Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

3 Defensive Stocks for 'Sell in May' Season

Historically, equity markets have underperformed between May and October, and delivered outsized gains between November and April. However, in recent years, this gap in performance has been closing.

For instance, according to a report from Cetera Investment Management, the S&P 500 Index ($SPX) has delivered positive returns between May and October in 26 out of the 34 years between 1990 and 2023. It suggests that people who offload stocks from their portfolio in May would be really disappointed, and indicates that timing the market based on historical trends is extremely futile.

This spring, investors are understandably worried about a slew of macro headwinds - including geopolitical tensions, rising oil prices, elevated interest rates, and inflation, which refuses to cool down. Any of these factors might drive the equity market lower in the near term.

But you can continue to invest in quality stocks and benefit from outsized gains when market sentiment improves. Here are three defensive stocks for this year's “sell in May” season that you can consider buying right now.

1. AbbVie Stock

Valued at $287 billion by market cap, AbbVie (ABBV) is a research-based biopharma company that develops and sells pharmaceutical products. Its flagship drug is Humira, which treats multiple conditions, including psoriasis, arthritis, and Crohn’s disease.

In 2023, AbbVie reported $54.3 billion in sales, with Humira accounting for $14.4 billion of its top line. AbbVie continues to expand its revenue base, and drugs such as Rinvoq and Skyrizi are forecast to generate $27 billion in annual sales by 2027.

Priced at 15x forward earnings, AbbVie is not too expensive, and is part of the recession-resistant healthcare sector.

Out of the 21 analysts covering ABBV stock, 11 recommend “strong buy,” two recommend “moderate buy,” and eight recommend “hold.” The average target price for ABBV stock is $179.37, indicating an upside potential of over 10% from current levels.

In addition to its attractive valuation, the healthcare stock offers a forward yield of 3.8%. Moreover, AbbVie has raised these payouts by 270% in the last decade.

2. Cboe Global Markets Stock

Valued at $19 billion by market cap, Cboe Global Markets (CBOE) operates an exchange that allows investors to trade sophisticated financial instruments, such as futures and options. Similar to other exchanges, Cboe is fairly cyclical, and benefits from higher trading volumes during bull markets. However, with its flagship Cboe Volatility Index ($VIX) and a suite of related exchange-traded products (ETPs), the exchange operator also maintains a unique foothold in the market during times of increased volatility amid heightened demand for hedging instruments.

Cboe generates revenue from trading fees, and ended 2023 with $3.77 billion in sales. Priced at 21x forward earnings, CBOE stock is not too expensive, given its earnings are forecast to expand by 8.5% annually in the next five years.

In Q1 of 2024, CBOE added 106 new ETF securities across its global network. Over 120 issuer partners currently list ETF products on Cboe’s network of stock exchanges, allowing the company to surpass over 1,000 ETF listings in the process.

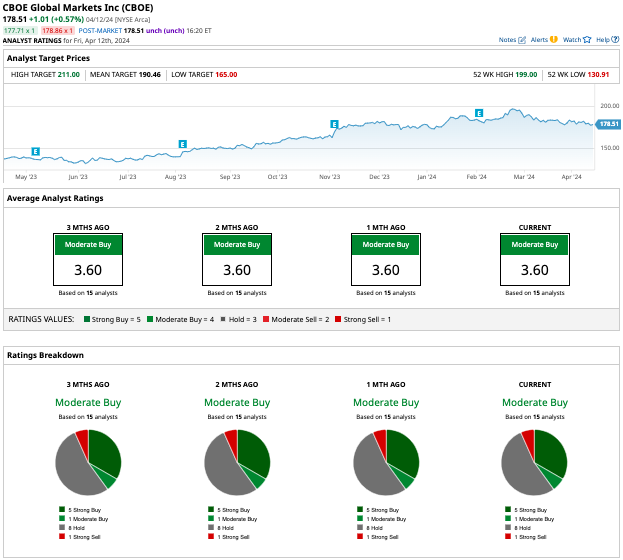

Out of the 15 analysts covering CBOE stock, five recommend “strong buy,” one recommends “moderate buy,” eight recommend “hold,” and one recommends “sell.”

The average target price for CBOE stock is $190.46, indicating an upside potential of 6.7% from current levels.

3. Verizon Stock

The third defensive stock on my list is Verizon(VZ), one of the largest telecom companies globally. Valued at $167 billion by market cap, Verizon offers shareholders a dividend yield of 6.7%, making it attractive to income-seeking investors.

While Verizon is part of a mature sector, it has raised dividends for 17 consecutive years - the longest streak out of its telecom peers in the U.S.

In 2023, Verizon's operating cash flow totaled $37.5 billion, while it allocated $18.8 billion toward capital expenditures, resulting in a free cash flow of almost $19 billion. The company paid $11 billion to shareholders via dividends, indicating a payout ratio of less than 65%.

Verizon’s future cash flows should expand, given its continued investment in organic growth, such as building out a robust 5G network. The telecom heavyweight aims to spend between $17 billion and $17.5 billion in capital expenditures, which should drive earnings and cash flow growth.

Out of the 20 analysts covering Verizon stock, six recommend “strong buy,” three recommend “moderate buy,” and 11 recommend “hold.”

The average target price for VZ stock is $44.66, indicating an upside potential of nearly 12% from current levels.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.