Ultra-high-yield stocks, or stocks with yields exceeding 7% on an annualized basis, have a rich tradition of generating market-beating returns. That said, there is an important caveat associated with this group of equities. Namely, a scorchingly high yield can also be a sign that a company is dealing with a major headwind. That's not always the case, but investors should always exercise caution when shopping for an ultra-high-yield dividend stock.

Which stocks with mouthwatering yields are worth buying right now? Although cigarettes represent a shrinking industry from a sales volume standpoint, the tobacco companies Altria(NYSE: MO) and Vector Group(NYSE: VGR) still screen as incredible passive income plays for a few reasons. To wit, both companies offer extraordinarily generous yields (9.32% and 7.7%, respectively), attractive valuations, and robust free cash flows. Read on to find out more about these two top ultra-high-yield dividend stocks.

Image Source: Getty Images.

Altria: A solid income play

Altria is a leading U.S. tobacco company. It owns some of the most well-known cigarette brands globally, such as Marlboro, which dominates its segment with a 50% market share. Altria also operates in other tobacco and related segments, such as smokeless tobacco (Copenhagen, Skoal), cigars (Black & Mild), and oral nicotine pouches (On!).

Altria has a strong track record of dividend growth, having increased its dividend 58 times in the last 54 years. It currently offers an annualized yield of 8.9%, which is substantially higher than the average of 1.54% for S&P 500 listed stocks. However, investors should also be aware of the high payout ratio of 98.9%, which indicates that the company is paying out almost all of its earnings as dividends. This fact could limit its ability to reinvest in its business or mitigate unexpected headwinds.

All that said, Altria's dividend is supported by its consistently high free cash flows, which have been steadily rising over the past decade, as well as its solid overall financial performance. Consequently, this American tobacco titan stock screens as a dependable income play, despite the long-term headwinds facing its business. Perhaps best of all, Altria's shares are trading at only 8.2 times projected earnings at the moment, which is a bargain basement valuation for blue chip stock with an abnormally high yield.

Vector Group: A sizzling yield at a hefty discount

Vector Group operates in two different sectors: discount tobacco and real estate. However, most of its revenue comes from its tobacco subsidiaries Vector Tobacco and Liggett Group. Vector Group is the fourth largest U.S. cigarette manufacturer by sales volume, with an extensive operating history dating back to 1873. It offers low-cost cigarette brands such as Montego, Eagle 20's, Pyramid, Grand Prix, Liggett Select, and Eve. The company's key competitive advantage is its lower price point compared to premium cigarette brands.

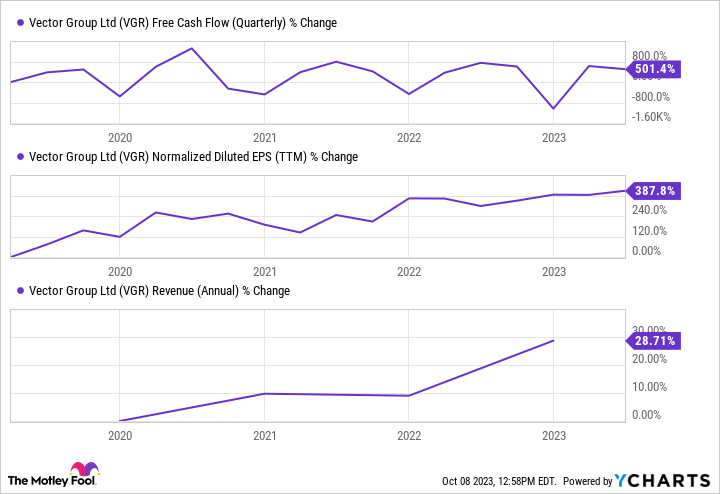

At current levels, Vector Group stock pays a healthy 7.7% annualized yield, and its shares trade at a mere 9 times projected earnings. The company's payout ratio is on the high side at 79.2% and management has reduced the payout in the fairly recent past. But with its free cash flows, annual revenue, and income all moving in the right direction (see graph below), Vector Group should have little trouble paying its sizable dividend in the near term. Nonetheless, this ultra-high-yield dividend stock is arguably best suited as a minor component of an income-oriented portfolio, because of the substantial risks associated with the tobacco industry at large.

VGR Free Cash Flow (Quarterly) data by YCharts

10 stocks we like better than Altria Group

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Altria Group wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of October 2, 2023

George Budwell has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.