Traders work on the trading floor at the New York Stock Exchange in Manhattan on Aug. 2.ANDREW KELLY/Reuters

In the stock market, it’s February, 2020, all over again.

The colossal slump that has seized financial markets around the world in recent months has now reduced the S&P/TSX Composite Index to roughly the same level it was just prior to the COVID-19 crisis.

After more than 2½ wild years, in which investors saw markets crash over the worst pandemic in a century, only to storm back in a bull run for the ages, before crumbling once again in the fight over inflation, the net effect has been zero – by one measure, at least.

The experience of such a powerful and compressed boom-and-bust cycle, however, will leave a mark on those who participated in it. Like the global financial crisis and the bursting of the dot-com bubble, these are the moments that stand out over a lifetime of investing.

“You can study history all you want, but there’s nothing like living through it to make you understand your own behaviour,” said Craig Basinger, chief market strategist at Purpose Investments. “What is your true risk tolerance? Because you would have experienced it, in both directions, in the last two years.”

After the initial pandemic shock wave hit financial markets in early 2020, the sell-off lasted all of a month before the rally was under way. Fuelled by the full force of the world’s central banks, the stock frenzy would ultimately generate absurd returns among the most speculative and dodgy pockets of the market, such as meme stocks and cryptocurrencies.

And in a market where reckless risk taking is handsomely rewarded, investors in plain vanilla portfolios tend to get more than a little covetous. The fear of missing out permeated not only the retail investing community, but also put pressure on portfolio managers. Steering clear of the speculative excess generally meant falling short of the market’s towering returns.

Of course, it was all predicated on central banks, particularly the U.S. Federal Reserve, remaining hyper-accommodative. Once inflation forced the Fed’s hand, the bull market was doomed.

“You can’t argue with ‘Don’t fight the Fed,’” Mr. Basinger said. “In a disinflationary environment, central bankers can go to town and do whatever they can to help the economy along.”

