In the spring of 2017, bombs were detonated under the bus of a pro football team in Germany. Terrorists were initially suspected, but the truth was more bizarre – it was a short seller.

Sergei Wenergold had purchased 15,000 put options on the club’s shares, expecting to profit big time when they plunged after the attack. Miraculously, nobody was seriously injured and the club’s stock barely budged. Mr. Wenergold ended up with 14 years in jail.

Short sellers are sometimes accused of manipulating stocks, although the deed usually involves spreading false information instead of bombs. Nonetheless, these machinations are infrequent, according to academic studies.

For example, a study by Professors Purnanandam and Seyhun in the June 2018 Journal of Financial & Quantitative Analysis concludes: “On average, short sellers bring informational efficiency to market prices rather than destabilize them.”

That’s why it’s worth monitoring short sellers. According to dozens of peer-reviewed studies, their trades usually incorporate more accurate views of the world, and are better at signaling what’s up ahead. To make a long story short (no pun intended), large short positions tend to foreshadow underperformance.

So, what is short selling activity telling us during the first half of November? Let’s examine short positions on exchange-traded funds (ETFs) to see what bearish sentiment is like at the market and sector levels. Let’s also highlight some individual stocks currently in short sellers' sights.

Bearish bets at the market level

Bearish sentiment on the Toronto Stock Exchange can be proxied by the short position in the iShares S&P/TSX 60 Index ETF (XIU-T). Since it tracks the 60 biggest companies in terms of market capitalization, a large short position in XIU could warn of a market downturn.

On this basis, we may not have much to worry about: as of Oct. 31, short interest in XIU stood at 85.6 million, a level not too far above the average of recent years. If short interest had stayed at the year-to-date high of 122 million units, then we might have some concerns.

Bearish bets at the sector level

Preferred shares, energy companies, REITs and European blue chips are the sectors tracked by ETFs with significant amounts of short interest. Specifically, the ETFs are: BMO Laddered Preferred Shares (ZPR-T), iShares S&P/TSX Capped Energy (XEG-T), iShares S&P/TSX Capped REITs (XRE-T) and BMO MSCI EU High Quality Stocks (ZEQ-T) ETFs.

ZEQ appears to be the most significant case. Although it had only the fourth largest number of shares short, it had the highest percentage of units sold short (15 per cent) and a huge percentage increase in short interest during the two weeks to Oct. 31.

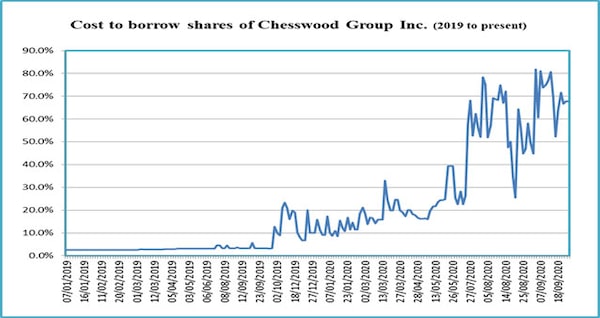

The escalating cost to borrow shares in a leasing company

Following the COVID outbreak in March, Chesswood Group Ltd. (CHW-T) granted payment deferrals and accommodations on a number of its equipment leases to companies. Management also launched cost-cutting measures and reduced – then suspended – its dividend. The company’s shares are currently trading 40 per cent lower than at the beginning of 2020. The cost to borrow shares had been rising before COVID and continued afterward to now stand above 60 per cent (annualized).

The Globe and Mail

Rising short position in Ballard Power shares

Hydrogen fuel-cell developer Ballard Power Systems Inc. (BLDP-T) has seen a doubling in its short position to nearly 18 million shares during the past six months. Over 90 per cent of the short position is on the NASDAQ and the rest is on the TSX. Ballard Power’s shares have gone parabolic during the past 12 months and now trade 160 per cent higher.

The Globe and Mail

Writing on seekingalpha.com, Henrik Alex warns the company has had some setbacks that could undermine its near and medium term prospects at a time when market valuation is very high. The setbacks include COVID-19 related delays in orders from customers, changes in China’s subsidy incentives for alternative energy vehicles and a reduced scope in the technology development contract signed with the Audi subsidiary of German auto company Volkswagen Group.

Ballard Power’s technology is used in more than 650 electric buses and more than 2,200 electric trucks in China. The company’s stock got a lift in July from a $7.7-million order from China. On the balance sheet, there is over $300-million in cash (from a recent issue of shares) and no debt.

Activist short seller Spruce Point Capital released a sell recommendation on Ballard Power in 2018. Lakewood Capital published a bearish report this past summer. It believes the company is facing a commoditized and competitive landscape, and has been a “consistently loss-making and cash-burning Canadian company.” Lakewood Capital adds: “We have tracked Ballard Power … for the past decade, and on five separate occasions, investors bid up the shares in a frenzy only to be left holding the bag months later when they came crashing down to earth.”

Larry MacDonald can be contacted at mccolumn@yahoo.com

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.