Provided Content: Content provided by Barchart. The Globe and Mail was not involved, and material was not reviewed prior to publication.

Northrop Grumman and 2 More Stocks Politicians Are Buying

While they don't quite fit into the same category as company insiders, politicians are arguably better informed than the average retail investor about the potential consequences of their own fiscal policies. That said, members of Congress have generally proven to be as hit or miss as the rest of us when it comes to stock picking - but their personal investments are, nevertheless, matters of understandable public interest.

In the current climate - with geopolitical tensions running high, regulatory issuesfront and center, and elevated bond yields raising alarms - we bring to you three stocks that U.S. politicians have been buying with their own money, on their own behalf. Interestingly, these stocks all stand out as defensive plays - most notably, Northrop Grumman (NOC) is an actual defense giant, and the other two Beltway buys are drawn straight from the consumer staples space. While these names are traditionally defensive, it's worth pointing out that one of these companies would seem to be facing some heightened risk right now… in the form of scrutiny from federal regulators.

That said, here's a look at three stocks members of Congress are buying.

Northrop Grumman

First up, with the fate of a multi-billion dollar aid package for U.S. allies Israel and Ukraine hanging in the balance, we have Northrop Grumman, the aerospace and defense giant. Commanding a market cap of $72.38 billion, Northrop is one of the world's largest weapons manufacturers, and a major provider of military aircraft, spacecraft, and defense systems.

NOC offers a dividend yield of 1.50%, and appears to have caught the attention of Rep. Josh Gottheimer (D-NJ), who purchased shares of the defense titan on Sept. 26. Gottheimer, who serves on the House Financial Services Committee and the House Permanent Select Committee on Intelligence, is one of the most active traders in the House, and also picked up shares of Tesla (TSLA), Eli Lilly (LLY), Broadcom (AVGO) and Mastercard (MA) in late September.

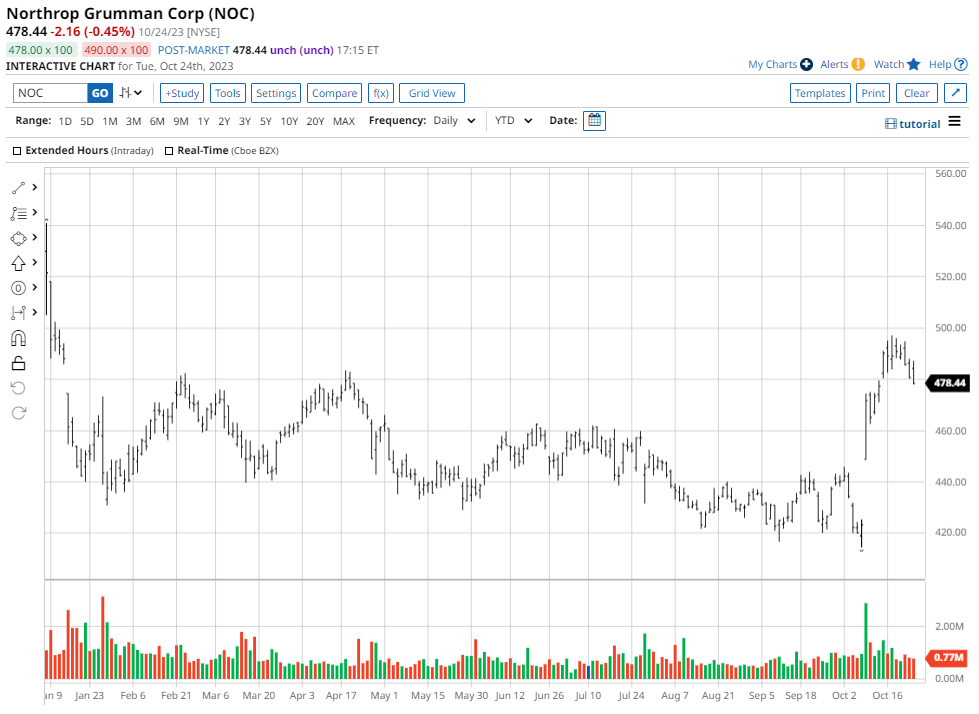

Northrop stock has corrected 10% on a YTD basis - but the shares are up 13.9% in the past month alone, propped up by the ongoing Israel-Hamas conflict. (Shares of recent Gottheimer pick Tesla, for what it's worth, are down about 13% over the past month.)

