Wingstop Inc(WING-Q)NASDAQ

Wingstop (NASDAQ:WING) Exceeds Q3 Expectations, Stock Soars

Fast-food chain Wingstop (NASDAQ:WING) reported Q3 FY2023 results topping analysts' expectations, with revenue up 26.4% year on year to $117.1 million. Turning to EPS, Wingstop made a GAAP profit of $0.65 per share, improving from its profit of $0.45 per share in the same quarter last year.

Is now the time to buy Wingstop? Find out by accessing our full research report, it's free.

Wingstop (WING) Q3 FY2023 Highlights:

- Revenue: $117.1 million vs analyst estimates of $109.1 million (7.34% beat)

- EPS: $0.65 vs analyst estimates of $0.52 (24% beat)

- Gross Margin (GAAP): 48.8%, down from 83% in the same quarter last year

- Same-Store Sales were up 15.3% year on year

- Store Locations: 2,099 at quarter end, increasing by 201 over the last 12 months

"Our third quarter results showcase the multi-year strategies we are executing against, delivering 15.3% domestic same-store sales growth in the quarter, primarily driven by transaction growth. We are measuring record levels in brand health metrics, demonstrating the underlying momentum at Wingstop, and putting us on a path to deliver our 20th consecutive year of domestic same-store sales growth," said Michael Skipworth, President and Chief Executive Officer.

The passion project of two chicken wing aficionados in Texas, Wingstop (NASDAQ:WING) is a popular fast-food chain known for its flavorful and crispy chicken wings offered in a variety of sauces and seasonings.

Modern Fast Food

Modern fast food is a relatively newer category representing a middle ground between traditional fast food and sit-down restaurants. These establishments feature an expanded menu selection priced above traditional fast food options, often incorporating fresher and cleaner ingredients to serve customers prioritizing quality. These eateries are capitalizing on the perception that your drive-through burger and fries joint is detrimental to your health because of inferior ingredients.

Sales Growth

Wingstop is a small restaurant chain, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

As you can see below, the company's annualized revenue growth rate of 23.7% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional as it added more dining locations and increased sales at existing, established restaurants.

This quarter, Wingstop reported remarkable year-on-year revenue growth of 26.4% and its $117.1 million of revenue topped Wall Street analysts' estimates by 7.34%. Looking ahead, the analysts covering the company expect sales to grow 10.5% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Number of Stores

When a chain like Wingstop is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Wingstop's restaurant count increased by 201, or 10.6%, over the last 12 months to 2,099 locations in the most recently reported quarter.

Over the last two years, Wingstop has rapidly opened new restaurants, averaging 12.4% annual increases in new locations. This growth is among the fastest in the restaurant sector and gives Wingstop a chance to scale towards a mid-sized company over time. Analyzing a restaurant's location growth is important because expansion means Wingstop has more opportunities to feed customers and generate sales.

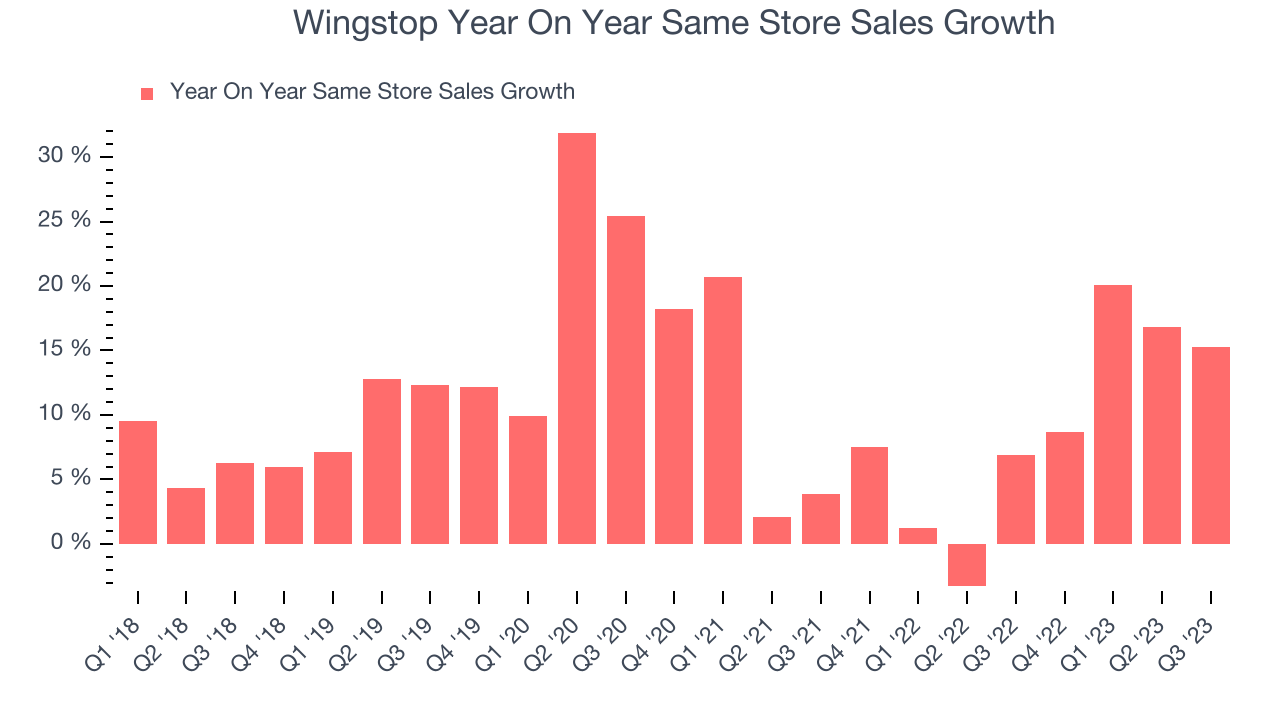

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for restaurants.

Wingstop's demand has outpaced the broader restaurant sector over the last eight quarters. On average, the company has grown its same-store sales by a robust 9.15% year on year. With positive same-store sales growth amid an increasing number of restaurants, Wingstop is reaching more diners and growing sales.

In the latest quarter, Wingstop's same-store sales rose 15.3% year on year. This growth was an acceleration from the 6.9% year-on-year increase it posted 12 months ago, which is always an encouraging sign.

Key Takeaways from Wingstop's Q3 Results

With a market capitalization of $5.48 billion and more than $89.4 million in cash on hand, Wingstop can continue prioritizing growth.

We were impressed by how significantly Wingstop blew past analysts' revenue expectations this quarter, driven by better-than-expected same-store sales growth. We were also excited its adjusted EBITDA and EPS outperformed Wall Street's estimates. On the other hand, its gross margin missed analysts' expectations. Overall, this quarter's results seemed fairly positive and shareholders should feel optimistic. The stock is up 5.07% after reporting and currently trades at $192 per share.

So should you invest in Wingstop right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.