Gold(GCX24)COMEX

Today's Change

Delayed Last Update

After Hours Change

After Hours Last Update

Volume

Latest News

Dollar Weighed Down by Lower Bond Yields and Strength in Stocks

Barchart - Thu Nov 7, 2:46PM CST

Barchart

Thu Nov 7, 2:46PM CST

The dollar index (DXY00 ) Thursday fell by -0.71%. The dollar on Thursday fell back from Wednesday’s 4-month high after the FOMC cut the fed funds target range by -25 bp. Also, lower T-note yields Thursday weakened the dollar’s interest rate differentials. In addition, Thursday’s US economic news weighed on...

Can the REMX ETF Rally?

Barchart - Thu Nov 7, 2:00PM CST

Barchart

Thu Nov 7, 2:00PM CST

While the REMX ETF’s name implies significant exposure to rare earth metals and minerals, the product’s holdings are primarily invested in lithium-producing mining companies. REMX has been under pressure, but commodity cyclicality suggests that it is in the buying zone below $50 per share.

Dollar Retreats Ahead of FOMC Meeting

Barchart - Thu Nov 7, 10:50AM CST

Barchart

Thu Nov 7, 10:50AM CST

The dollar index (DXY00 ) today is down by -0.71%. The dollar today fell back from Wednesday’s 4-month high on profit-taking ahead of the FOMC meeting results later this afternoon when the Fed is expected to cut the fed funds target range by -25 bp. Also, today’s US economic news...

Gold and USD Index Under Trump’s Presidency

Sunshine Profits - Thu Nov 7, 9:45AM CST

Sunshine Profits

Thu Nov 7, 9:45AM CST

That's just the beginning.

Dollar Retreats Ahead of FOMC Meeting

Barchart - Thu Nov 7, 9:38AM CST

Barchart

Thu Nov 7, 9:38AM CST

The dollar index (DXY00 ) today is down by -0.71%. The dollar today fell back from Wednesday’s 4-month high on profit-taking ahead of the FOMC meeting results later this afternoon when the Fed is expected to cut the fed funds target range by -25 bp. Also, today’s US economic news...

The Hangover is Gone! Time to Re-Examine Precious Metals

Blue Line Futures - Thu Nov 7, 7:48AM CST

Blue Line Futures

Thu Nov 7, 7:48AM CST

Today’s Metals Minute calls for a closer look at precious metals. Phil Streible dives into key levels and fresh insights on gold and silver.

The Election of Trump Boosts the Dollar and Hammers Gold Prices

Barchart - Wed Nov 6, 2:31PM CST

Barchart

Wed Nov 6, 2:31PM CST

The dollar index (DXY00 ) Wednesday rallied sharply to a 4-month high and finished up by +1.58%. The dollar soared Wednesday after Republican candidate Trump won the US presidential election. There is concern that Trump’s low tax and high tariff policies will boost inflation and slow the pace of Fed...

The Morning After

Blue Line Futures - Wed Nov 6, 12:30PM CST

Blue Line Futures

Wed Nov 6, 12:30PM CST

Bill Baruch joined the Schwab Network the morning after the election to dive into how he's navigating macro and markets ahead of FOMC.

Dollar Surges and Gold Plunges as Trump Wins US Presidential Election

Barchart - Wed Nov 6, 9:50AM CST

Barchart

Wed Nov 6, 9:50AM CST

The dollar index (DXY00 ) today is up sharply by +1.58% at a 4-month high. The dollar is soaring today after Republican candidate Trump won the US presidential election. There is concern that Trump’s low tax and high tariff policies will boost inflation and slow the pace of Fed interest...

Precious Metals Digest Election Results – Key Levels

Blue Line Futures - Wed Nov 6, 8:17AM CST

Blue Line Futures

Wed Nov 6, 8:17AM CST

With election results in focus, today’s Metals Minute with Phil Streible breaks down precious metals’ key levels and market response in gold and silver.

Dollar Weakens Ahead of US Election Results

Barchart - Tue Nov 5, 2:30PM CST

Barchart

Tue Nov 5, 2:30PM CST

The dollar index (DXY00 ) on Tuesday fell by -0.43% and posted a 2-1/2 week low. Long liquidation weighed on the dollar ahead of the results of Tuesday’s US presidential election, which is too close to call. Also, Tuesday’s US Sep trade deficit was wider than expected, a negative factor...

Dollar Falls on Long Liquidation Ahead of Today’s US Election Results

Barchart - Tue Nov 5, 9:49AM CST

Barchart

Tue Nov 5, 9:49AM CST

The dollar index (DXY00 ) is down by -0.28% and modestly above Monday’s 2-week low. Long liquidation is weighing on the dollar ahead of the results of today’s US presidential election, which is too close to call. Also, today’s US Sep trade deficit was wider than expected, a negative factor...