Northrop is set to report its Q3 earnings this Thursday, Oct. 26, with analysts expecting the company to report adjusted EPS of $5.73. In the previous quarter, the company's revenue and earnings both came in above expectations, and sales of $9.6 billion were up 9% from the year prior.

With interests in a range of product offerings - from missile defense and commercial space operations to multi-domain warfare support, F-35 fuselage production, advanced AI, supercomputers, and related services - NOC has diversified well beyond old-school defense. Further, the company's strong order backlog (about $79 billion), along with its expansion into Europe and continuing tensions in the Middle East and Ukraine, all provide strong revenue visibility, as defense spending seems likely to remain robust.

Analysts have a “Moderate Buy” rating on the stock with a mean target price of $506.88. This indicates an upside potential of roughly 5% from current levels. Out of 15 analysts covering the stock, 7 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, 6 have a “Hold” rating, and 1 has a “Strong Sell” rating.

Mondelez

Taking a sharp left turn from defense and tech stocks, another House member just picked up shares of the confectionery giant responsible for iconic brands like Cadbury, Oreo, Ritz, and Trident.

When Rep. Richard Larsen (D-WA) recently purchased shares of Mondelez (MDLZ) on Oct. 4, it was notable in part because he doesn't trade nearly as actively as his colleague Gottheimer. Larsen has represented Washington, D.C.'s 2nd district since 2001, and is the ranking member of the House Transportation and Infrastructure Committee.

With a giant market cap of $87.15 billion, Mondelez's products are sold in over 150 countries and regions, and it employs over 80,000 people worldwide. It also offers a dividend yield of 2.41%, and is part of Warren Buffett's portfolio. In 2023,Mondelez stock is roughly flat - but over the last five years, the stock is up 79%.

In Q2 2023, Mondelez said net revenues increased by 17% from the previous year to $8.5 billion, while EPS of $0.76 was up 13.4% - and continued the company's streak of topping analysts' consensus bottom-line estimates. Over the past five years, MDLZ has grown revenue at a compounded annual growth rate (CAGR) of 5.3% and EPS at a 6.3% CAGR.

In terms of its credentials as a defensive stock pick, Mondelez's standing as a global consumer goods giant is evident from its diverse revenue base spread across different markets, including Europe (36%), North America (31%), Asia (21%), and Latin America (12%) - which helps to insulate the company somewhat from adverse region-specific macro developments.

Analysts have a “Strong Buy” rating on the stock, with a mean target price of $80.41. This indicates an upside potential of roughly 22.4% from current levels. Out of 17 analysts covering the stock, 14 have a “Strong Buy” rating, 1 has a “Moderate Buy” rating, and 2 have a “Hold” rating.

Kroger

Next up is Kroger (KR), which has a high-profile investor in Senator Tommy Tuberville (R-AL).

Kroger is one of the largest grocery retail chains in the U.S., operating over 2,700 stores in 35 states. Founded in 1883, the over century-old company offers a wide variety of grocery and other household items, as well as fuel and pharmacy services.

The grocery chain attracted attention from members of the Senate earlier this year not only over wage and labor concerns, but also in relation to a high-profile acquisition that's still in the works. Tuberville, who bought KR shares in late September, sits on multiple Senate committees - including Agriculture, Nutrition, and Forestry; Armed Services; and Health, Education, Labor, and Pensions.

The former Auburn University head football coach is not only one of the most active traders on Capitol Hill, he's also one of the highest rollers, with the second-largest trade value over the last 60 days. However, he appears to have steered clear of violating the STOCK Act in recent years.

Kroger's market cap currently stands at $31.37 billion, and offers shareholders a dividend yield of 2.45%. Kroger stock is up about 1% on a YTD basis, but the shares are up 146% over the last decade.

For its latest quarterly results, Kroger reported revenues of $33.9 billion, down 2.3% from the year-ago period. However, Kroger's EPS of $0.96 were up 6.7%, and surpassed expectations for EPS of $0.91. In fact, the company's EPS has surpassed expectations in each of the past five quarters.

Notably, Kroger's digital business is generating a substantial portion of its overall revenues. Sales from Kroger's digital channel recently exceeded $10 billion, and are set to grow much stronger than Kroger's consolidated top line.

Further, Kroger's impending acquisition of Albertsons (ACI) - on pace to close in early 2024 - will allow it to challenge the market leader, Walmart (WMT), with a bigger footprint.

Analysts have assigned a “Moderate Buy” rating on KR, with a mean target price of $52.71. This denotes an upside potential of about 19% from current levels. Out of 13 analysts covering the stock, 6 have a “Strong Buy” and 7 have a “Hold” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.