Shares of restaurant chain Wingstop(NASDAQ: WING) absolutely plunged on Wednesday after the company reported financial results for the third quarter of 2024. As of 3 p.m. ET, Wingstop stock was down a painful 20%.

Incredible growth, but profits not what investors expected

The Q3 headline numbers were incredible for Wingstop. The company had nearly 2,400 locations at the end of the second quarter, but still added 106 more in Q3 alone. The chain enjoyed 20% same-store-sales growth in the U.S., leading to year-over-year revenue growth of 39%. If investors were hoping for impressive growth, they got it.

Wingstop's Q3 net income was up 32% to $25.7 million. And that's strong growth as well in isolation. But profits were up less than revenue, and investors were hoping for more. In a nutshell, that's why Wingstop was down so much today.

The business is strong but the pullback unsurprising

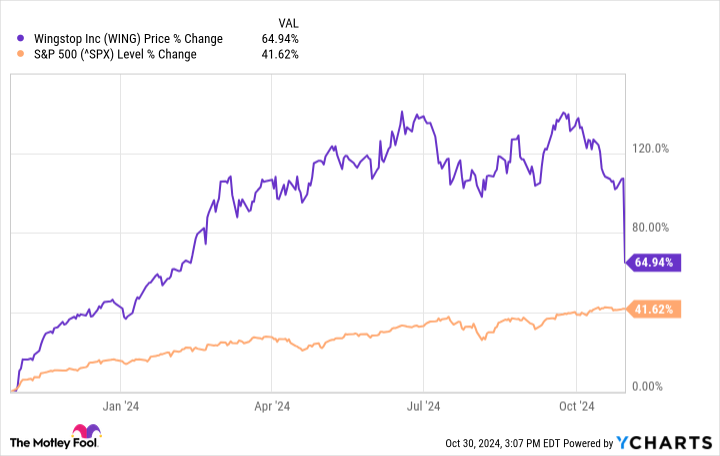

Is the drop with Wingstop stock justified? Well, additional context is important here. Even with today's 20% drop, Wingstop stock is still up a hefty 65% in the past year, handily outpacing the historic returns for the S&P 500(SNPINDEX: ^GSPC).

Even if Wingstop had hit its profit number, I don't think the stock was worth what it was trading for. For this reason, I'd say the pullback for the stock is justified, even though Q3 numbers were strong.

The valuation is still pricey for Wingstop stock. But for investors solely looking at the business, I see little reason for concern. Some are pointing to rising expenses with chicken wings, which is true. But as a primarily franchised business model, this rising cost doesn't impact Wingstop as much as restaurant chains with a company-owned model.

Therefore, while Q3 margins took a step back, I don't believe this is a trend that will meaningfully accelerate in coming quarters for Wingstop. Shareholders can take comfort in knowing that its brand is more popular than ever, and long-term growth is still on the menu.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 825% — a market-crushing outperformance compared to 171% for the S&P 500.*

They just revealed what they believe are the 10 best stocks for investors to buy right now… and Wingstop made the list -- but there are 9 other stocks you may be overlooking.

*Stock Advisor returns as of October 28, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Wingstop. The Motley Fool has a disclosure policy.