How to Avoid Canadian Market Bias with this ETF

Canada’s equity market performance year to date has been moderate compared to other regions. Against the backdrop of a changing macroeconomic environment, with the central banks of various economies beginning to lower their respective policy rates, there is anticipation of an upswing in equity market performance. For Canadian investors, now may be the time to consider investment opportunities beyond one’s border.

A Look At The Landscape

While the prevailing news headlines would lead many to believe that U.S. equities are the top-performing country equity market in 2024, Argentina’s year-to-date performance has been leading, with a return of 35% as of September 20th, 2024. Malaysia, the country with the next best performance, has drawn significant attention, earning recognition and endorsements from institutional investment firms. Recently, JP Morgan highlighted Malaysia’s stronger-than-expected growth, upgrading its rating from “underweight” to “neutral.” This shift is attributed to policy reforms, data center investments, and infrastructure development, all of which have boosted the economy, driving its faster-than-anticipated progress.

The performance of these countries is worth mentioning because it highlights the depth of investment opportunity present globally and the fact that many Canadian investors are missing out due to Home Bias.

What is Home Bias?

Home bias refers to investors’ tendency to favor domestic over foreign investments, even when international opportunities may offer better diversification or higher returns. It reflects a preference for investing in familiar, local markets and assets rather than entering global markets. In the case of equity investing, investors disproportionately allocate capital to stocks of companies based in their home country.

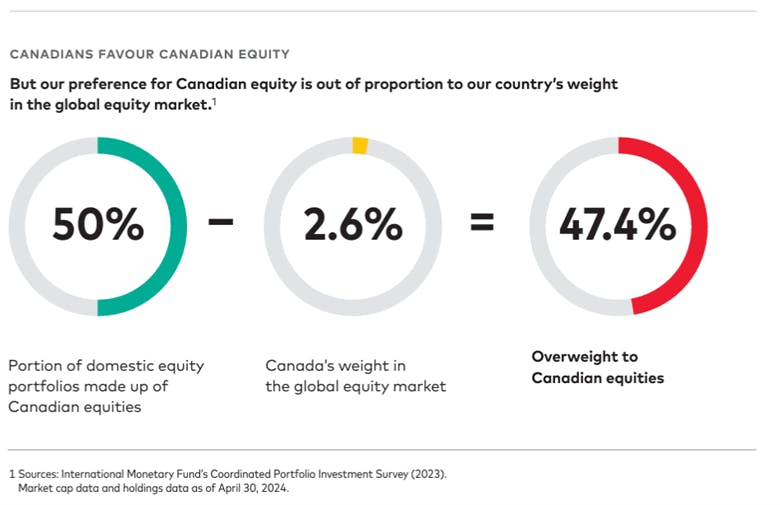

As highlighted in a research paper published by Vanguard Canada earlier this year, Canadian investors tend to allocate a significant portion of their portfolio to domestic assets while underweighting or neglecting international investments. Given the country’s weight in the global equity market, this degree of allocation is out of proportion.

The Adverse Impacts of Home Bias

Portfolios with a significant concentration in Canadian stocks are inherently more vulnerable to market fluctuations and volatility. While the Canadian market demonstrates strength, its relatively small size and heavy influence from specific sectors, particularly energy and financials, create unique challenges for investors. This sector-specific concentration means that a downturn in a single industry can have a disproportionate impact on the entire portfolio, making it more susceptible to market swings compared to a more globally diversified investment approach.

The overexposure to the Canadian equity market can lead to inefficiencies in portfolio management and limit the benefits of diversification. By focusing predominantly on one country’s market, investors may inadvertently miss out on growth opportunities in other global markets, thereby increasing their security concentration risk.

This narrow focus on domestic stocks can result in portfolios that are less resilient to economic shocks and market downturns, ultimately leading to higher volatility and a potentially bumpier investment journey.

Diversifying globally offers a solution to these challenges, as it allows investors to spread their risk across multiple markets, sectors, and economies. This broader approach can help reduce the impact of country-specific or sector-specific risks, improving the overall stability and performance of investment portfolios.

By embracing a more globally diversified strategy, investors can potentially achieve a smoother and more consistent investment experience and be better equipped to weather various market conditions and economic cycles.

ETFs That Provide Global Exposure – Excluding Canada

For investors seeking to gain global equity exposure while excluding Canada, the iShares Core MSCI All Country World ex Canada Index ETF (Ticker: XAW/XAW.U) and Vanguard FTSE Global All Cap ex Canada Index ETF (Ticker: VXC).

The iShares ETF is an ETF of ETFs solution replicating the performance MSCI® ACWI ex Canada IMI Index. As of September 20th, 2024, the year-to-date performance of XAW was 19.95% and 1-year performance was 26.82%.

The Vanguard ETF seeks, on the other hand, to track the FTSE Global All Cap ex Canada China A Inclusion Index, which invests directly or indirectly primarily in large, mid, and small capitalization stocks of companies located in developed and emerging markets. As of September 20th, 2024, the year-to-date performance of XAW was 19.80% and 1-year performance was 26.95%.

Please note this article is for information purposes only and does not in any way constitute investment advice. It is essential that you seek advice from a registered financial professional prior to making any investment decision.