Over the past few years, highly scalable, low-marginal-cost tech companies have been all the rage. And I own a few, with software -- software-as-a-service (SaaS) stocks in particular -- featured heavily among them. At scale, the economics of these companies can turn them into cash cows.

Yet at the same time, investors shouldn't lose focus on the real world. As much as technology is disrupting much of the modern world, humanity still runs on clean, cheap water, reliable transportation, and increasingly low-carbon energy. The companies that own and operate the infrastructure that delivers on these basic needs can make for incredible long-term investments. Two in particular that stand out are Brookfield Infrastructure (NYSE: BIP)(NYSE: BIPC) and Brookfield Renewable (NYSE: BEP)(NYSE: BEPC).

And it looks like Mr. Market is giving investors a great opportunity to buy both. Brookfield Infrastructure shares are down 31% from the all-time high, while Brookfield Renewable has lost a painful 58% of its value from the peak. I'm not sitting on the sidelines, either, having recently bought more both.

The case for owning the infrastructure

We talked about the nearly zero-marginal-cost benefits for SaaS and software companies in general. Once the code is written, the incremental cost of serving it to 1 million customers isn't that much different than 100,000 customers. In other words, once you cover your operating expenses, each additional customer gets very, very profitable.

The challenge is that the economics look good on paper, but your competitors see the same opportunities. It can be really hard to build truly durable competitive advantages in technology. As a result, the land grab phase quickly turns into a war of attrition to retain customers, and the profits don't necessarily materialize quickly, or at all.

Infrastructure, on the other hand, has much higher fixed costs. There's no scaling from 100,000 customers to 1 million at similar operating costs when you're transporting water, producing electricity, or operating a toll road. The economics work when you operate at a high level of maximum capacity the majority of the time.

Despite the less appealing economics, there are very good reasons to own these assets. The risk of competitive threat is much lower, as the cost of entry is simply too high. Moreover, infrastructure assets tend to generate consistent cash flows, often across economic environments and for multiple decades with little risk of disruption.

It's like owning a money tree surrounded by a big moat.

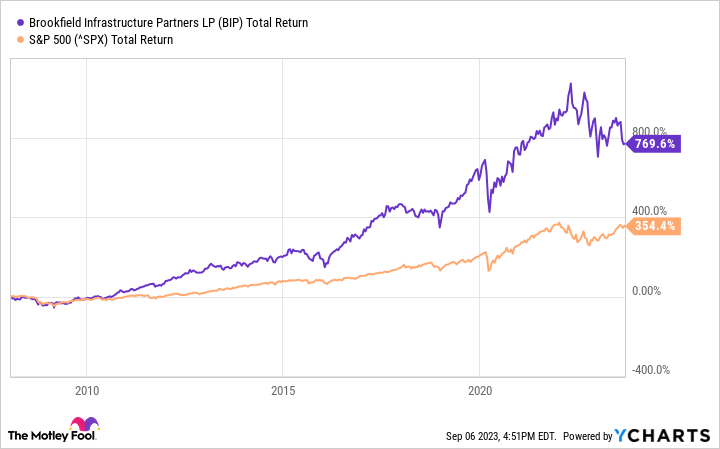

How much money, and how big of a moat? Brookfield Infrastructure went public on the NYSE in January 2008, and has generated almost 9X total returns. That's more than double the S&P 500:

BIP Total Return Level data by YCharts

A big part of that return is dividends. Since the first payout, it has grown the distribution almost 10-fold.

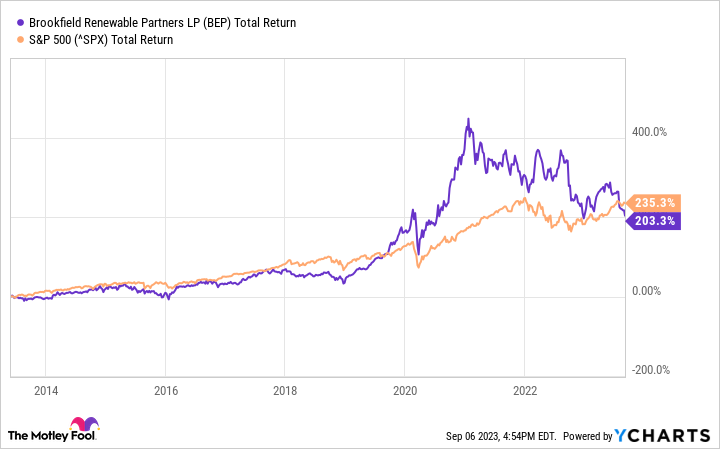

Brookfield Renewable's return profile isn't quite as good. Since going public on U.S. markets in 2013, its shares are up 203% in total returns. That's more than triple, but it trails the 235% in total returns for the stock market over the same period:

BEP Total Return Level data by YCharts

However, since its big move into wind and solar in 2017, Brookfield Renewable has flexed market-beating returns, a path it's likely to remain on.

