks for a difference in the price per 100 grams, also known as the unit price. “That’s where the real information is and it’s absolutely gone up. They’ll change the packaging or the way it looks altogether so you don’t notice it,” she says. “I’m an accountant – I’m hyper-aware of these things.”

Comparing the price per grams of Halloween candy is a trick that Nicole Neary used when buying candy before switching to full-size chocolate bars. With shrinkflation, while the price of candy may stay consistent throughout the years, the amount you’re purchasing can shrink.

A 50-pack of assorted Nestlé chocolate bars, including Aero, Kit Kat, Smarties and Coffee Crisp, was 510 grams a decade ago and now has been reduced to 485 grams.

After years of giving a handful of mini chocolate bars to trick-or-treaters, Ms. Neary did the math and it turned out to be more economical to buy full-sized chocolate bars at 75 cents each instead of boxes upon boxes of the “itty bitty” ones. Her house – with its elaborate, spooky decor, including a 12-foot skeleton – is known as a trick-or-treating destination in her neighbourhood, a reputation she relishes, and so she has increased her budget to keep up with the rising price of chocolate.

This year will be her splashiest yet: she has put together 120 treat bags for kids that include a soft drink, a pack of Pokémon cards and a full-sized Mr. Beast Feastable chocolate bar. The bars alone were going to cost $4 apiece but she spent weeks hunting online for deals and found them at a 25-per-cent discount, 6,500 kilometres away in Calgary, where she had a conveniently timed business trip.

As for Ms. Martins in Winnipeg, she has purchased a few boxes of Nestlé miniature chocolate bars and bags of Old Dutch chips. She’s stocked up for 100 trick-or-treaters, even though she had 130 last year.

There will be no 11th-hour dashes to the store if she runs out. Her own kids will usually do a round of trick-or-treating, stop at home to drop off their loot, and then go out again for a second round. Ms. Martins will sort through that initial haul, pick out the “stuff they’re not crazy about” and redistribute it to kids who come to her door.

“The last 30 will get the recycled stuff,” she said.