It's not often that one can find a leading internet stock for a bargain price, but Match Group(NASDAQ: MTCH) may be one of those rare finds.

Or is it a value trap?

On the surface, Match has a lot of the makings of a bargain stock opportunity. But investors should home in on this one singular aspect of its business that will be the deciding factor.

Match Group controls most of online dating life

More and more people are finding love online these days, yet growth opportunities remain. A study by Morgan Stanley revealed that as of 2023, only 32% of the U.S. single population uses an online dating app. And of those 32%, only slightly more than a quarter pay for features. While it's true user growth has slowed in recent years, the large number of people not using apps and under-monetization of some platforms still means lots of opportunity in the sector.

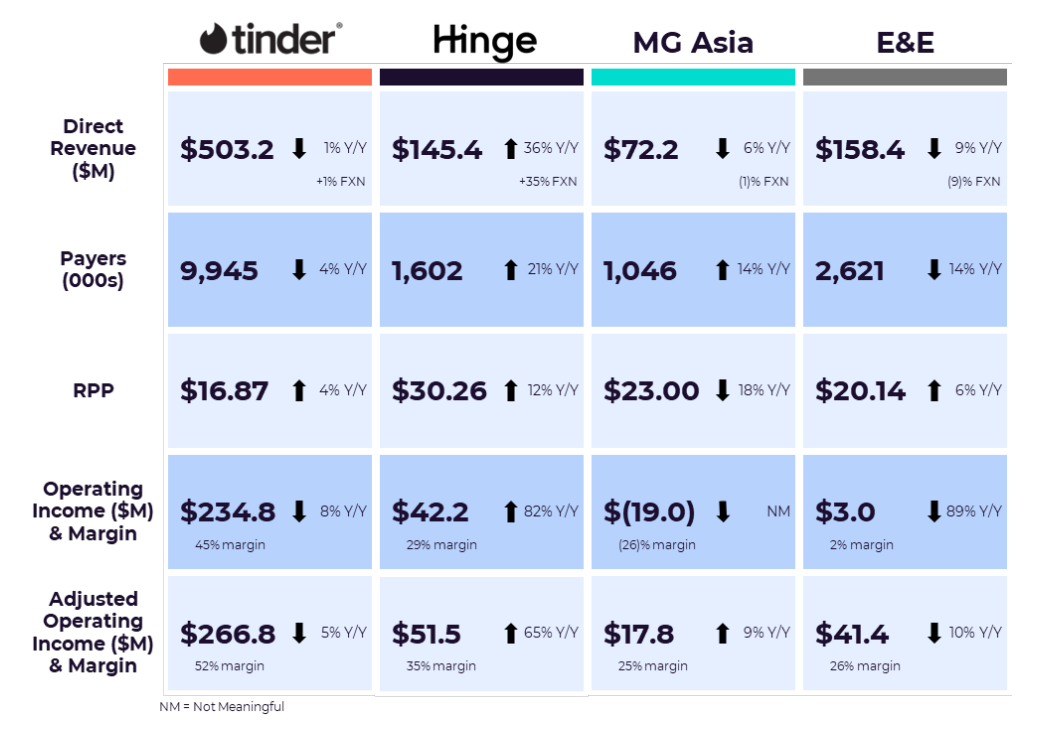

Match Group not only owns the namesake Match.com, but a portfolio of leading online dating sites including Tinder, Hinge, Meetic, OkCupid, Pairs, Plenty Of Fish, Azar, BLK, Hakuna, and others. Match now groups its various brands into four large segments: Tinder, Hinge, MG Asia, and "Evergreen & Emerging," an amalgam of Match's older no-growth brands and emerging subscale dating brands.

Despite having many of the premier online dating brands, Match only trades for 15.7 times this year's earnings estimates as of this writing, and just 12.4 times 2025 earnings estimates.

Not only that, but high-profile activist investors Starboard Value and Elliott Management recently got involved with the stock. With two high-profile activists guiding management and the board of directors, more shareholder-friendly initiatives should be coming.

So you have an industry leader, a cheap valuation, and activist investors stepping in to boost shareholder value. Seems like a great setup!

But Match has a Tinder problem

While Match may purport itself to be "diversified," and therefore a safer investment than other one-product companies, its results are extremely concentrated in one app: Tinder.

Image source: Match Group Q3 shareholder letter.

As you can see, it is really Tinder that will dictate the performance of Match Group in the immediate future, accounting for 52.6% of the company's third quarter revenue and an even higher 77.8% of adjusted operating income.

While Hinge, a dating app meant to lead to serious relationships, is a clear rising star within the Match portfolio, management forecast a pretty serious deceleration for the current quarter, with growth set to step down to 25% from 36% in Q3.

So, as goes Tinder, so goes Match Group in the immediate future, and Tinder has been seeing user and payer declines, with management still trying to figure out how to right the ship. If the Tinder app is in decline, that would theoretically put a crimp into the overall Match Group investment thesis.

Tinder's problems and fixes

In the post-pandemic, high-inflation environment, online dating apps were challenged generally. And as online dating has become pervasive, it's attracted bad actors. According to a recent Pew Research study, 52% of online daters said they have encountered someone trying to scam them, with 57% of female online daters finding it not to be safe, and 85% reporting people continuing to message them after saying they weren't interested. For Tinder specifically, its app became saturated with spam, including fake users, as the app's "hookup" reputation became fodder for exploitation.

The good news is that Match management is attacking these problems. The bad news is that the "cleanup" efforts result in lower monthly active user (MAU) and payer numbers. However, it's the right thing to do.

Management's new initiatives including mandating a face photo in order for a "faceless" profile to send likes. Other new initiatives include "Spotlight Drops" and an expanded "Explore" tab, geared toward helping people find dates with common interests. Another recent marketing campaign "It Starts With a Swipe" is meant to show how even Tinder dates can lead to lasting relationships.

These initiatives are meant to reposition Tinder as something more than a "hookup" site and reattract women back to Tinder. And some initiatives have shown signs of success, such as a recent sequential increase in paying users, even though payers are still declining year-over-year.

However, there are still headwinds. Tinder's MAU count continues to decline, and management expects a 2-3% revenue decline in the current quarter. Management is also still trying to find the right pricing optimization, such as a la-carte features meant to upgrade free users to paying users. But when tested last quarter, the a-la-carte offers actually led to some cannibalization of full subscription-payers, so Tinder is going back to the drawing board to refine these new ideas.

The turnaround could be bumpy

Investors shouldn't expect Match's turnaround to be smooth. However, if management can at least stabilize Tinder and turn it from a declining business to a growth business again, the stock could really take off.

That hasn't happened just yet, but investors should monitor the situation closely for positive signs, as Match looks like a rare potential bargain in the tech world.

Should you invest $1,000 in Match Group right now?

Before you buy stock in Match Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Match Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $890,169!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of November 11, 2024

Billy Duberstein and/or his clients have no position in any of the stocks mentioned. The Motley Fool recommends Match Group. The Motley Fool has a disclosure policy.