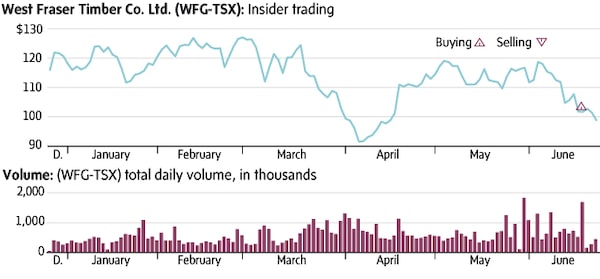

Forest product stocks have been cut down this year over fears rising bond yields will destroy housing demand. West Fraser Timber Co. Ltd. WFG-T is no exception, off more than 15 per cent year-to-date. When it reported first-quarter results, West Fraser noted it has experienced transportation and logistics constraints in North America. On the positive side, West Fraser expects aging housing stock to support repair and renovation demand for lumber, plywood and oriented strand board. Meanwhile, during the recent sell-off an officer bought 2,568 shares in the public market on June 17.

stock

Ted Dixon is CEO of INK Research, which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.