Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

3 Top Semiconductor Stocks to Watch Right Now

Semiconductor stocks have been the darling of the stock market in 2023, thanks in large part to rising investor enthusiasm over increased adoption for artificial intelligence (AI) - which depends on specialized chips to deliver those high-powered computing results. And beyond the unavoidable AI headlines, semiconductors are already necessary equipment in everything from your smartphone to your car. In fact, rising auto demand was a key driver behind the ongoing semiconductor shortage in recent years.

However, the semiconductor rally has hit a speed bump this month. After gaining 54% through the first seven months of 2023, the iShares Semiconductor ETF (SOXX) - which tracks the performance of the 30 largest listed semiconductor companies in the U.S. - has tumbled 10.5% so far in August. That said, SOXX is still up 38% YTD, outperforming the Nasdaq Composite's ($NASX) rise of 28% over the same period.

And the recent weakness in semiconductor stocks hasn't been isolated. Broader markets have pulled back this month, with many traders taking profits off the table after a stellar first half for equities. The risk-off attitude has been exacerbated by uncertainty over further policy tighteningby the Fed, troubling economic data out of China, and a poorly received earnings report from tech giant Apple (AAPL), to name a few contributing factors.

There may still be some additional volatility for semiconductor stocks in the immediate days ahead, as Nvidia's (NVDA) upcoming quarterly results on Aug. 23 will be closely watched as an indicator of actual AI demand vs. headline hype - and the bar is set quite high, as analysts are looking for staggering year-over-year earnings growth in excess of 400%.

All of that said, semiconductor demand isn't going anywhere - and the recent pullback could create opportunities to pick up some quality chip stocks at cheaper prices. Here's a look at three semiconductor stocks that are trading off their highs, and may soon find their footing near more attractive levels for investors looking to add exposure to the group.

ON Semiconductor

Founded 24 years ago as a spinoff of Motorola's Semiconductor Components Group, ON Semiconductor (ON) - popularly known as Onsemi - has come a long way since then, The $39.78 billion market cap company is now owned by Belgian foundry BelGaN Group BV. Onsemi's semiconductor chips have a wide variety of applications, including in smartphones, laptops, tablets, automobiles, industrial equipment, and medical devices among others.

Shares of Onsemi are up 45.2% YTD, including a 15.9% pullback so far during the month of August.

In the second quarter, the company posted strong numbers, with both revenue and earnings surpassing estimates - although they remained nearly flat on a yearly basis. Revenues for the quarter came in at $2.1 billion, unchanged from the prior year's figure. EPS came in at $1.33, in keeping with the previous year's figure.

Onsemi has strengthened its balance sheet by reducing the quantum of its long-term debt to roughly $2.5 billion from about $3 billion at the start of the year. However, the company's capability to generate cash from its operations was negatively impacted, as this metric slowed to $390.8 million for the April-June period, compared to $420.8 million a year ago. Worryingly, the company reported a free cash outflow of $39.8 million in the quarter, compared to a corresponding inflow of $202.7 million in the prior year.

On the plus side, the company has been making some notable operational moves to bolster its revenue in recent times. Onsemi is well-positioned to benefit from the rising demand for Silicon Carbide (SiC), primarily due to its applications in the EV and renewable energy spaces. Management remains confident about gaining market share in the EV space, in particular, due to its strong position in SiC-driven products. In fact, the company recently signed an agreement with Magna, an automotive supplier, to integrate Onsemi’s EliteSiC intelligent power solutions into its eDrive systems.

Analysts are expecting ON to report earnings growth of 2.27% for the next quarter, although the bottom line is expected to decline 2.63% overall in FY23.

Overall, analysts remain cautiously optimistic about the stock, maintaining a consensus rating of “Moderate Buy” with a mean target price of $118.23 - indicating upside potential of about 30% from current levels. Out of 26 analysts covering the stock, 17 have a “Strong Buy” rating, 1 have a “Moderate Buy” rating and 8 have a “Hold” rating.

NXP Semiconductors

Dutch semiconductor company NXP (NXPI) was founded in 2006 as a spin-off of Phillips. The company currently commands a market cap of $50.72 billion, and provides semiconductor solutions to the automotive, industrial, IoT, mobile, and communication infrastructure markets.

NXP has followed the same pattern as the broader semiconductor industry on the charts, giving up 12.6% in August but still resting on a year-to-date gain of 24.7%.

The company's latest quarterly results were impressive, even though the top line remained flat from the previous year. NXP reported revenues of $3.3 billion in the second quarter, while EPS arrived at $3.43 - down 2.6% YoY, but above the consensus estimate of $3.28. The trend in earnings has been strong, as NXPI has surpassed analysts' expectations in each of the past five quarters.

The slowdown in revenues can be attributed to a 19% yearly drop in the Industrial & IoT segment to $578 million. However, the automotive business - which forms the bulk of the company's revenues - grew 9% to $1.9 billion. To that end, the company also announced that Nio (NIO), one of the leading players in the smart EV market, will make use of NXP’s leading automotive radar technology in its vehicles, further strengthening its automotive business.

