A home for sale in Toronto’s Annex neighbourhood is photographed on July 18.Fred Lum/The Globe and Mail

The housing market appears to have cooled in recent weeks, but that doesn’t mean it’s now more affordable to enter the market. In fact, owing to rising interest rates, the opposite is true.

Within the past four months, the yearly income needed to buy the average Canadian home on a fixed mortgage with 20 per cent down has climbed by an average of $18,000, according to new data from Ratehub, a loan-comparison website. It determined these numbers by contrasting data from the Canadian Real Estate Association on all housing types from March with June, using the average mortgage rates of Canada’s five largest banks.

In Vancouver, would-be homebuyers must now take home a minimum of $232,000 a year to afford a home, an increase of almost $32,000 since March. That’s despite the average home price in B.C.’s largest city dropping by nearly $30,000, to approximately $1,236,000 in June, according to Ratehub.

To purchase a home in Toronto, Ratehub.ca says people need to make roughly $226,000 a year, an additional $16,000 in four months time. In June, Ratehub said home prices in Toronto fell to roughly $1,205,000, down $130,000 since March.

Monthly payments on variable-rate mortgages could increase as borrowers near their ‘trigger rate’

What is your mortgage trigger rate? This calculator helps you estimate it

The greatest increase since March occurred in Victoria, where the minimum annual income to afford a home, on average, is pegged at $188,000 – ballooning by 23 per cent, or about $36,000. Home prices in Victoria actually rose by nearly $50,000 between March and June, landing at $985,500, according to Ratehub’s figures.

The mortgage stress test is to blame for these large jumps. As concerns over inflation have pushed mortgage rates up in recent weeks, the threshold required to pass the government-mandated mortgage stress test has also risen, making homeownership even less attainable to many Canadians.

The stress test was first introduced during the 2016-2017 housing boom to ensure that homebuyers could afford their mortgage payments if interest rates rose, as well as to slow the frenetic markets in Toronto and Vancouver.

Interestingly, despite the notion that home prices have declined in markets across the country in the wake of rising interest rates, Ratehub found that among the 10 cities it assessed, only half saw their average home prices shrink between March and June.

”Home prices will need to drop significantly in order to neutralize the effects that higher mortgage rates have on the stress test,” said James Laird, co-CEO of Ratehub. “Unless this happens, home affordability will continue to be impacted significantly by the current rising rate environment.”

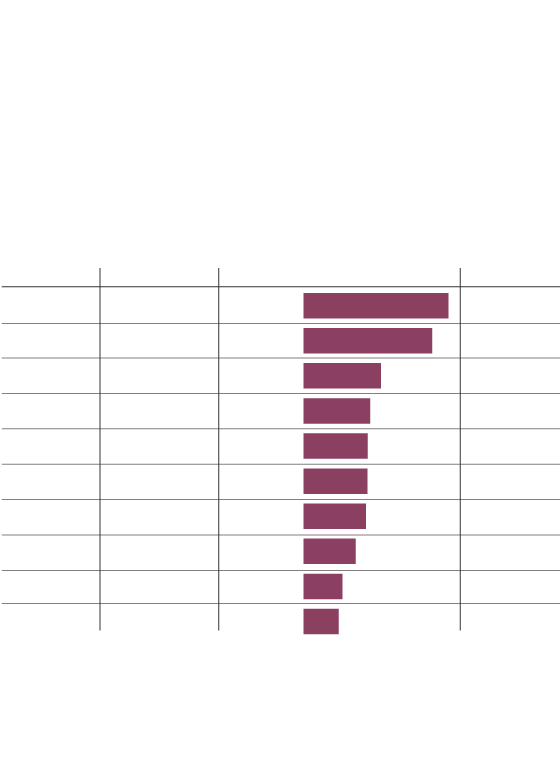

Change in annual income required

to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

City

Income req.

