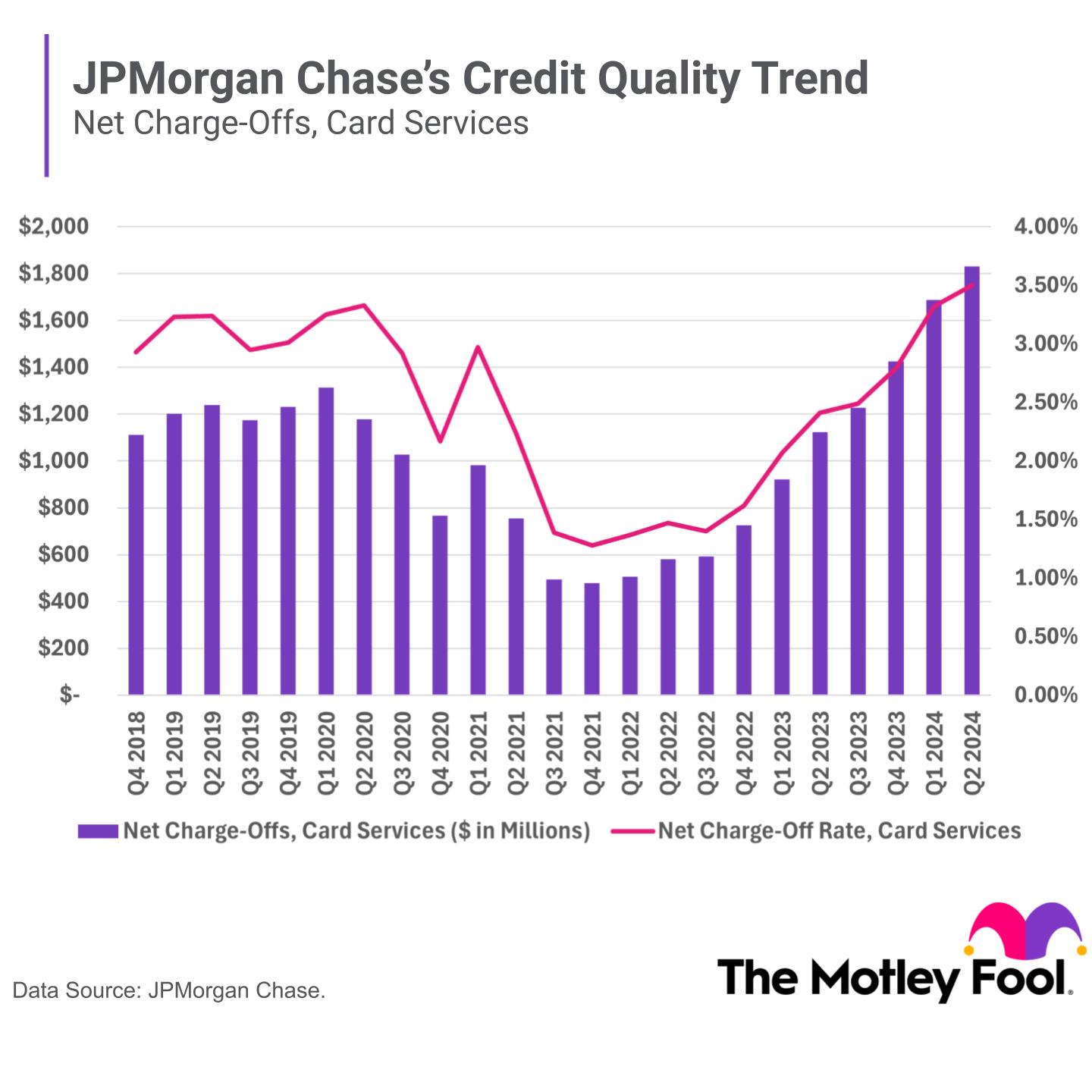

For the 10th consecutive quarter, charge-offs for credit cards at JPMorgan Chase(NYSE: JPM) rose, indicating that increasing numbers of people are struggling to keep up with their growing debt. In the second quarter, the largest bank in the U.S. charged off $1.8 billion in card loans.

The bank also built up its reserves for potential losses and now has $3.1 billion provisioned in the event of further losses. With consumer credit metrics weakening, is JPMorgan indicating an economic downturn is on the horizon?

Consumer credit metrics are showing cracks

JPMorgan posted solid Q2 earnings results, with rising revenue and net income while posting stellar results on key capital levels and return ratios. However, one weakness that persists for the largest U.S. bank is its consumer credit trends.

The bank's net charge-off rate is the proportion of debt the bank is unlikely to collect and is an annualized ratio of net charge-offs to average loans outstanding. In Q2, JPMorgan's net charge-off rate on its card services loans (credit cards issued to consumers and small businesses) was 3.5%, the highest level since the pandemic.

Why is this important? In the later stages of the pandemic, consumer credit trends were strong. Delinquencies and charge-offs fell among all banks as the gigantic fiscal stimulus from the federal government helped buoy consumers and businesses. As you can see in the chart below, JPMorgan's net charge-off rate on card services bottomed out in late 2021 and early 2022.

Chart by author.

However, as the economy emerged from the pandemic, rising inflation brought along higher interest rates while pandemic-era stimulus waned and economic conditions returned to a more normalized state.

During the past few years, credit card loan balances have risen and now stand at $1.12 trillion, according to the Federal Reserve Bank of New York. These high credit card loan balances come as credit card interest rates are near record levels, which has put a strain on consumers.

This stress has resulted in higher credit card delinquency rates. JPMorgan Chase's latest delinquency rate was above its average of 3.11% in the year before the pandemic, a sign that people are feeling the pinch.

How banks are preparing for the unknown

Earlier this year, JPMorgan Chase Chief Executive Officer Jamie Dimon said that he believes the chances of a recession are "higher than people think" and that he continues to see risks to the economy, including ongoing geopolitical tensions, large fiscal deficits, and uncertainty about the Federal Reserve's interest rate increases and its effect on banks.

Banks across the industry have built up their provisions for credit losses to account for rising delinquencies. These provisions reflect estimates of the potential losses a bank could experience; they are expensed on a bank's net income statement. In JPMorgan Chase's case, it charged off $2.2 billion in the quarter and built additional reserves of $821 million to account for future charge-offs.

During the bank's most recent earnings call, Chief Financial Officer Jeremy Barnum told analysts that the uptick in charge-offs and delinquencies is "normalization, not deterioration" and that "there's not much to see there." He said consumer credit quality is "certainly a lot stronger than anyone would have thought given the tightness of monetary conditions."

For now, the reserve build and credit quality are in line with expectations laid out in the first quarter, when the bank projected net charge-offs from card services to be about 3.4% for the full year.

Does JPMorgan Chase expect a recession soon?

JPMorgan Chase continues to take a cautious approach to the economy and its reserve increases indicate that the bank believes further credit losses are possible in the near future. That doesn't necessarily mean a recession will happen, but it does suggest a higher degree of uncertainty about what happens next in the economy.

As the largest bank in the U.S., JPMorgan must consider the various risks, including interest rate or credit risk, that could affect its business and bottom line. With this perspective, the bank maintains a fortress balance sheet. This helps it to get ahead of those risks and position itself to do well today and in an uncertain future, proving why it is one of the best-run banks today.

Should you invest $1,000 in JPMorgan Chase right now?

Before you buy stock in JPMorgan Chase, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and JPMorgan Chase wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $722,993!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of July 15, 2024

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends JPMorgan Chase. The Motley Fool has a disclosure policy.