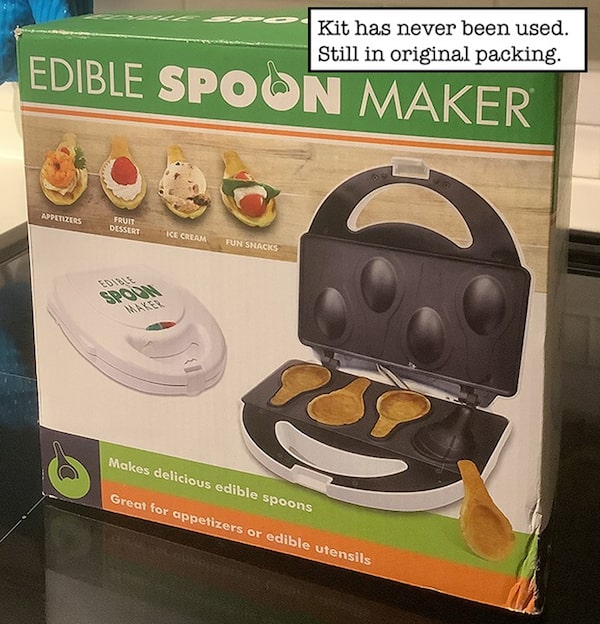

Someone in my neighbourhood is selling an Edible Spoon Maker for $10.

For a quick tutorial on edible spoons, consult this Youtube video. Then, maybe you can help me and the rest of the Stress Test podcast team with an episode for our upcoming sixth season on the secondhand trend. We’re looking for examples of the best bargains people have found in the secondhand market, and the most unique – OK, weird – things they’ve bought. Send your story to Stress Test producer Kyle Fulton at kfulton@globeandmail.com.

Second-hand shopping was a hot trend even before interest rates and inflation soared, but now it’s become something bigger. A financial survival tactic, maybe? Between rising interest rates and never-ending hikes in food costs, it’s a stretch for many people to buy new clothes, electronics, furniture, baby equipment. Buying used can help make these expenses manageable.

The Edible Spoon Maker was listed recently on a message board used in our neighbhourhood to sell and give away secondhand items. Forums like this are a great place to find used goods, along with Facebook, online marketplaces like Kijiji, thrift stores, consignment shops and websites or apps like Etsy, Karrot and Used.ca. Also check out Freecycle.org to see if it’s available in your city. On Freecycle, people give away things they don’t need any longer.

Some useful stuff listed along with the spoon maker included a food processor, never used, and a hardly worn ski/snowboarding jacket. Looking for used baby gear? Kijiji offers 20 categories of baby items. Need furniture? Karrot offers couches, tables, dressers and more to residents of B.C., Alberta and Ontario. If you’re open to something more whimsical, there’s the corner of the secondhand market where the Edible Spoon Maker exists.

Rob Carrick/The globe and Mail

As you can see in this photo, the spoon maker for sale in my neighbourhood is in the original packaging and has never been put to use. Act now and never wash a spoon again.

Subscribe to Carrick on Money

Are you reading this newsletter on the web or did someone forward the e-mail version to you? If so, you can sign up for Carrick on Money here.

Rob’s personal finance reading list

Financial etiquette for today’s world

Advice on paying while on a date, dividing the bill when out with friends and how to handle the bill when you’re drinking and your friend is not. Lots more non-financial stuff, too.

Best cashback prepaid cards

A different way of banking – load cash on a prepaid credit card and then use it to cover your spending. Helps you budget, and you can earn cashback on purchases.

The ‘bank investigator’ scam

All about a scam where a fraudster calls you claiming to be a bank investigator. The ask: Please withdraw some money from your account to help with a criminal investigation. Never do this.

That sinking feeling, condo-style

An overview of special assessment insurance for condo owners. A special assessment results when a condo’s reserve fund isn’t sufficient to cover the cost of a repair or maintenance problem. This article cites an example of a $14,000 assessment charged to owners of a condo with a sinking foundation.

Ask Rob

Q: Which online broker has the best GIC product selection? I have an account [at a bank-owned broker], but the best GIC rates are not available.

A: You won’t find the best GIC rates at an online broker. The best rates come from GIC issuers who sell directly to the public only – Oaken Financial is an example. The issuers that offer GICs through online brokers have lower rates, in part because they pay commissions to the selling broker.

Do you have a question for me? Send it my way. Sorry I can't answer every one personally. Questions and answers are edited for length and clarity.

Today’s financial tool

The Canadian Real Estate Association’s national price map – average resale prices in cities across the country.

The Money-Free Zone

The 50 best original songs written for movies. Block some time out for this one.

From the Twitterverse

CBC journalist Duncan McCue asks a great question: Why are Canadian car rental companies not required to put snow tires on their rental vehicles?

What I’ve been writing about

- Bonds beat GICs right now for investors who want to maximize returns

- A house isn’t special. Get your head straight about the reality of home ownership

- Given all the interest in GICs, how about some love for annuities? They’re guaranteed, too

More Rob Carrick and money coverage

Subscribe to Stress Test on Apple podcasts or Spotify. For more money stories, follow me on Instagram and Twitter, and join the discussion on my Facebook page. Millennial readers, join our Gen Y Money Facebook group.

Even more coverage from Rob Carrick:

- 🎧 Catch up on Stress Test: Is the middle class dead for millennials and Gen Z? • Gas prices are soaring. Are electric vehicles an affordable solution? • Crypto is booming, but should you invest? • How are young Canadians dealing with soaring rents? • Inflation is squeezing our finances. What can we do about it? • Is a hot housing market squeezing Canadians out of their small towns?

- ✔️ The housing file: How bad is housing affordability? Even a crash won't help • Sell the family home to lock in profit and then rent? Better not • Why young adults can't afford houses: Hard work got you more in the past than it does now • Five reasons you should not buy a house till you're at least 30 • Now more than ever, owning a house is not a retirement plan

- 📈 Investing: The 2022 ETF buyer’s guide: Best Canadian equity funds • The 2022 Globe and Mail digital broker ranking: Does the zero-commission revolution flip the script on who’s best? • With bonds sinking, conservative investors are waking up to risks they never saw coming • A five-step plan for dealing with the sad fact that almost every investment is falling lately • The best financial advice in advance of retirement? Work on your marriage • One-year GICs are the best deal in town for safety seekers • What to do if the financial plan you paid thousands for disappoints

- 💰 Your money: Are you prepared for the pandemic wealth boom to blow up in our faces? • This hard-working 24-year-old is nailing it financially. But where’s the happiness? • Who should and shouldn’t worry about the wave of rate increases this year, and what every stressed-out borrower should do right now • Don’t make this potentially costly assumption about the CPP Survivor’s pension