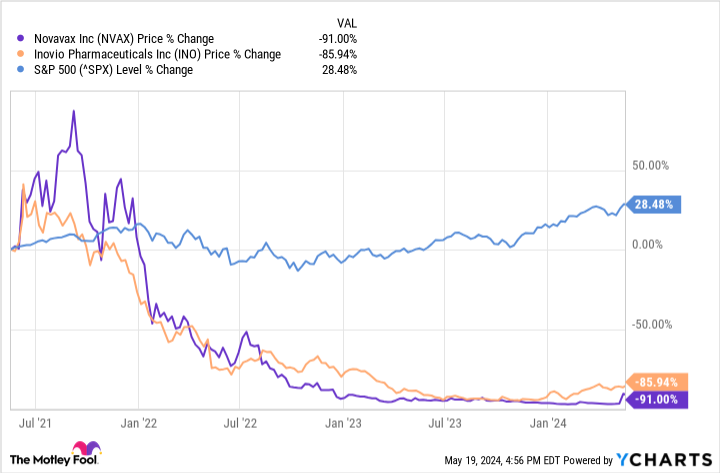

The COVID-19 vaccine was worth tens of billions of dollars, but most of it went into the hands of Moderna and Pfizer. Smaller biotechs that tried to dominate this market were much less successful. That group includes Novavax(NASDAQ: NVAX) and Inovio Pharmaceuticals(NASDAQ: INO). The former did launch a coronavirus vaccine in the U.S., but the latter never got that far.

Both have substantially lagged the market over the past three years, but they now seem to be experiencing significant rebounds; shares of Novavax and Inovio have soared since 2024 started. Which of these two biotechs can outperform the other moving forward? Let's take a look.

The case for Novavax

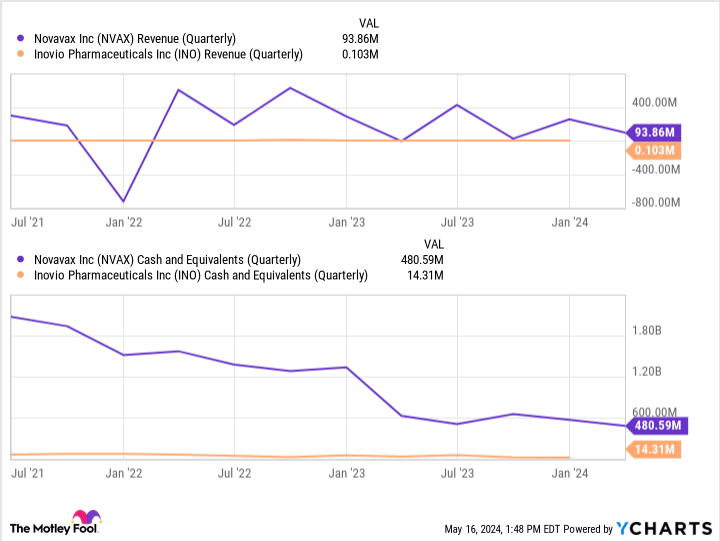

Novavax earned approval for its COVID-19 vaccine, Nuvaxovid, in various countries. In the U.S., it is still under Emergency Use Authorization. However, the biotech is now seeking full approval. Novavax generated almost $1 billion in total revenue last year. In the first quarter, its top line came in at $93.9 million, higher than the $81 million reported in the prior-year period.

Novavax initially projected that it would record sales of at most $1 billion this year. That was before striking a major agreement with Sanofi, a biotech giant headquartered in France. Sanofi will pay Novavax $500 million up front for the rights to distribute Nuvaxovid in most countries worldwide, an exclusive license to use Novavax's adjuvant technology (designed to boost efficacy) in flu vaccines, and a non-exclusive license to use the technology in non-flu vaccines. Sanofi also acquired a 4.9% stake in Novavax for $70 million.

Novavax could receive up to $700 million in development milestone payments from this deal. The biotech will also earn royalties from the sale of marketed vaccines developed by Sanofi that use the adjuvant technology. This partnership will improve Novavax's financial situation and prospects.

Elsewhere, the biotech is racing toward the start of a phase 3 study for its combined COVID-19/flu vaccine, which it plans to kick off during the second half of the year.

Finally, Novavax has implemented a more disciplined approach, reducing unnecessary expenses and costs over the past 18 months. While the business was at risk of going under in early 2023, that's no longer the case. If Novavax can continue down the same path it has so far this year, it could deliver outsize returns to investors.

The case for Inovio Pharmaceuticals

Inovio Pharmaceuticals is developing several promising products. The most advanced is INO-3107, an investigational therapy for human papillomavirus (HPV)-associated recurrent respiratory papillomatosis (RRP), a rare disease that causes non-cancerous tumors to grow in the respiratory tract. RRP can cause difficulty performing otherwise routine tasks, such as breathing, swallowing, or speaking.

Inovio estimates an annual prevalence of 14,000 cases in the U.S. Following a successful phase 1/2 clinical trial for INO-3107, regulators told the company that the data from this study would be enough to support accelerated approval. True, Inovio will still need to perform a late-stage study to confirm the results from the earlier trials and earn full approval. However, the accelerated pathway could allow INO-3107 to reach the market at least a year before it otherwise would have.

The developments surrounding INO-3107 are behind Inovio's surging stock price this year. The biotech does have several other candidates in phase 1 and phase 2 testing, but its performance in the mid-term will likely largely depend on INO-3107. Considering that Inovio's market capitalization is just $310 million, consistent clinical and regulatory progress could send the stock price soaring even more.

The verdict

Novavax currently generates much higher revenue than Inovio. The former also has more cash on hand, and its partnership with Sanofi improves its prospects.

NVAX Revenue (Quarterly) data by YCharts

Though INO-3107 looks like it is making solid progress, its target population is small, and there are still plenty of potential clinical and regulatory pitfalls ahead for Inovio Pharmaceuticals. That's why Novavax is a better bet among these two companies, even though its market capitalization is much higher at $1.87 billion. With that said, Novavax and Inovio Pharmaceuticals both look like risky options. There are much more attractive stocks in the biotech industry.

Should you invest $1,000 in Novavax right now?

Before you buy stock in Novavax, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Novavax wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $580,722!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of May 13, 2024

Prosper Junior Bakiny has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Pfizer. The Motley Fool recommends Moderna. The Motley Fool has a disclosure policy.