Formula 1 (F1) racing has delivered thrilling racing action for 73 years, but its most recent six seasons have been its biggest by far in terms of fan attendance and revenue.

The turning point came when Liberty Media agreed to buy F1 in 2016 for $4.6 billion. The media giant has rapidly expanded the sport by adding new races, giving fans a more engaging experience, and pulling in blockbuster sponsorships. F1 is on track to deliver record revenue in 2023, but it's set to do even better in 2024 thanks to the largest racing calendar in the sport's history.

Here's the good news: Investors can buy a stake in the sport through Liberty Media Formula One(NASDAQ: FWON.A)(OTC: FWON.B)(NASDAQ: FWON.K) stock, and here's why they might want to do so ahead of the new year.

Formula 1 is coming off its biggest season ever

Formula 1 entered the 2023 season with a 23-race calendar, just like 2022. But despite one event being canceled due to extreme weather (Emilia Romagna, Italy), an estimated 6.1 million fans attended races in person throughout the year. The official numbers will be released by Liberty soon, but it's clear the sport set a new record high and improved on the 5.7 million attendees it attracted in 2022.

Aside from strong organic growth at existing races, Formula 1 swapped out the sparsely attended French Grand Prix for the Las Vegas Grand Prix. Vegas pulled in 315,000 fans between Nov. 16 and 18, making it the seventh-most-attended race of the year.

Liberty invested over $500 million in the event, and the company's upcoming financial results are expected to show it was one of the most lucrative races in the sport's history. What we know so far is that it contributed $1.2 billion to the local economy in Vegas.

Attention is now turning to the 2024 season, which begins in March. Vegas will make a return, but so will the Chinese Grand Prix, which has been absent from the calendar since 2020 due to pandemic restrictions. That means next year will feature 24 races, the most in the sport's history.

Formula 1 is tracking for record revenue in 2023 and 2024

Formula 1 has three core sources of revenue:

- Media rights fees, which account for 36.4% of revenue. This includes TV and streaming deals.

- Race promotion fees, which make up 28.6% of revenue. This includes ticket sales.

- Sponsorship fees, which account for 16.9% of revenue. Each race on the calendar tends to have a corporate sponsor, but F1 also creates a number of smaller opportunities for brands to gain exposure.