Increase from March, 2022

% increase

23%

Victoria

$187,980

$35,760

16

Vancouver

231,950

31,730

21

Halifax

110,580

19,060

18

Calgary

108,050

16,440

17

Montreal

110,900

15,830

7

Toronto

226,500

15,750

13

Ottawa

137,050

15,350

17

Edmonton

86,770

12,870

14

Winnipeg

78,270

9,540

5

Hamilton

179,060

8,660

Data are based on: 20 per cent down payment, 25-year amortization, $4,000

annual property taxes and $150 monthly heating; mortgage rates average of

the Big Five banks’ five-year fixed rates in March and June; average home

prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

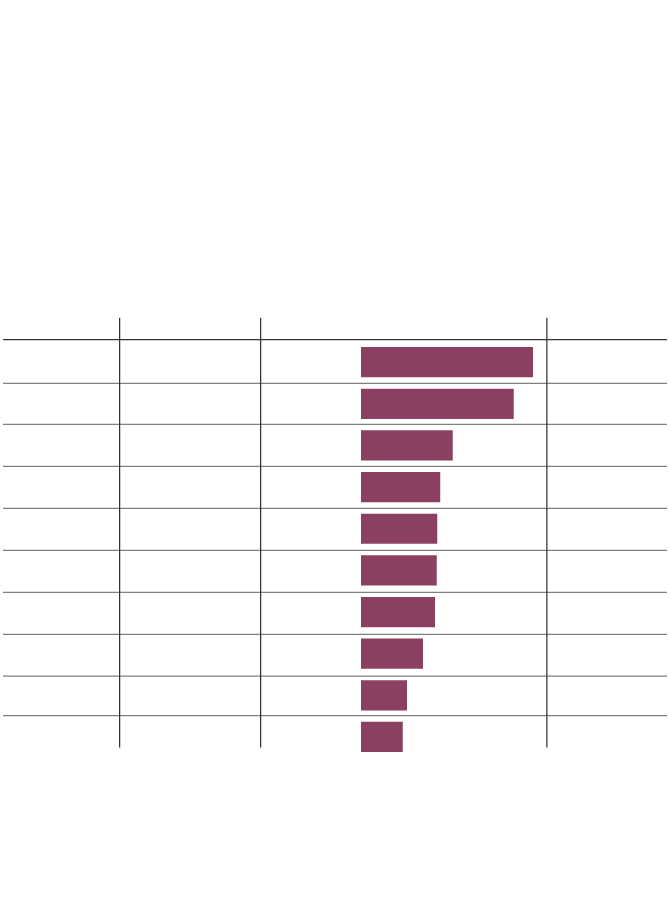

Change in annual income required

to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

City

Income req.

Increase from March, 2022

% increase

23%

Victoria

$187,980

$35,760

16

Vancouver

231,950

31,730

21

Halifax

110,580

19,060

18

Calgary

108,050

16,440

17

Montreal

110,900

15,830

7

Toronto

226,500

15,750

13

Ottawa

137,050

15,350

17

Edmonton

86,770

12,870

14

Winnipeg

78,270

9,540

5

Hamilton

179,060

8,660

Data are based on: 20 per cent down payment, 25-year amortization, $4,000

annual property taxes and $150 monthly heating; mortgage rates average of

the Big Five banks’ five-year fixed rates in March and June; average home

prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

Change in annual income required to buy a home in Canada

New analysis from Ratehub.ca, a loan-comparison website, shows it’s now more expensive to buy a home in Canada than it was a few months ago, despite the fact that the housing market has significantly slowed in many parts of the country. Rising mortgage rates – which have, in turn, caused stress-test rates to tick up – are to blame.

Select cities, June, 2022

City

Income required

Increase from March, 2022

% increase

23%

Victoria

$187,980

$35,760

16

Vancouver

231,950

31,730

21

Halifax

110,580

19,060

18

Calgary

108,050

16,440

17

Montreal

110,900

15,830

7

Toronto

226,500

15,750

13

Ottawa

137,050

15,350

17

Edmonton

86,770

12,870

14

Winnipeg

78,270

9,540

5

Hamilton

179,060

8,660

Data are based on: 20 per cent down payment, 25-year amortization, $4,000 annual property taxes and

$150 monthly heating; mortgage rates average of the Big Five banks’ five-year fixed rates in March and

June; average home prices from CREA MLS home price index.

the globe and mail, Source: ratehub.ca

As of last June, the stress test requires potential buyers to prove that they can keep up with mortgage payments at either a minimum rate of 5.25 per cent or their individual mortgage rate plus 2 per cent –whichever is higher.

With historically low interest rates, that meant the stress-test rate was almost universally set at 5.25 per cent for people seeking both variable and fixed-rate mortgages, which appear, by far, to be the most popular option in Canada.

But now that fixed-mortgage rates have increased by two-thirds in only four months, according to Ratehub, many hoping to buy with a fixed rate are facing stress-test rates around 7.21 per cent, on average.

John Pasalis, president of a Toronto-based real estate brokerage called Realosophy Realty, played down the significance of these changes. Most buyers, he said, are now opting for variable-rate mortgages because their stress-test rates are now closer to 6 per cent.

Rising mortgage rates add layers of stress to home ownership

Dave Larock strongly disagrees. The president of Integrated Mortgage Planners Inc., a Toronto firm, told The Globe and Mail these numbers highlight a major regulatory misstep by the Office of the Superintendent of Financial Institutions (OSFI), the independent federal agency that oversees the mortgage stress test.

“There should never be a point where a borrower can borrow more if they take a variable rate versus a fixed rate,” Mr. Larock said. “That’s a flaw in the design of the stress test.”

It’s now easier for the most stretched borrowers to qualify for variable-rate mortgages, according to Mr. Larock. OSFI should have addressed this problem at its previous meeting in late June, he added.

“As a banking regulator whose stated goal is to preserve the stability of the market, that was a glaring mistake,” he said.

Mr. Larock, who said he firmly supported the implementation of a stress test, went on to question whether it’s still necessary with rates as high as they are now. If it’s to remain, he said OSFI should set a single stress-test rate for all would-be homebuyers.

With a report from Rachelle Younglai

Are you a young Canadian with money on your mind? To set yourself up for success and steer clear of costly mistakes, listen to our award-winning Stress Test podcast.