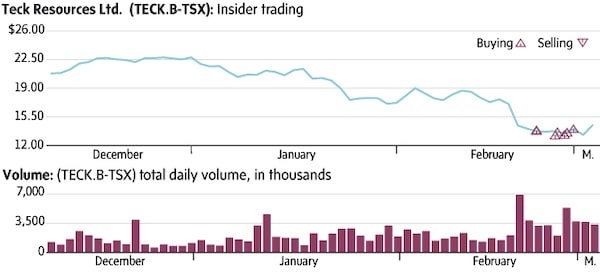

Teck Resources Ltd. is in part a proxy for the health of the Chinese economy given the company’s exposure there. In 2019, revenue from China represented just under 17 per cent of total revenue, the highest of any country. For investors who believe the Chinese economy is on the path to recovery, Teck could be a way to play the prospect of better days ahead. Insiders seem to be betting on it, with six of them spending total $945,955 buying shares as the stock traded under $14.

stock

Ted Dixon is CEO of INK Research which provides insider news and knowledge to investors. For more background on insider reporting in Canada, visit the FAQ section at www.inkresearch.com. Securities referenced in this profile may have already appeared in recent reports distributed to INK subscribers. INK staff may also hold a position in profiled securities.

Chart reflects public-market transactions of common shares or unit trusts by company officers and directors.