Stock Market Overview: US Elections and Cautious Investor Behaviour

Zaye Capital Markets - Tue Nov 5, 9:44AM CST

Zaye Capital Markets

Tue Nov 5, 9:44AM CST

Stock markets around the world in the US and Europe, are moving as investors wait to see the results of a divided US presidential election. Polls suggest a close race between Democratic nominee Kamala Harris and Republican nominee Donald Trump leading traders to hold back showing clear signs of caution. The unclear election outcome could make markets more unstable, as different winners might cause different market reactions.

European Commodities: Cocoa Reaches the Key Level of 5,500

Barchart - Tue Nov 5, 7:34AM CST

Barchart

Tue Nov 5, 7:34AM CST

Cocoa ramped higher last week, while coffee fell sharply.

Make Silver Great Again! -Copper Breakout, Silver Next?

Blue Line Futures - Tue Nov 5, 7:13AM CST

Blue Line Futures

Tue Nov 5, 7:13AM CST

Is silver set to follow copper’s breakout? Today’s Metals Minute with Phil Streible dives into key levels and market insights as silver aims for a comeback

Panic (Buying) in the Streets of London: Here's the 1 Stock Set to Benefit

Barchart - Mon Nov 4, 4:51PM CST

Barchart

Mon Nov 4, 4:51PM CST

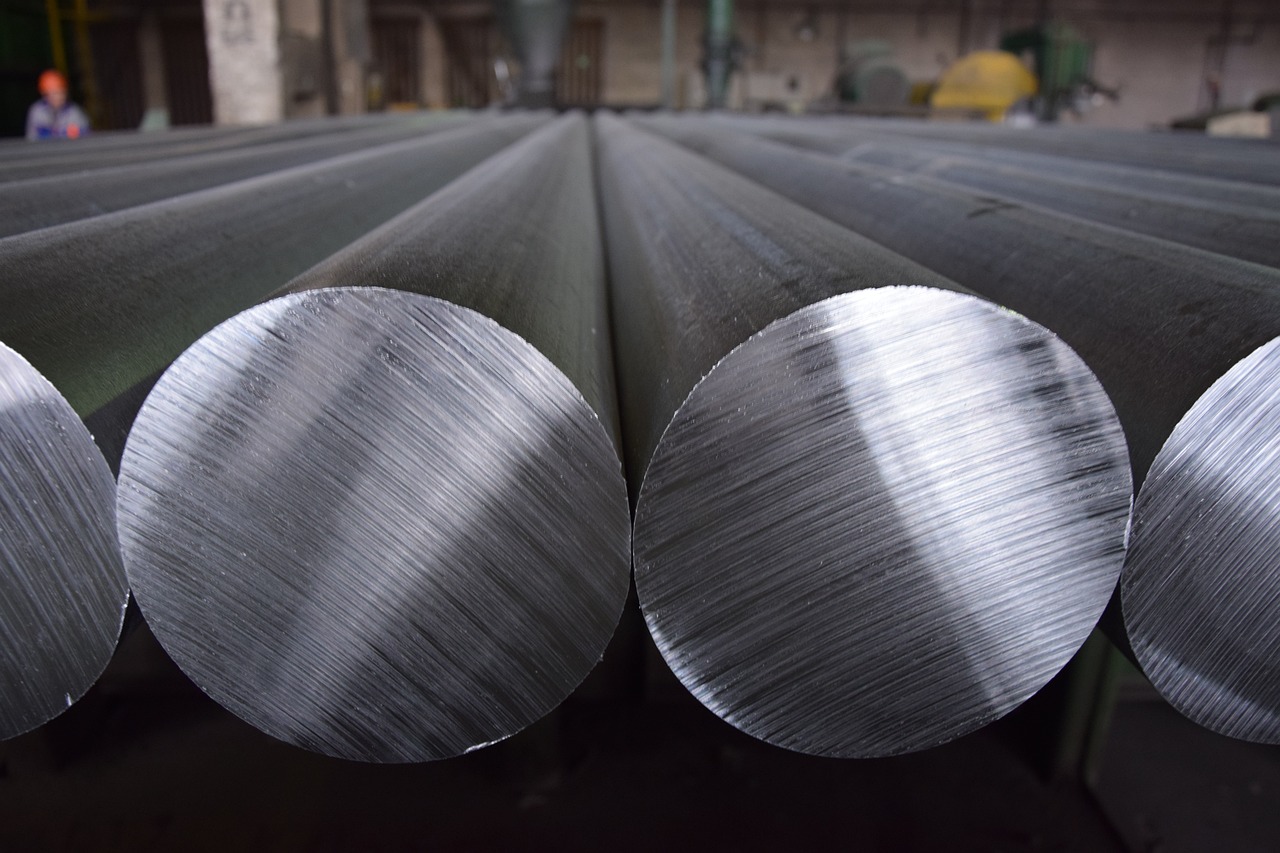

The blocking of bauxite exports from Guinea is the latest news to send alumina prices skyrocketing, with much of the panic buying coming from China, the world's biggest aluminum producer. Prices hit a record high last week, surpassing levels last seen in 2018, when the U.S. placed sanctions on Russia’s Rusal. One company poised to benefit is Alcoa.

Dollar Retreats with T-Note Yields Ahead of Tuesday’s US Presidential Election

Barchart - Mon Nov 4, 2:32PM CST

Barchart

Mon Nov 4, 2:32PM CST

The dollar index (DXY00 ) Monday fell by -0.40% and posted a 2-week low. The dollar was under pressure Monday after updated polls over the weekend shifted in favor of Democratic candidate Harris for president. Harris’s high-tax and low-tariff policies are seen as limiting growth and inflation and are seen...

Stocks Waver Before This Week’s US Election and FOMC Meeting

Barchart - Mon Nov 4, 10:05AM CST

Barchart

Mon Nov 4, 10:05AM CST

The S&P 500 Index ($SPX ) (SPY ) today is off -0.40%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is down -0.88%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is off -0.35%. Stocks are churning today and are trading mostly lower ahead of the US presidential...

Dollar Slips on Swings in US Election Polls and Fed Rate Cut Expectations

Barchart - Mon Nov 4, 9:33AM CST

Barchart

Mon Nov 4, 9:33AM CST

