For Royal Caribbean (NYSE: RCL), the skies may have just turned bluer than the water in which its ships sail. The company just released earnings for the third quarter of 2024, revealing higher bookings and increased guidance for the current year.

Such improvements have contributed to Royal Caribbean's rising stock price over the last year. The question now is whether the rise in the stock price can continue or whether the ship has sailed on Royal's bull run.

Royal Caribbean's results

In the first three quarters of 2024, the company reported almost $13 billion in revenue, a 20% yearly increase compared with the same period in 2023.

On its Q3 2024 earnings call, CEO Jason T. Liberty credited higher consumer spending on leisure as the reason for the increase. Also, in Q3, the load factor rose to 111%, an impressive feat considering that the industry defines 100% capacity as having two people in every cabin.

This led to a net income for the first nine months of 2024 exceeding $2.3 billion, rising 64% from year-ago levels. Royal Caribbean kept operating expense growth in check, accounting for most of the increase.

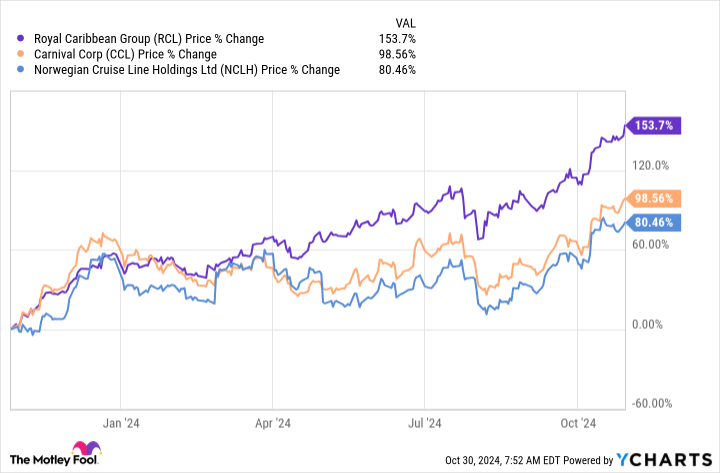

As mentioned before, improved results and clear signs that it has moved on from the pandemic shutdowns have dramatically boosted confidence in the stock, rising more than 150% over the last year. This means that it dramatically outperformed its two largest competitors, Carnival Corp. and Norwegian Cruise Line Holdings.

Royal Caribbean is looking forward

The company says bookings for 2025 were higher than one year ago for 2024. Also, analysts forecast 19% revenue growth for 2024 before it slows to 9% in 2025, signaling that the recovery from the pandemic is almost complete.

Despite that slowdown, the valuation metrics point to both value and financial improvement. The stock's P/E ratio is only 23. While that makes it more expensive than its larger competitor, Carnival, whose stock is 20 times its earnings, Royal Caribbean still appears inexpensive. Additionally, its forward P/E of 18 would imply that analysts expect significant profit increases, which bodes well for its stock.

Also, its total debt of $21 billion continues to fall, albeit slowly. This represents a substantial burden considering the $7 billion in shareholders' equity.

Fortunately, this has not stopped Royal Caribbean from adding capacity as demand for cruises soars. The company took delivery of two additional cruise liners in the first half of the year and expects an additional three ships over the next two years and two additional vessels with its joint venture with TUI Cruises.

Such gains will likely not help it to catch up to Carnival, which claims 43% of the industry's total passenger count, according to Cruise Market Watch. Still, with Royal Caribbean at 27%, it remains a major force in the cruise industry, and the added capacity will keep it ahead of third-place Norwegian Cruise Line Holdings (NYSE: NCLH), which carries about 9% of all cruise passengers. That should position it to continue capturing a large portion of the robust demand for cruises.

Investing in Royal Caribbean stock

Given current conditions, it is likely not too late to buy Royal Caribbean stock. Admittedly, the company lags behind Carnival in passenger counts, and Carnival remains a cheaper stock from a P/E ratio perspective. Also, the size of Royal Caribbean's debt load undoubtedly burdens its balance sheet.

However, Royal Caribbean's stock price growth has far outpaced its rivals. Moreover, the strength of occupancy and bookings makes it likely that the company's investments in additional capacity will pay off for the cruise line stock.

With a relatively low earnings multiple and all the signs pointing to continued growth, it will probably still pay for investors to own shares of Royal Caribbean stock.

Should you invest $1,000 in Royal Caribbean Cruises right now?

Before you buy stock in Royal Caribbean Cruises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Royal Caribbean Cruises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $829,746!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of October 28, 2024

Will Healy has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.