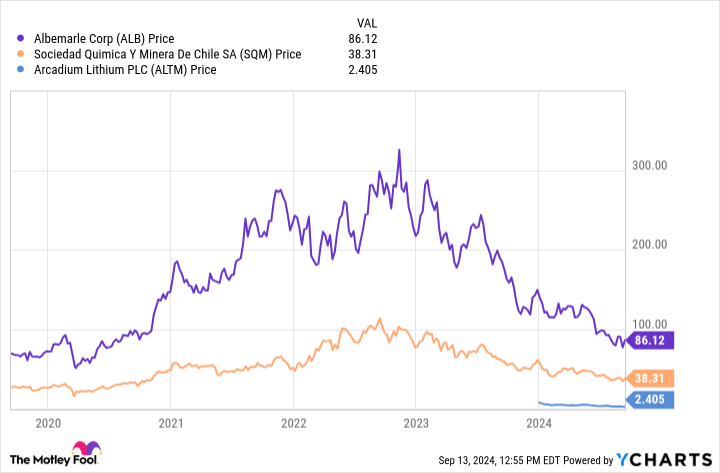

Lithium stocks have been hammered this year alongside lithium prices, but a major industry development this week lifted investors' hopes of a turnaround and sent shares of lithium producers soaring.

Here are some top-performing lithium stocks and the percentage by which they rallied at their highest points in trading this week through 12:30 p.m. ET Friday, according to data provided by S&P Global Market Intelligence:

- Albemarle(NYSE: ALB): Up 16.8%.

- Sociedad Quimica y Minera de Chile SA (NYSE: SQM): Up 12.8%.

- Arcadium Lithium(NYSE: ALTM): Up 10.2%.

Could this be the beginning of the next bull run in lithium stocks? One lithium stock, in particular, looks like a solid buy now.

The news that sent lithium stocks soaring

After hitting an all-time high of 575,000 yuan per ton, or $80,000 per ton, in December 2022, lithium carbonate prices have fallen off a cliff and are now hovering at only around 75,000 yuan per ton on fears of an oversupply. China, in particular, has continued to expand its lithium capacity even as demand for lithium from key industries like electric vehicles (EVs) and solar fell amid a global slowdown.

This week, some analysts reported China-based CATL's plans to cut production at its huge lithium mine in Jiangxi province because of rising costs. Reuters later confirmed the news. CATL is among China's leading lithium producers and, ironically, also the world's largest EV battery maker.

Analysts at UBS, who were the first to report CATL's plans, expect the move to reduce China's lithium carbonate output by nearly 8% and believe it could help rebalance demand and supply. UBS expects lithium prices to rise by 11% to 23% over the remaining months of 2024.

Any rebound in lithium prices will be a lifeline for lithium stocks. That's how commodity stocks behave: Their prices fluctuate with commodity prices, although a company's fundamentals have far-reaching effects on its stock price in the long run.

SQM; Arcadium Lithium, which listed itself earlier this year; and Albemarle are all profitable lithium companies, but there's a reason why Albemarle stock was one of the top performers during the lithium price boom and why it logged the biggest gains among lithium stocks this week.

One lithium stock to buy now

Albemarle is one of the world's largest lithium producers and the world's largest lithium company in terms of market capitalization. Despite lower lithium prices, Albemarle's net sales surged 31% to a record high of $9.6 billion in 2023. It earned its second-highest net profits of $1.6 billion in the year.

Tumbling lithium prices have hit Albemarle's top line since, forcing it to cut production and put growth projects on hold to preserve cash. As of the end of the second quarter, the company projected revenue of only $5.5 billion to $6.2 billion for 2024. Albemarle has the financial flexibility to navigate down cycles and should be one of the biggest beneficiaries as and when the lithium markets recover. That's why if I were to place a bet on one lithium stock now, it would be Albemarle.

Should you invest $1,000 in Albemarle right now?

Before you buy stock in Albemarle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Albemarle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $730,103!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. TheStock Advisorservice has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of September 9, 2024

Neha Chamaria has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.