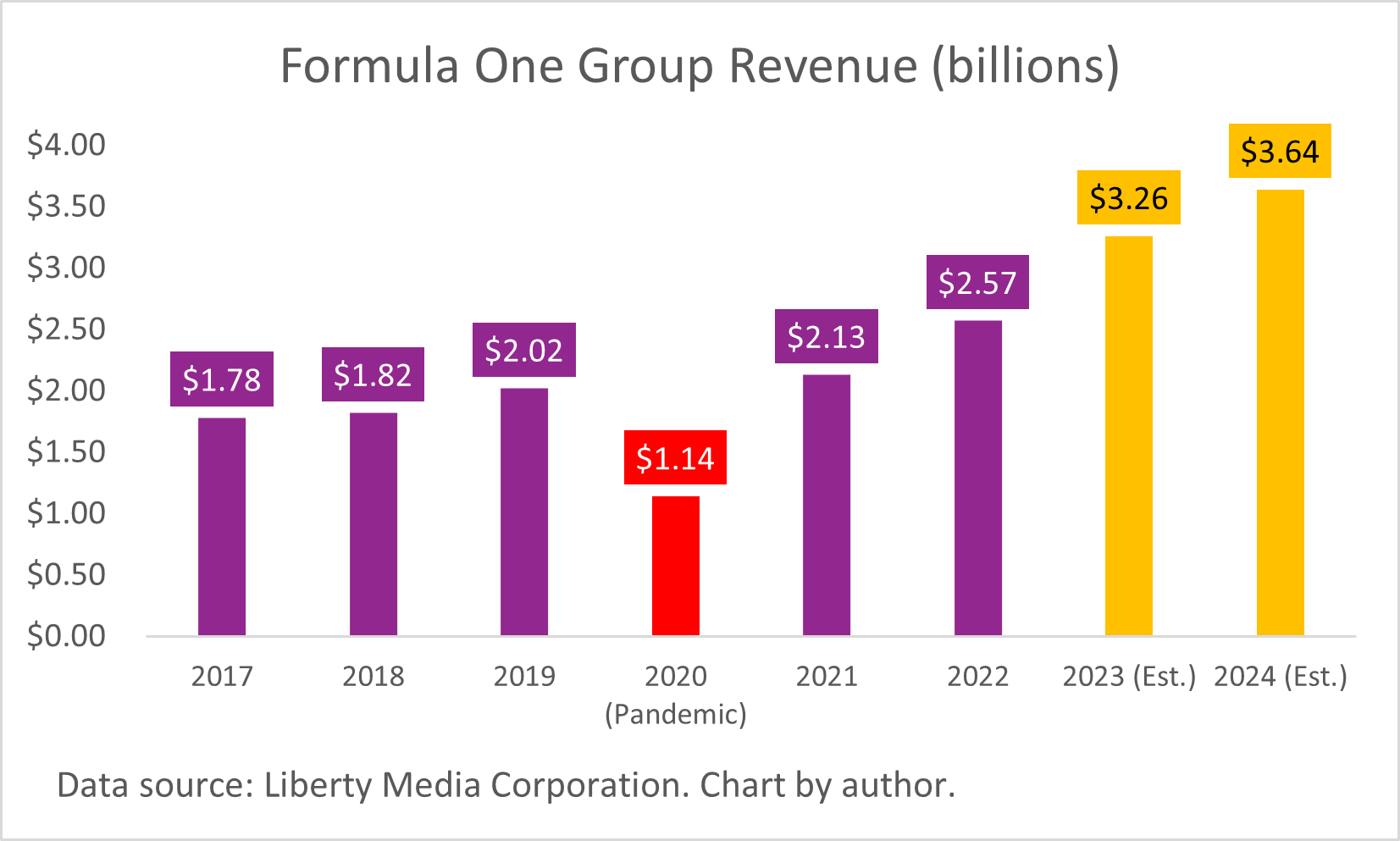

Formula 1 is on track to deliver $3.26 billion in revenue for 2023, which would be an increase of 27% year over year. It would be the fastest pace of annual growth since Liberty's first full season at the helm in 2017 (excluding 2021, which was a rebound year following the pandemic).

But Wall Street's early estimates point to another record year of revenue in 2024, even though growth won't be quite as strong. The sport could bring in over $3.6 billion, which means revenue will have officially doubled since the Liberty acquisition.

Data source: Liberty Media. Chart by author.

Why Formula 1 stock is a buy now

While Formula 1 is set for another record-breaking year in 2024, there are significant long-term growth drivers on the horizon investors should focus on. A couple of months ago, rumors were swirling that Apple is preparing a bid worth $2 billion per year for the global streaming rights to F1.

Formula 1 Group's financials suggest it brought in just under $1 billion from media rights in 2022, which would immediately double if Apple brings that deal to the table.

The main rights are currently held by a combination of Sky Sports (United Kingdom and Europe) and ESPN (United States). Sky's deal runs until 2029, and ESPN will maintain its rights until 2025. However, even if Apple doesn't swoop in right now, it's clear F1's largest revenue component is set for substantial growth in the coming years.

But the sport itself could also expand. There are currently 10 teams and 20 cars on the grid from leading manufacturers like Ferrari, Mercedes-Benz, and Aston Martin. But talks are underway to add another team, which could pull in more fans and create further opportunities for the sport to generate revenue.

Whichever way you look at it, F1 is poised for solid long-term growth. Investors who want to get involved can buy either the Class A shares, which come with voting rights (ticker FWONA); or the Class C shares, which have no voting rights (ticker FWONK). Both will track the performance of the sport all the same.

Should you invest $1,000 in Formula One Group right now?

Before you buy stock in Formula One Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now... and Formula One Group wasn't one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.

*Stock Advisor returns as of December 11, 2023

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple. The Motley Fool has a disclosure policy.