A positive week for the S&P/TSX Composite saw equities climb 1.3 per cent to Thursday’s close. Technically speaking, the benchmark’s Relative Strength Index (RSI) reading of 51.1 puts it in neutral territory, roughly mid-way between the oversold buy signal of 30 and the overbought RSI sell signal of 70.

There are eight oversold, technically attractive index member stocks according to RSI this week. Transcontinental Inc is the most oversold company in the benchmark, followed by Celestica Inc., Altagas Ltd., Aecon Group Inc., Canfor Corp., Advantage Oil and Gas Ltd, CCL Industrials Inc. and Kelt Exploration Ltd.

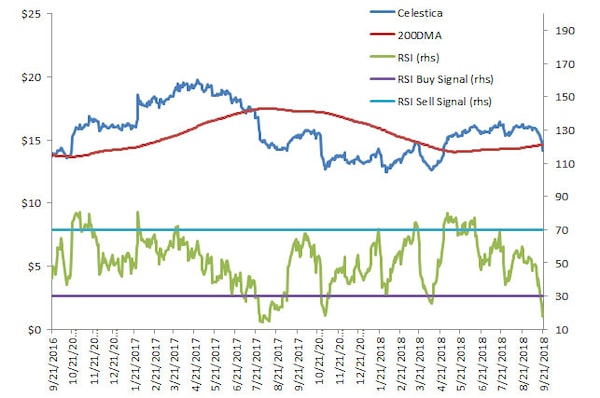

I picked Celestica as the focus chart this week in part to see whether it can provide a window into what’s happening in the technology sector generally. The stock appears to be another case where the 200-day moving average is an important indicator of reliability for RSI buy signals.

In July 2017, Celestica was significantly oversold from late July to early September, but the buy signal was followed by a small rally before further weakness ensued. The same pattern reoccurred in early November 2017, late January 2018 – buy signals predicted a small bounce but not a sustainable rally.

An RSI buy signal on April 9, 2018 did work well as Celestica rallied 31 per cent to mid-July.

The stock does seem sensitive to the 200-day moving average trend line. The 200 day provided price support in September and October 2016, and resistance to further gains on March 15 of this year.

Celestica’s stock price is currently below the 200-day moving average – making the buy signal suspect – but it’s not far below the line. If the price pops above the 200-day, this could become a reasonably interesting buying opportunity.

As always, investors should always complete fundamental research before making any investment.

The Relative Strength index uncovers nine stocks this week that are frothy and overbought, led by Enercare Inc. Nevsun Resources Ltd. is the second most technically vulnerable S&P/TSX member, followed by Torex Gold Resources Inc., Labrador Iron Ore Royalty Co., Alaris Royalty Corp., ATS Automation Tooling Systems , Aurora Cannabis Inc., Methanex Corp., Intact Financial Corp., and Canadian Imperial Bank of Commerce.