Given ExxonMobil's(NYSE: XOM) enormous cash war chest, there has been a lot of focus recently on its next acquisition. However, instead of shopping, Exxon recently agreed to sell an asset and add to its cash position.

That deal will provide a boost to the buyer, Chord Energy(NASDAQ: CHRD), potentially giving it more fuel to pay dividends. Here's a closer look at the deal and how it will benefit both oil stocks.

Striking the right chord

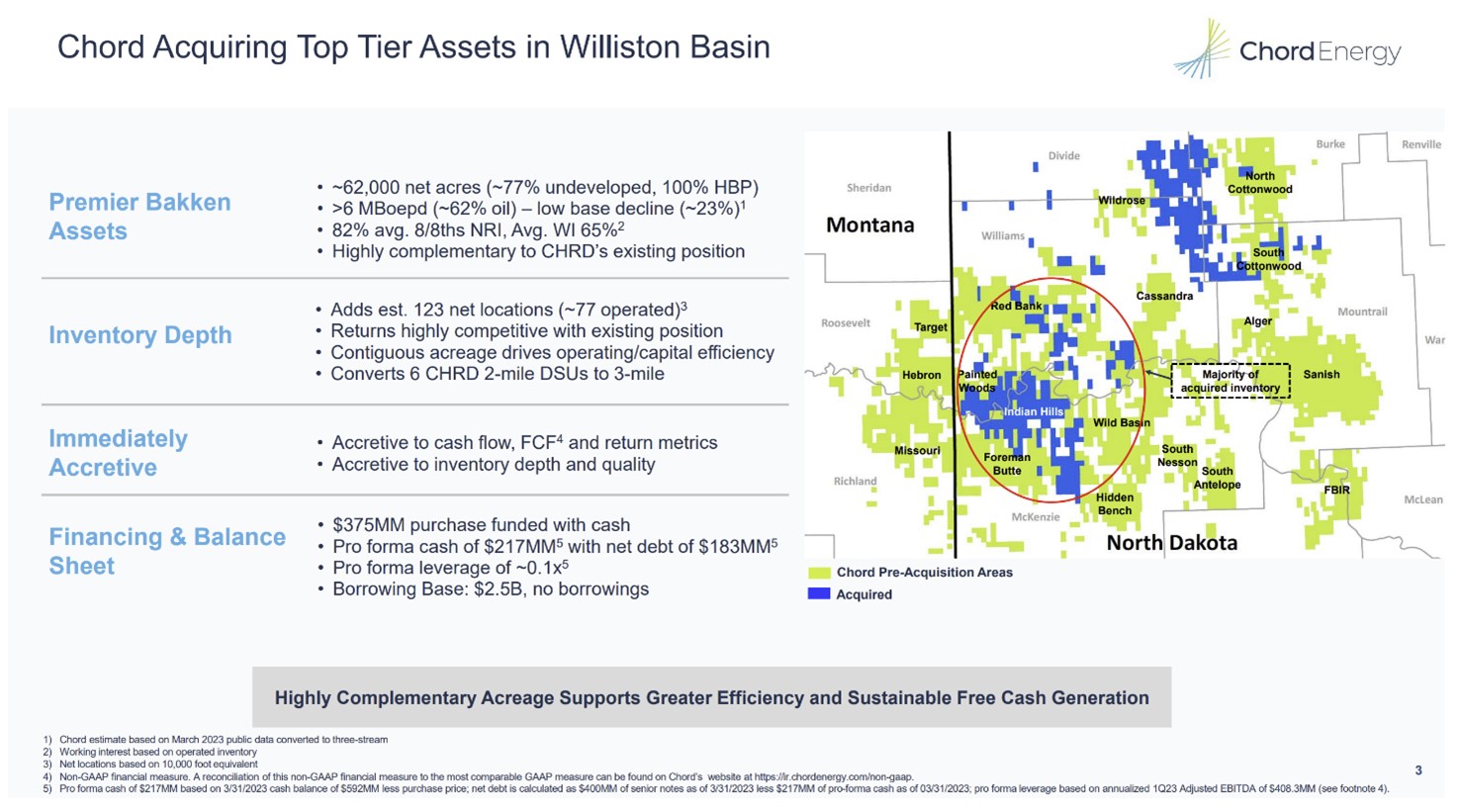

Chord Energy has agreed to acquire 62,000 acres in the Williston Basin of North Dakota from Exxon. It's paying $375 million in cash for largely undeveloped land (77% undeveloped with 123 future drilling locations). The strategically located acreage fits like a glove within the company's existing acreage position in the oil-rich basin:

Image source: Chord Energy.

Chord Energy expects the acquisition will be accretive to its cash flow, free cash flow, and return metrics.

The transaction will also enable the company to continue returning more than 75% of its free cash flow to shareholders. Chord Energy has a three-tiered capital return strategy based on its leverage ratio. With leverage expected to remain well below 0.5, it will return capital at the high end of its range. The company does that through a combination of a base dividend, variable dividend, and share repurchase program.

Chord's base dividend of $5 per share each year ($1.25 per quarter) provides a nice base return. The oil company's dividend yield on that fixed quarterly payment is 3.3% based on the recent stock price (about double the dividend yield of the S&P 500). Meanwhile, the most recent base-plus-variable quarterly dividend payment of $3.22 per share pushes its dividend yield up to 8.6% by annualizing that rate. With the Exxon deal enhancing its free cash flow, Chord will have more money to pay dividends in the future.

Why is ExxonMobil selling?

ExxonMobil has a focused upstream investment strategy. It's investing in high-return, low-cost-of-supply projects with lower carbon emissions profiles. That's leading it to invest 70% of its upstream capital in four core resources: The Permian Basin, Brazil, Guyana, and LNG. These investments should generate a more than 10% return at oil prices of around $35 a barrel. That focused investment strategy has Exxon on track to double its earnings and cash flow by 2027 from 2019's baseline and oil and gas price point.

These Williston Basin assets no longer fit within Exxon's investment strategy. Since they're relatively immaterial to the oil giant and don't deliver on its returns, supply costs, and lower carbon goals, the company is cashing in on the position. It can eventually recycle this capital into its best assets by deploying the proceeds in the future as a compelling investment opportunity arises.

Exxon is on the prowl for an acquisition to bolster its position in the Permian Basin. It has reportedly talked to Pioneer Natural Resources about a deal. However, the company is in no hurry to spend its nearly $33 billion cash war chest. It's willing to wait for the right opportunity to leverage its technological advantage in the Permian to get the most value from a future acquisition. In the meantime, cash will continue to pile up on its balance sheet, further strengthening its financial position.

A win-win deal

The Williston Basin isn't core to Exxon's strategy. That's leading it to sell some assets in the region to Chord Energy, which focuses on that basin. It will supply that company with more free cash flow to support its cash return strategy, which could give it the fuel to increase its already attractive dividend. Meanwhile, Exxon can eventually redeploy the cash from this sale into its core assets, which are key to its strategy of growing shareholder value. That makes it a win-win deal for both companies.

10 stocks we like better than ExxonMobil

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and ExxonMobil wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of May 22, 2023

Matthew DiLallo has no position in any of the stocks mentioned. The Motley Fool recommends Pioneer Natural Resources. The Motley Fool has a disclosure policy.