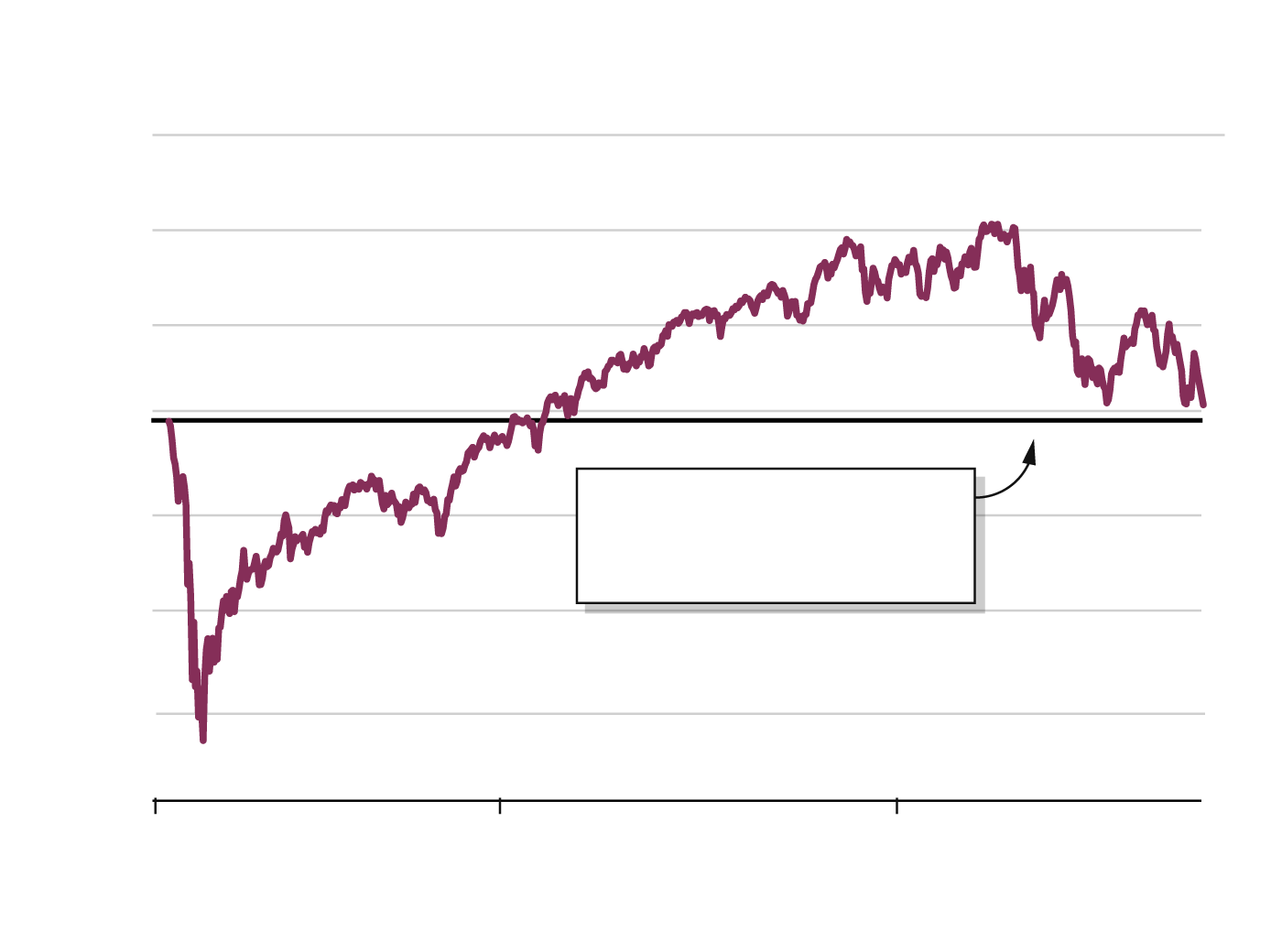

The TSX’s round trip

This year’s sell-off in Canadian stocks has effectively wiped out two-and-a-half years of gains.

24,000

22,000

20,000

18,000

16,000

The S&P/TSX is close to falling to its prepandemic high

14,000

12,000

10,000

Feb.

Jan.

Jan.

2020

2021

2022

the globe and mail, Source: refinitiv eikon

The TSX’s round trip

This year’s sell-off in Canadian stocks has effectively wiped out two-and-a-half years of gains.

24,000

22,000

20,000

18,000

The S&P/TSX is close to falling to its prepandemic high

16,000

14,000

12,000

10,000

Feb.

Jan.

Jan.

2020

2021

2022

the globe and mail, Source: refinitiv eikon

The TSX’s round trip

This year’s sell-off in Canadian stocks has effectively wiped out two-and-a-half years of gains.

24,000

22,000

20,000

18,000

The S&P/TSX is close to

falling to its prepandemic

high

16,000

14,000

12,000

10,000

Feb.

Jan.

Jan.

2020

2021

2022

the globe and mail, Source: refinitiv eikon

In the stock market, the Fed is akin to the tide, lifting (or lowering) all boats. This is not a new lesson for investors, but it’s one that has been vigorously reinforced by the swings in pandemic-era markets.

Another major takeaway is that valuation still matters. For a while there, trading multiples had little relevance in determining how stocks performed. With near-zero interest rates seeming like an indefinite reality, growth stocks were the only game in town.

When runaway inflation ultimately forced the Fed into the fastest rate-hike cycle on record, a brutal reappraisal of the most richly valued assets was soon to follow.

Consider Shopify Inc. SHOP-T The Ottawa-based e-commerce company’s price-to-earnings multiple exceeded all rational limits when its stock rose by more than 350 per cent between February, 2020, and November, 2021. Once the reckoning came for high-valuation stocks, sectors and styles, Shopify went into freefall. Its loss in share price from its peak now sits at more than 80 per cent.

“As longer-term investors, I think we should be happy for this normalization of interest rates,” said Stephen Lingard, the head of investment research of CI Investments’ multiasset team.

For one, higher rates have made the Canadian stock market look better by comparison. Valuations on the average TSX stock didn’t rise anywhere close to the level of its U.S. counterpart. So domestic stocks were less vulnerable to the global sell-off in the first place. That explains why the S&P/TSX Composite is down by just 14 per cent so far this year, while the S&P 500 has lost 25 per cent, and the Nasdaq Composite Index is off by 33 per cent.

Even after a bruising slide, U.S. stock benchmarks are still generally not cheap by historical standards. The S&P/TSX Composite, on the other hand, is trading at about 13 times earnings estimates, down from 19 times prior to the pandemic.

Another way of putting it is that the TSX benchmark index is essentially flat over the past 2½ years, while earnings have risen by roughly 50 per cent.

“That’s good news,” Mr. Lingard said, adding investors are getting the earnings power of the TSX at a “six-point discount” to what they could get historically.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.