Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

2 Top Value Stocks to Scoop Up Now

Value investing remains as popular as ever - although, after a remarkably strong performance by the broader market this year, it might seem harder than ever to find truly compelling value stocks. With the S&P 500 Index ($SPX) up more than 18% on the year, even boring consumer staples stocks like Procter & Gamble (PG) are now trading at a significant premium to historical valuation multiples.

In the simplest terms, value investing refers to buying stocks that appear underpriced relative to their intrinsic value, or book value. Here, we've uncovered two well-established stocks that are value priced at current levels, buy-rated by analysts, and offer healthy upside potential heading into 2024.

Valero Energy

Crude futures (CLF24) have been notably volatile in recent months, as investors react to daily headlines about OPEC+ supply cuts, persistent global demand concerns, and flaring geopolitical tensions in the Middle East.

Meanwhile, looking back over the past five years, shares of oil refiner Valero Energy (VLO) have nearly doubled in value - comfortably outperforming not only the S&P 500, but also the S&P 500 Energy Sector SPDR (XLE), as well as the United States Oil Fund (USO). And right now, the stock is quite attractively priced.

Valero is a downstream petroleum company, primarily engaged in the manufacturing and marketing of transportation fuels, other petrochemical products, and power. It is also one of the largest independent petroleum refiners in the world, with a refining capacity of over 3 million barrels per day (bpd).

Currently commanding a market cap of $42.4 billion, Valero stock is just barely positive on a YTD basis. The stock offers a dividend yield of 3.27%, with a modest payout ratio of 13%.

Valero's results for the latest quarter were mixed, as the refiner missed on revenues but beat on earnings. Q3 revenues of $38.4 billion were down 13.6% from the previous year, and missed the consensus forecast of $41.5 billion. However, EPS rose by almost 5% to $7.49, surpassing the consensus estimate of $7.47. Valero's EPS have topped expectations in each of the past five quarters.

From a valuation perspective, VLO is quite attractively priced. The forward price/earnings ratio of 4.99 is roughly half the Energy sector median, and the forward price/sales of 0.29 also compares favorably to sector peers. Plus, VLO's price/book is 1.64 - narrowly below the sector median, as well as the stock's own 5-year historical average.

Overall, analysts have a “Moderate Buy” rating on the stock, with a mean target price of $153.12. This represents an upside potential of about 24% from current levels. Out of 16 analysts covering Valero stock, 11 have a “Strong Buy” rating, one has a “Moderate Buy” rating, three have a “Hold” rating, and one has a “Strong Sell” rating.

M/I Homes

Founded in 1976, M/I Homes (MHO) is a leading national homebuilder with operations across the country. It serves a broad segment of the housing market, including first-time, move-up, luxury, and empty-nest buyers. It is also committed to sustainable home-building and is a member of the National Association of Home Builders' (NAHB) National Green Building Standard program.

With a market cap of $2.9 billion, M/I Homes stock has gained an incredible 125% on a YTD basis - yet the stock is still undervalued, based on a number of key indicators.

The homebuilder's latest results for the third quarter were highlighted by record revenues. Total revenues of about $1 billion were up 3.3% year over year, while EPS of $4.82 improved by 3.2% from the year-ago period. Adjusted EPS beat Wall Street's expectations, though revenue fell short of the consensus forecast.

Key operating metrics like new contracts (+50% YoY), average community count (+15.6% YoY), and homes delivered (+3.45% YoY) all improved from the prior year, while cancellation rates fell to 10% from 17% in the year-ago period.

In terms of valuation, M/I Homes is trading at attractive levels compared to its peers. The price/book of 1.14 is well below the sector median of 2.43, while outperforming MHO is priced at 5.97x forward EPS and 0.69x forward sales.

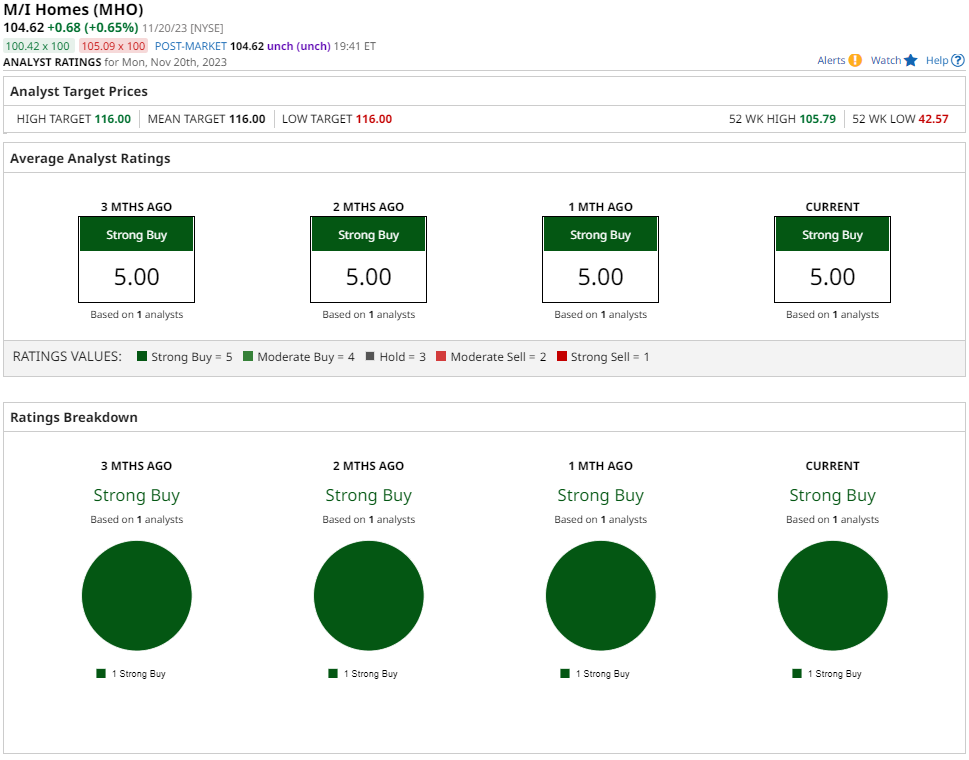

Wall Street coverage remains limited on the stock, with just one analyst tracking MHO. The stock's sole endorsement is a “Strong Buy” rating with a $116 price target, denoting an upside potential of 11% from current levels.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.