Many investors favor dividend stocks for their ability to reduce volatility, create capital gains in down markets, and provide steady income for long-term shareholders. However, it is well known that growth stocks have outperformed income stocks by a wide margin since 2007.

Some academic studies have suggested that this performance gap between growth and dividend/value stocks may be due to the structural changes in the U.S. economy over the last 40 years. Specifically, the U.S. has shifted away from agriculture and manufacturing to more of a service- and knowledge-based economy.

Image source: Getty Images.

This change has created new opportunities for growth, especially in the biotech and tech industries. But it has also seemingly made investors less interested in companies operating in slower-growth sectors, even though many of these companies still generate ample free cash flows and pay regular dividends to shareholders.

These trends have clear implications for investors who want to buy dividend stocks. Below is an analysis of data from 50 Dividend Kings in relation to their recent 12-month performance and how these trends should guide investors when choosing dividend stocks for their portfolio.

Five guideposts

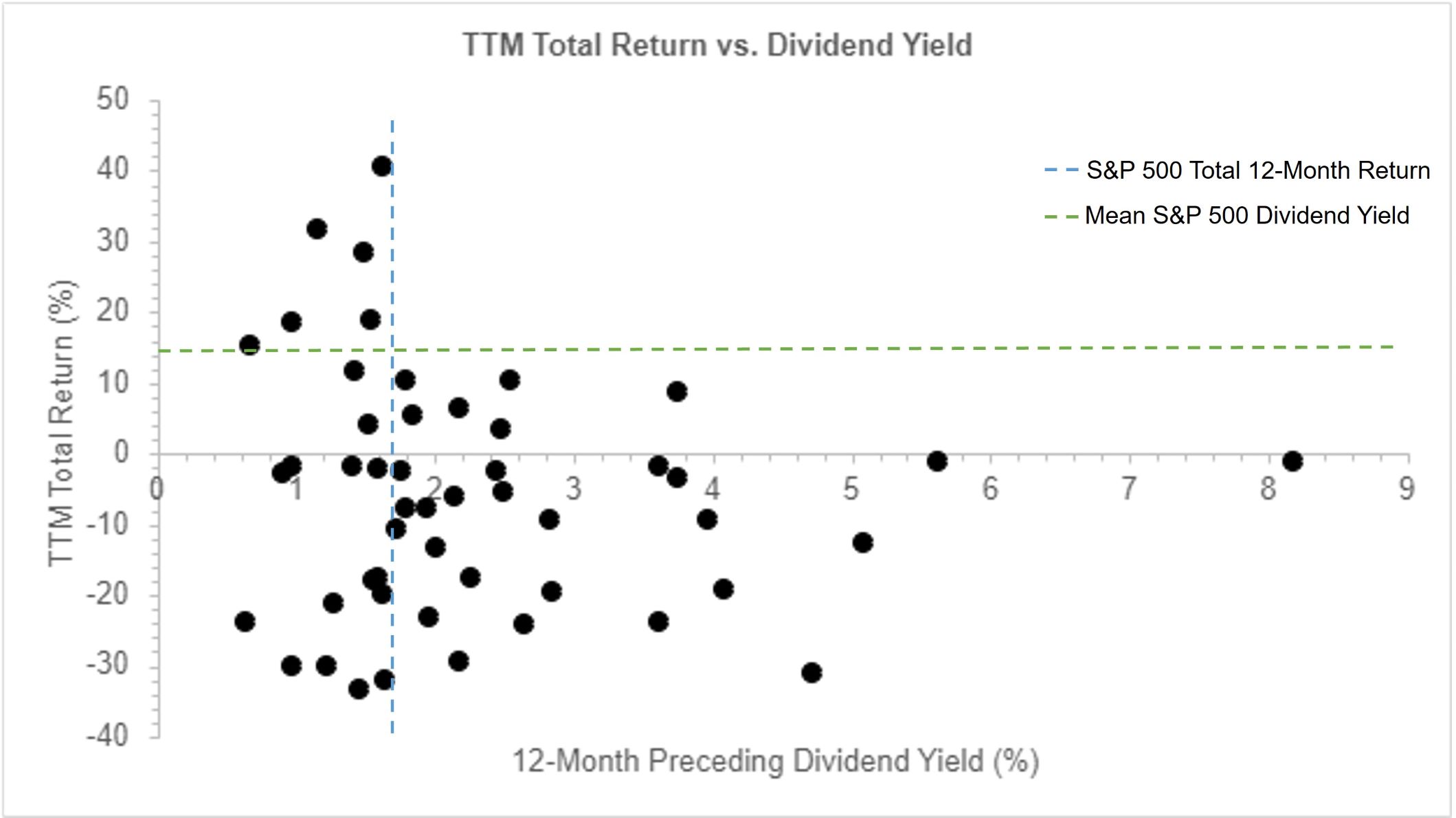

Dividend Kings are comprised of companies that have raised their dividends for no less than half a century, making them an ideal group in which to explore the relationship between dividend yield and stock performance. The graph below sketches out the non-linear relationship between total returns over the past 12 months (assuming the dividend was reinvested) and a stock's divided yield one year ago (i.e., the yield investors would have observed prior to buying the stock).

