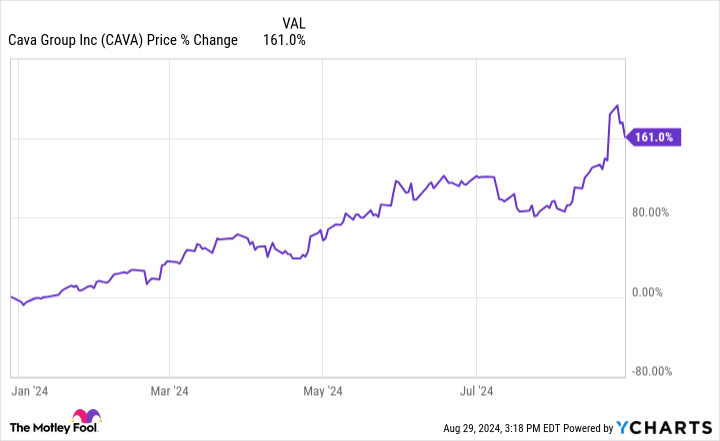

Few stocks have outperformed Nvidia this year. Cava Group(NYSE: CAVA) is one of them. The newly public restaurant chain focused on Mediterranean food is up over 160% so far in 2024 due to investor enthusiasm over its growth potential and the same-store sales growth at its existing restaurants. The stock now has a market cap of $13 billion.

There is a lot of hype for what some are calling the next Chipotle Mexican Grill, and that hype is looking increasingly deserved. But is it too late to buy the stock with shares up over 160% this year?

Strong comparable sales in a weak restaurant environment

Cava Group has a simple strategy: serve fresh Mediterranean-style food at a reasonable price. This includes menu items with falafel, hummus, pita bread, and Greek chicken. With no national brand serving this style of food, Cava sees an opportunity to fill a vacuum, similar to what Mexican food chains have done over the last few decades.

So far, it looks like consumers are loving the restaurant concept. Last quarter, Cava revenue grew 35% year over year to $231.4 million. Sales growth was driven by an impressive same-store sales growth of 14.4%, with traffic up 9.5% to boot. This means that more people are visiting existing Cava locations and spending more money. Profits are strong as well, with 26.5% restaurant-level margins last quarter.

What makes this even more impressive is the fact that a lot of restaurant brands are struggling at the moment. For example, McDonald's same-store sales have been trending in the wrong direction for several quarters and just flipped to negative. Perhaps a small reason is that more restaurant-goers are switching to healthier options at Cava.

Long runway for unit expansion

With 341 restaurant locations around the United States, Cava believes there is plenty of room to reinvest in the business for many years. It plans to open 54 to 57 restaurants in 2024. If it can add around 60 every year for the next 10 years, Cava will have 1,000 unit locations within a decade. And that is still significantly smaller than Chipotle, which is closing in on 4,000 restaurant locations around the world.

Cava locations have an average unit volume (AUV) of $2.7 million. This is solid for a new restaurant concept, but there is still plenty of room for improvement over the next 10 years. If Cava hits 1,000 locations and a $4 million AUV, that is $4 billion in annual revenue 10 years from now with still plenty of room for store expansion thereafter. Trailing-12-month revenue was $845 million.

Should you buy the stock?

Let's assume Cava hits $4 billion in sales 10 years from now. Assuming a standard consolidated profit margin of 15% for restaurants -- the 26.5% figure above excludes corporate overhead costs -- that equals $600 million in annual profits for Cava in 2034.

Today, Cava trades at a market cap of $13 billion, or a 10-year forward price-to-earnings ratio (P/E) of 21.6 based on my estimates. So, the stock will trade at close to the S&P 500 average P/E today in 10 years if you believe this growth trajectory will continue.

What this tells me is margin expansion, unit growth, and same-store sales growth are already priced into Cava stock for many years into the future. Perhaps even more than 10. Restaurants can't grow at absurdly quick rates like a software or internet company. They simply can't secure real estate and build restaurants fast enough. This limits the year-over-year revenue growth rate potential. There are also limits to margin expansion due to food costs and labor costs.

I have no doubt that Cava can keep growing at a durable rate over the next 10 years. But that does not mean the stock is automatically a buy. Cava stock looks overvalued after this year's monster gains. I think investors who buy this stock today will be disappointed over the next 10 years.

Should you invest $1,000 in Cava Group right now?

Before you buy stock in Cava Group, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cava Group wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of August 26, 2024

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Chipotle Mexican Grill and Nvidia. The Motley Fool recommends Cava Group and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.