In the world of fast-casual restaurants, two companies with similar concepts for customizable meals, but in different cuisine categories, stand out: Cava Group(NYSE: CAVA) and Chipotle Mexican Grill(NYSE: CMG). Each has delivered market-beating returns since going public, but which of these restaurant chains offers the tastiest opportunity for investors from here? Let's try and find out.

Weighing the financials

Chipotle's successful strategy of only having company-owned and operated restaurants was a blueprint that Cava, a Mediterranean food chain, has emulated. As of the ends of their respective second quarters, Chipotle was operating 3,530 restaurants, while younger upstart Cava had only 341 locations.

In Q2, Chipotle generated $2.97 billion in revenue and $455.7 million in net income, for year-over-year growth of 18.2% and 33.3%, respectively. Its revenue growth was partly attributable to the 262 net new locations it opened over the prior 12 months, but it also grew its comparable-restaurant transaction volume by 8.7% year over year. Additionally, the company's restaurant-level operating margin widened from 27.5% in Q2 2023 to 28.9% in Q2 2024.

By comparison, in Cava's fiscal Q2, which ended July 14, it produced revenue of $231.4 million and $19.7 million in net income, equating to growth of 35.2% and 203.1% year over year, respectively. The growth was largely driven by 62 net new locations it added since Q2 2023 -- a 22.2% year-over-year expansion -- as well as traffic increasing by 9.5%. Cava's restaurant-level profit margin also improved from 26.1% in Q2 2023 to 26.5% in Q2 2024.

Given that Chipotle's footprint is nearly more than 10 times the size of Cava's, there are naturally going to be significant differences between them in terms of revenue and profits. Because of that, the most important metric to focus on when comparing them is restaurant-level operating margin. This captures both a chain's pricing power and its operational efficiency. In this case, the advantage goes to the more established chain, Chipotle.

Growth opportunities

Cava management hopes to nearly triple its location count to 1,000 by 2032. However, management doesn't plan on opening new restaurants at breakneck speed. The Mediterranean chain opened 72 net new restaurants in 2023, and expects to only add 54 to 57 more in 2024.

That slowdown is less about demand and more about management protecting its brand and quality as the company grows. During the Q1 earnings call, co-founder and CEO Brett Schulman emphasized this point. "We are not just scaling a business, we are creating long-term value for our guests, team members, and shareholders," he said.

For comparison, Chipotle's long-term plan is to roughly double its restaurant count to 7,000 in North America, though it hasn't specified when it expects to hit that target. Chipotle also has overseas expansion opportunities, and already operates locations in the United Kingdom, France, Germany, and Kuwait. The company plans to open between 285 and 315 new restaurants in 2024. Through the first half of 2024, it opened 95 net new company-operated locations and its first-ever licensed location.

Some long-term strategic plans may have been put on the back burner, however, after former CEO Brian Niccol resigned in August to take the CEO position at Starbucks. To hold the role of interim CEO, Chipotle has appointed Chief Operating Officer Scott Boatwright, who joined the chain in 2017. However, the abrupt departure of Niccol -- who had led the company since 2018 -- creates some uncertainty regarding its growth plan, considering that he had a major hand in devising it.

Both companies offer incredible long-term growth opportunities when it comes to adding new restaurants. However, given the sheer size of Chipotle and the fact that it recently lost its well-regarded CEO, the advantage in this category goes to Cava.

Valuation vs. valuation

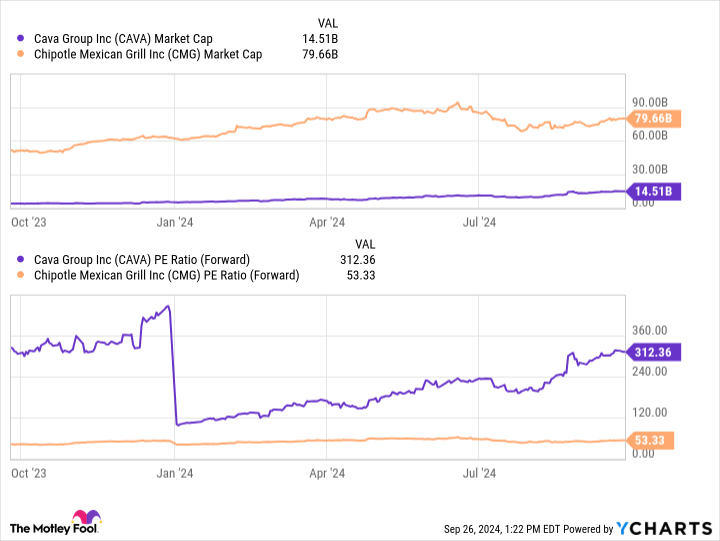

It will come as no surprise that Chipotle's market capitalization of $79.7 billion is much larger than Cava's $14.5 billion. But to assess which stock is the better value, consider their forward price-to-earnings (P/E) ratios. Currently, Chipotle trades at about 53 times its projected earnings for the next 12 months, while Cava trades at a dizzying ratio of 312.

CAVA Market Cap data by YCharts.

Further, when comparing market cap and sales to the number of locations, Chipotle's stock looks cheaper. The average Cava restaurant has a value of $42.5 million and generated revenue of almost $679,000 last quarter. For comparison, each Chipotle location averages a value of $22.6 million and produced approximately $842,000 in revenue last quarter.

Overall, between the upstart Cava and established Chipotle, the latter has the better-priced stock in this category.

Is Cava or Chipotle the better stock to buy?

Cava has generated a lot of excitement among investors -- understandably, considering that the chain is already profitable, is debt free, and has lofty growth goals. Still, its stock already has sky-high long-term expectations priced into it. Between these two restaurant stocks, Chipotle, with its market-leading position and less-ambitious valuation, offers a better opportunity for investors buying in now.

Should you invest $1,000 in Chipotle Mexican Grill right now?

Before you buy stock in Chipotle Mexican Grill, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Chipotle Mexican Grill wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $744,197!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 30, 2024

Collin Brantmeyer has positions in Chipotle Mexican Grill. The Motley Fool has positions in and recommends Chipotle Mexican Grill. The Motley Fool recommends Cava Group and recommends the following options: short September 2024 $52 puts on Chipotle Mexican Grill. The Motley Fool has a disclosure policy.