When my daughter was young, I needed to make sure that nothing bad would happen to her or my family, and the dividend income from my portfolio provided an important financial backstop. Though I never needed that income, I was happy to pay taxes on my dividends, knowing that I could easily access the cash in an emergency.

My daughter is in college now, and I no longer have the same financial needs. Here's how I'm using my Roth accounts to make sure I pay as few taxes as possible going forward.

What is a Roth account?

There are different types of tax-advantaged retirement accounts. In one, typified by a traditional IRA, you put pre-tax dollars into the account and reduce your current income by the money you save. You are, therefore, saving on the taxes today. However, all of the income that you withdraw from the account in retirement is taxable. A Roth IRA basically flips that script.

Image source: Getty Images.

You fund a Roth, typified by a Roth IRA, with after-tax money. When you withdraw money from the account in retirement, every penny is tax-free. To be fair, you avoid paying taxes on dividend income in both types of accounts while you are still working and saving. But the difference when withdrawing from the account is tremendous. A Roth can be a very powerful tool if you are a dividend investor. Essentially, the dividend income I generate within my Roth accounts today and when I retire will all be tax-free.

In my situation, I'm using both a Roth IRA and a Solo Roth 401k. In principle, the two accomplish the same goal. But there's more to this story than just putting some dividend stocks into a Roth.

I'm starting with the biggest problems first

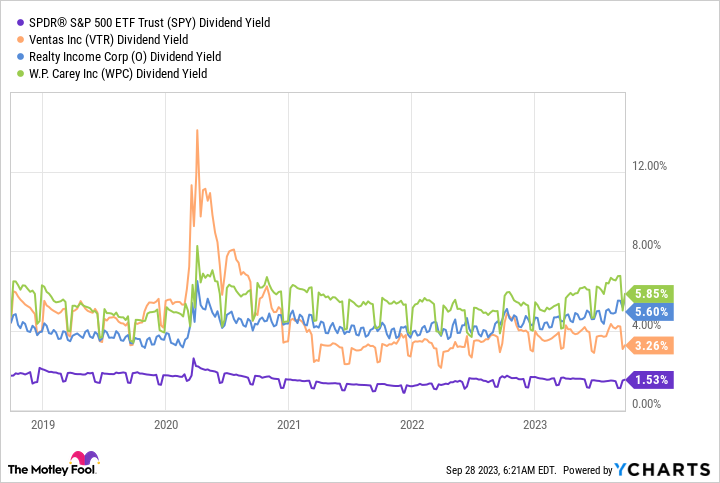

The rubber hits the road for me with real estate investment trusts (REITs). REITs do not pay corporate taxes, instead passing that income on to investors who pay taxes on the dividend the REIT pays at their regular income tax rate. So, REIT dividends, essentially, add to your yearly income. In that way, they aren't great for your tax situation, even though they can create a large income stream.

SPY Dividend Yield data by YCharts.

As such, I've been moving REITs into my Roth accounts. This requires selling the security in the taxable account and buying it in the Roth. Doing this can result in capital gains taxes, which is hard to complain about. But to make this effort as tax-efficient as possible, I've been capturing losses where I can to offset gains that I have in the REITs. That's step two in avoiding paying more in taxes than I need to. So far, I've moved my positions in Ventas(NYSE: VTR), Realty Income(NYSE: O), and most of my holdings in W.P. Carey(NYSE: WPC).

Now that these stocks are in the Roth, the dividends I collect avoid corporate-level taxes and are no longer subject to taxation as dividends are paid to me. More important, however, is that when I retire, that situation won't change, as it would with a traditional IRA. I'm basically ducking the taxes forever unless the tax code changes with regard to Roth accounts. A win/win for me tax-wise.

Another small nuance from Canada

I also moved my position in midstream giant Enbridge(NYSE: ENB) from my taxable account into a Roth. The first benefit is that Enbridge has a high yield, and now that income is shielded from taxation. But there's a second issue here because Enbridge is Canadian. In my taxable account, Canadian taxes get removed from the dividends I collect. I can claim them back when I file my U.S. taxes, but there are limits, and it requires additional effort come April 15.

ENB Dividend Yield data by YCharts.

There's a tax treaty between the U.S. and Canada that shields dividends received within qualified retirement accounts from Canadian taxes. This requires your broker to fill out paperwork, which not all brokers do. Mine has, so I now avoid paying taxes to Canada and Uncle Sam by owning Enbridge in a Roth. I also simplify my taxes just a little, which I see as another win. Taxes are complicated enough already!

Subtle shifts can make a big difference

I believe fully in paying taxes. I love having roads to drive on and a fire department to make sure my house doesn't burn down. But that doesn't mean I want to pay more taxes than I have to. If you have Roth accounts, as I do, you can shift your investments around to make the tax hit from collecting dividends as small as possible. The low-hanging fruits, as far as I'm concerned, are REITs and high-yield Canadian stocks. I'm picking all the fruit I can, so I keep more of my dividends for myself and my family. With a little planning, you can do the same thing.

10 stocks we like better than Walmart

When our analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Walmart wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of 9/25/2023

Reuben Gregg Brewer has positions in Enbridge, Realty Income, Ventas, and W. P. Carey. The Motley Fool has positions in and recommends Enbridge. The Motley Fool recommends Realty Income and W. P. Carey. The Motley Fool has a disclosure policy.