Why are these stocks down so much?

Brookfield Renewable is down by more than half. Even when adding back in distributions paid, investors who bought at the peak have lost about 45%.

So what's sent shares down? A couple of things, starting with the stock price getting way ahead of itself on renewable energy hype in 2020 and early 2021. Shares essentially doubled in value over 13 months, from the beginning of 2020 through late January 2021. A company like Brookfield Renewable simply cannot double its business that quickly. It takes years to build and deploy solar and wind farms, and even its acquisition-driven process can't yield doubling-of-cash flows results that fast. So the stock was priced for perfection that the business couldn't live up to.

The negative sentiment has ramped up over the past year, as skyrocketing interest rates mean that business like Brookfield face a much higher cost-of-capital environment than they've operated in over the past decade. As a result, Mr. Market has priced these stocks much lower to account for the risk of lower returns from here.

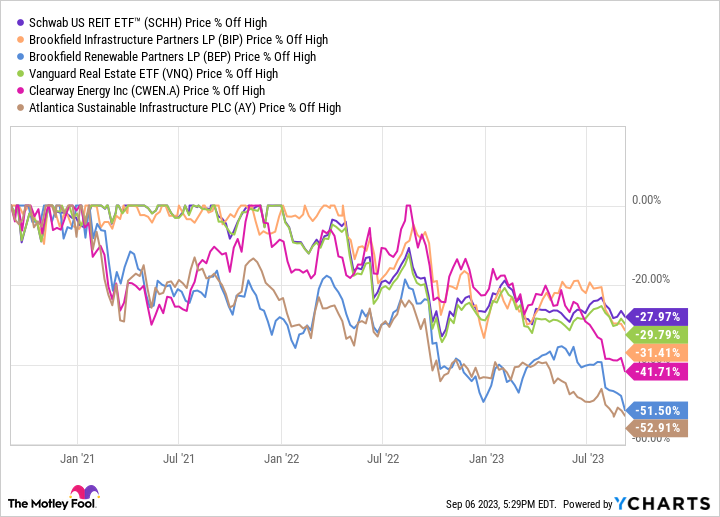

The market seems to be valuing both inline with commercial real estate. Here's how they fare against several of the largest REIT -- real estate investment trust -- ETFs, the Schwab US REIT ETF (NYSEMKT: SCHH), and Vanguard Real Estate ETF (NYSEMKT: VNQ):

As you can also see in the chart, Clearway Energy (NYSE: CWEN.A) and Atlantica Sustainable Infrastructure (NASDAQ: AY) have lost between 40% and 50% of their value, similar to the decline for Brookfield Renewable. Investors are very concerned about rising rates on these debt-heavy businesses, and possible headwinds and an cloudy outlook for wind and solar projects.

That revaluing is an opportunity for investors

Yes: Rising interest rates mean higher cost of capital. But just as we have seen commercial real estate prices fall because of higher rates, both Brookfields are positioned as strong buyers with ample access to liquidity too get deals done. This has been a competitive advantage in the past, and I expect it will remain such.

The short-term focus on rates and the market cycle ignores the huge global opportunity. Wind and solar are getting a significant amount of global investment in energy growth, while a burgeoning global middle class -- Visa (NYSE: V) expects it will add $15 trillion in consumer spending by 2030 -- will demand more clean water, transportation, and data access.

So while Mr. Market focuses on short-term risks, investors should think about the long-term prospects. I've added to my holdings in both of these Brookfield subsidiaries recently; other investors should consider doing the same.

10 stocks we like better than Brookfield Renewable Partners

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now... and Brookfield Renewable Partners wasn't one of them! That's right -- they think these 10 stocks are even better buys.

*Stock Advisor returns as of September 5, 2023

Jason Hall has positions in Atlantica Sustainable Infrastructure Plc, Brookfield Infrastructure, Brookfield Infrastructure Partners, Brookfield Renewable, Brookfield Renewable Partners, Clearway Energy, and Visa. The Motley Fool has positions in and recommends Brookfield Renewable, Vanguard Specialized Funds-Vanguard Real Estate ETF, and Visa. The Motley Fool recommends Brookfield Infrastructure Partners and Brookfield Renewable Partners. The Motley Fool has a disclosure policy.