Image source: Author.

Scatterplot of the 12-month preceding dividend yield versus total returns (assuming dividends were reinvested) on capital over prior 12 months for 50 companies on the list of Dividend Kings. Data covers the dates Nov.10, 2022 to Nov.10, 2023. Data sources include Yahoo! Finance, YCharts, among others. Note the above graph seems to indicate six stocks produced market-beating returns when in fact only five stocks did so. S&P Global stock narrowly missed the cut, and its corresponding data point only appears to be above the cut-off due to the enlargement of the plot points for readability purposes.

These data offer five important takeaways for dividend investors:

- As a stock's dividend yield rises, its total returns tend to decrease. Nearly identical patterns have been observed in the academic literature with markedly larger sample sizes and over far longer time frames (1880 to 2020). There are multiple notable exceptions to this trend outside of the Dividend King space, but most come from companies operating in cyclical industries like oil and gas.

- The average yield of S&P 500 listed stocks (1.68% average over the past 12 months) seems to be an invisible barrier for market-beating performance within this top-tier group of dividend payers. This performance threshold is not readily detected in the academic literature, perhaps making it the first time such a threshold has been discussed in the financial media. To be upfront, though, a more thorough search of the literature may reveal similar findings.

- Dividend Kings with yields above the average S&P 500 index all failed to produced market-beating returns in this sample.

- High-yielders (greater than 4%) generally lost investors money in the past 12 months. This trend is especially true for investors who chose not to reinvest the dividend and instead decided to take it as part of an income strategy.

- Although the full analysis isn't being shown here for the sake of brevity, modeling data that account for the covariation among variables (including several fundamental traits like free cash flow and earnings per share) imply that dividend yield may act as a key barometer for a stock's risk premium. This finding is well-supported by several peer-reviewed studies with much larger datasets.

Outliers and momentum

The small group of Dividend Kings that beat out the broader market over the prior 12 months were MSA Safety (NYSE: MSA), Parker-Hannifin(NYSE: PH), W.W. Grainger (NYSE: GWW), Tennant Company (NYSE: TNC), and Walmart(NYSE: WMT). Of note, S&P Global narrowly missed the cut by 1.12%. Two common themes that unite these stocks is that they all pay a rather modest dividend and none of them trade at a bargain valuation.

Company | Total return (%) | Dividend Yield (%) | P/E Ratio |

|---|---|---|---|

MSA Safety | 18.2 | 0.98 | 100.2 |

Parker-Hannifin | 40.5 | 1.63 | 24 |

W.W. Grainger | 31.5 | 1.16 | 19.4 |

Tennant Company | 28.1 | 1.51 | 18.8 |

Walmart | 18.5 | 1.56 | 28.4 |

Author's own data compiled from multiple sources such as Morningstar, Charles Schwab, among others. The P/E ratio refers to the company's trailing-12-month price-to-earnings ratio a year ago, reflecting its value proposition ahead of the stock's future performance. Dividend yield represents the stock's yield 12 months prior to the study period.

Furthermore, three of these five stocks fall within the 82 percentile in terms of total returns on capital among Dividend Kings over the past five years, with the exceptions being MSA Safety and Tennant Company.

MSA Total Return Price data by YCharts.

Over the prior 10 years, three of these top performers fell within the 86 percentile on this metric. Tennant Company and Walmart are the two stocks that have recently joined the list of top-performing Dividend Kings. Momentum is thus another important metric investors should bear in mind when selecting dividend stocks as capital-appreciation vehicles.

MSA Total Return Price data by YCharts.

Key takeaways

Wall Street rarely bargain hunts in the dividend-stock landscape, and high yields generally spell trouble in terms of future returns on capital, especially over short periods of time. Moreover, large institutional buyers often stick with what works, a fact that becomes evident in the form of a stock's forward momentum over both short and long periods of time. Hence, retail investors should carefully consider a stock's yield, valuation, and forward momentum before hitting the buy button.

10 stocks we like better than Walmart

When our analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Walmart wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of 11/27/2023

Charles Schwab is an advertising partner of The Ascent, a Motley Fool company. George Budwell has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends S&P Global and Walmart. The Motley Fool recommends Charles Schwab and Tennant and recommends the following options: short December 2023 $52.50 puts on Charles Schwab. The Motley Fool has a disclosure policy.