Looking for trillion-dollar opportunities? Check out the hydrogen market. This renewable fuel source could become a staple of the global economy during the next several decades. Global consulting firm Deloitte believes it will someday become a trillion-dollar market. McKinsey & Co, another global consultant, forecasts hydrogen demand to "grow significantly" in the years to come.

Plug Power(NASDAQ: PLUG) is one of the biggest names in the hydrogen industry, and many investors are betting on its big upside potential. The potential is not hard to calculate given the company's paltry $1.8 billion valuation. If demand meets expectations over the long term, expect to see some major hydrogen winners by 2050. But will Plug Power be one of them? The answer might surprise you.

Hydrogen is clearly a trillion-dollar opportunity

There's no doubt that the hydrogen market itself is set to grow by leaps and bounds by 2050. That's because hydrogen is a great option for what economists call hard-to-abate sectors.

Although it's relatively straightforward to replace coal-powered electricity with solar or wind power, certain sectors of the economy -- cement and steel production, for example -- require the high heat levels produced by burning fossil fuels. It's unlikely that existing technologies will be able to scale in a way that still supports these critical industries. That's where hydrogen technology comes into play. As research from Deloitte concludes, "Decarbonising hard-to-abate sectors like steelmaking, chemicals, aviation and shipping will likely require global hydrogen use to grow six-fold, to nearly 600 million tons, by 2050."

If this future comes to pass, Deloitte believes total hydrogen demand will surpass $1.4 trillion by 2050. But growth should pick up much sooner than that. According to estimates, demand could double between now and 2030, with the total market value reaching $642 billion.

The hydrogen market appears to be a great bet for investors willing to be patient. But is Plug Power stock a good way to profit from this multi-decade opportunity?

Will Plug Power be a hydrogen winner?

Hydrogen may indeed have enormous long-term promise. But investing in the industry is a much different challenge. The situation is very similar to other capital intensive, renewable energy businesses like electric vehicles. Although some companies like Tesla have prospered, countless other start-ups have gone bankrupt. The same will likely prove true for hydrogen. Building out the necessary infrastructure requires billions in financing, and there's no guarantee that any one company's technology will win out.

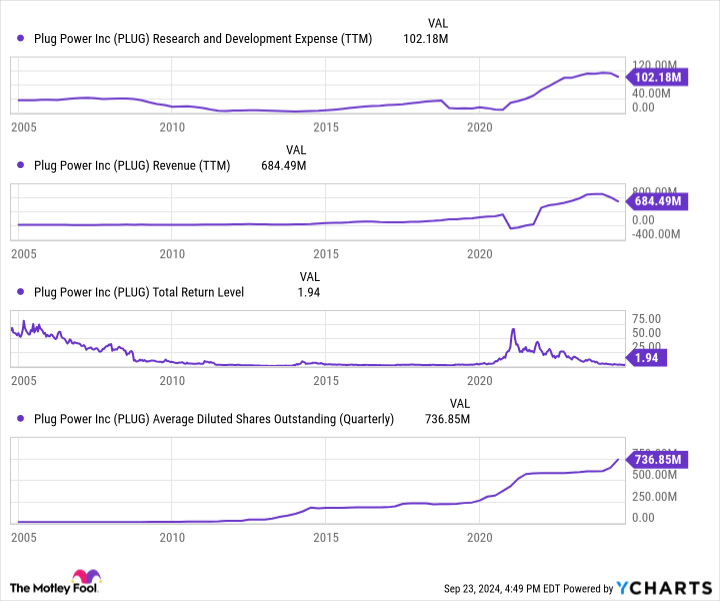

Plug Power's history during the past 20 years paints this picture well. Sales have picked up, freeing it to spend more on research and development. Yet long term, the stock has been a terrible investment. That's largely due to share dilution. During the past two decades, Plug Power's share count has expanded by an astounding 9,950%!

PLUG Research and Development Expense (TTM) data by YCharts

This is the chief issue with Plug Power today. Hydrogen demand will almost certainly rise during the next several decades, even though the exact scale and speed of that growth remains very uncertain. But Plug Power will continue to need billions in new capital to remain competitive. While it has survived thus far on share dilution and government subsidies, allowing it to gradually expand its sales base, mounting losses have wiped out any potential gains for shareholders.

This issue -- that market growth is simply occurring too slowly for shareholders to profit -- won't disappear anytime soon. Goldman Sachs recently estimated that Plug Power has an equity duration of 25.8 years. That figure intends to capture the weighted average of the company's expected cash flows. In a way, Plug Power stock is like buying a bond that doesn't mature for several decades, making the share price very sensitive to changes in interest rates and shifts in the competitive climate. Plug Power, for instance, could pour billions into its tech stack only for a competitor to overtake it with a new lower cost production method.

Could Plug Power become a trillion-dollar stock by 2050? The answer is almost certainly no. The total market size in 2050 is only forecast to reach around $1.4 trillion. And which companies or technologies will win is impossible to know at this point. The only thing we know for sure is that investment in competing technologies is rising, just as Plug Power's research and development budget begins to stagnate.

As recently as 2023, Plug Power received a going concern notice from its accountants, warning of potential insolvency should it fail to raise new capital. These financial stresses won't go away anytime soon, and further sales growth will likely be negated by more share dilution. For now, Plug Power seems poised to survive and potentially become a bigger player in the broader hydrogen market. But investors -- even those willing to accept more risk for more return -- should look elsewhere.

Should you invest $1,000 in Plug Power right now?

Before you buy stock in Plug Power, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Plug Power wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $740,704!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 23, 2024

Ryan Vanzo has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Tesla. The Motley Fool has a disclosure policy.