The dollar index (DXY00 ) today is down by -0.61% at a 2-week low. The dollar is under pressure today after polls over the weekend shifted in favor of Democratic candidate Harris for president. Harris’ high-tax and low tariff policies are seen as limiting growth and inflation and are seen...

Grain Market Watch: Can Wheat, Corn, and Soybean Prices Maintain Momentum?

Barchart - Mon Nov 4, 9:31AM CST

Barchart

Mon Nov 4, 9:31AM CST

The interview discusses the recent surge in grain prices, driven by increased demand from Mexico and China, as well as the uncertainty surrounding the US election and potential trade disruptions. Additionally, the rising demand for vegetable oils, particularly soybean oil, due to the growing renewable diesel market is highlighted. The interview also touches on the potential impact of weather conditions on winter wheat production and the bearish signals in the cattle and stock markets.

Stocks Under Pressure Ahead of Tuesday’s Election and FOMC Meeting

Barchart - Mon Nov 4, 9:05AM CST

Barchart

Mon Nov 4, 9:05AM CST

The S&P 500 Index ($SPX ) (SPY ) today is up +0.01%, the Dow Jones Industrials Index ($DOWI ) (DIA ) is up -0.27%, and the Nasdaq 100 Index ($IUXX ) (QQQ ) is down -0.15%. Stocks today are moderately lower on long liquidation pressures ahead of the US presidential...

Rising Copper Prices Boost Silver Overnight! Key Levels

Blue Line Futures - Mon Nov 4, 7:31AM CST

Blue Line Futures

Mon Nov 4, 7:31AM CST

Copper’s rise lifts silver overnight! Today’s Metals Minute with Phil Streible covers key levels and market impacts in gold and silver

Tracking Bitcoin and the Drivers to $100,000 after the election

Blue Line Futures - Fri Nov 1, 3:08PM CDT

Blue Line Futures

Fri Nov 1, 3:08PM CDT

Phil Streible of Blue Line Futures analyzes the market dynamics leading up to the election, emphasizing strategies for navigating volatility in stocks, bonds, and gold.

Dollar Recovers as Bond Yields and Equities Push Higher

Barchart - Fri Nov 1, 2:43PM CDT

Barchart

Fri Nov 1, 2:43PM CDT

The dollar index (DXY00 ) Friday recovered from a 1-1/2 week low and finished up by +0.31%. The dollar Friday initially retreated and posted a 1-1/2 week low on the weaker-than-expected US Oct payroll report, a dovish factor for Fed policy. Friday’s rally in stocks also reduced liquidity demand for...

Commodity Market Roundup: October’s Top Performers and Underperformers

Barchart - Fri Nov 1, 10:50AM CDT

Barchart

Fri Nov 1, 10:50AM CDT

Commodity prices turned mixed results in October even though bearish price action in the bond market and the pushed interest rates higher and bullish action in the dollar index tends to weigh on raw material prices.