NXP also announced a strategic move in the memory space by partnering with one of the biggest semiconductor manufacturers in the world, Taiwan Semiconductor (TSM), to deliver the industry’s first automotive embedded MRAM (Magnetic Random Access Memory) in 16 nm FinFET technology. Although the usage of this tech is in its infancy, it is expected to have widespread applications in future memory functions.

NXP also reduced its long-term debt to $10.2 billion from $11.2 billion at the start of the year, while generating a free cash flow of $556 million (up from $551 million in the prior year) at the end of the second quarter.

However, analysts are not so upbeat about NXP's earnings growth prospects. They are projecting earnings to decline by 7.9% in the current quarter and by 13.5% in FY 23.

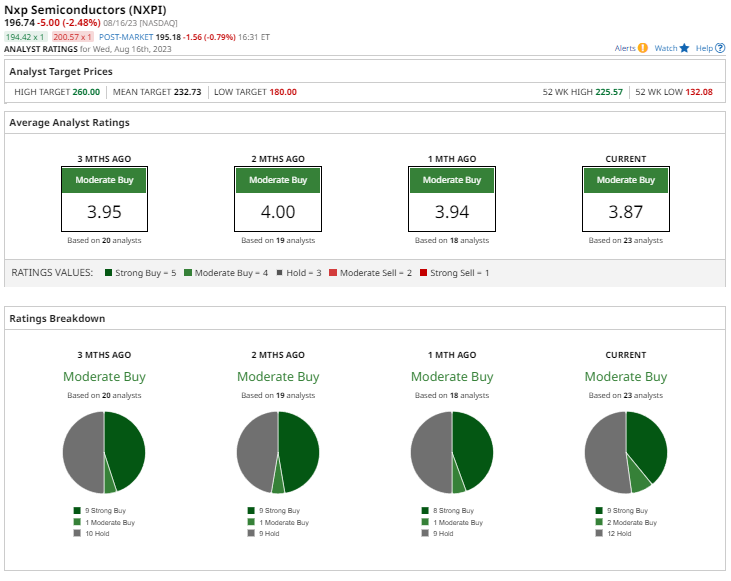

Neverthless, the consensus opinion on the stock is cautiously optimistic. Out of 23 analysts covering the stock, 9 have a “Strong Buy” rating, 2 have a “Moderate Buy” rating, and 12 have a “Hold” rating. NXPI's mean target price of $232.73 indicates expected upside potential of about 19% from current levels.

STMicroelectronics NV

Swiss semiconductor manufacturing company STMicroelectronics (STM) rounds out our list. Founded in 1987, the company has a market cap of $42.32 billion. It is the largest European semiconductor contract manufacturing and design company, and is a leading supplier of chips for a wide range of applications, including automotive, industrial, and consumer electronics.

From a technical standpoint, STM is down 14.1% over the past month, but still bests the broader Nasdaq with a gain of 30% year to date.

In its latest results for the second quarter, STM reported net revenues of $4.3 billion, up 12.7% on a YoY basis (and just above the consensus estimate of $4.27 billion). A 34.4% year-over-year jump in revenues for the Automotive segment to $1.95 billion contributed heavily to the top-line growth. EPS rose by 15.2% from the previous year to $1.06, missing the consensus estimate of $1.09. Notably, this was the first time in the last five quarters that STM missed its EPS estimates.

Long-term debt for the company declined slightly to $2.47 billion at the end of the June quarter from $2.54 billion at the beginning of the year. Cash flow from operating activities for the April-June period was $1.3 billion, up 24% from last year - but a 9.1% yearly decline in free cash flow to $209 million remains a concern.

STM has a somewhat evenly distributed customer base among the Top 10 OEMs (39%), Distribution (26%), and Other OEMs (25%). Moreover, it is also making its presence felt in the SiC space, thanks to an agreement to create a SiC device manufacturing factory in China, plus a cooperation agreement with airline manufacturer Airbus on aviation electrification.

However, earnings growth estimates are not optimistic for the company. Analysts are forecasting declines of 7.8% and 22.7% for the current and next quarters, respectively, resulting in expected earnings growth of just 2.4% for FY 2023.

Overall, analysts still like the stock, judging by the consensus “Moderate Buy” rating and mean target price of $61.50 - implying upside potential of about 33% from current levels. Out of 8 analysts covering the stock, 5 have a “Strong Buy” rating, 2 have a “Hold” rating and 1 has a “Strong Sell” rating.

Final Takeaway

The demand for semiconductors seems likely to rise globally, particularly given the rise of generative AI and increased usage in automotive manufacturing. Notably, all three companies mentioned above remain at the forefront of innovation in the semiconductor space, with a core focus on the relatively stable (and growing) automotive segment.

While additional short-term caution on semiconductors may be warranted, particularly ahead of next Wednesday's Nvidia earnings, investors who have been waiting for more attractive prices to add exposure to chip stocks should keep these names on watch as the August pullback begins to taper off.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.