The bulls are back in charge. Since the start of the year, stock markets have ripped higher, propelled by growing evidence that the global economy is in better shape than we feared a few months ago.

Canada’s S&P/TSX Composite Index has surged more than 6 per cent since New Year’s Day. The S&P 500 Index in the United States has jumped 8 per cent.

Riskier and more speculative assets have performed even better. The tech-heavy Nasdaq Composite Index is up 15 per cent so far this year. Bitcoin has gained 40 per cent. Tesla Inc. TSLA-Q, the favourite motorcar of tech bros everywhere, has rocketed 76 per cent higher.

After a stunningly awful 2022, the new outpouring of optimism is a welcome change for investors. But the sheer exuberance of the moves in recent weeks raises the question of whether we’re witnessing a rational repricing of the market outlook or just another manic – and temporary – swerve in sentiment.

Let’s look at the arguments, pro and con.

On the pro side of the ledger, the new bullishness does start with a genuine improvement in global fundamentals. China’s economy is reopening after nearly three years of rotating lockdowns. The euro zone has managed to survive the cutoff of Russian gas supplies and is faring better than just about anyone would have predicted six months ago.

Meanwhile, in North America, inflation has brightened everyone’s mood by turning lower.

Calm down

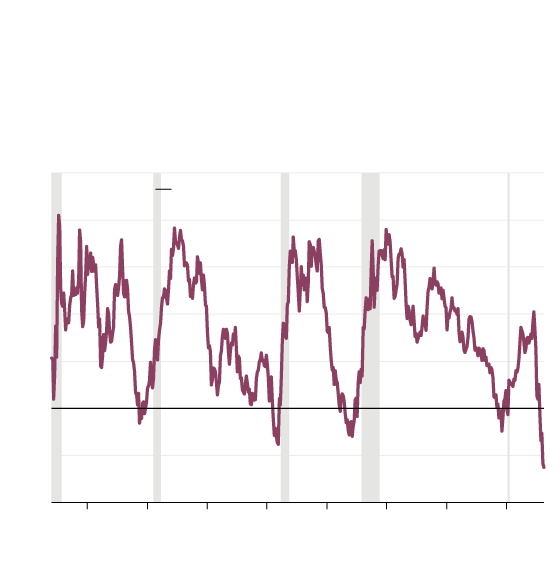

An inversion of the yield curve – such as occurs when three-month

Treasury bills pay more than 10-year Treasury bonds – has been an

excellent indicator of past downturns. Right now, the curve is at its

most inverted point in decades. (Yield on 10-year Treasury bond

minus yield on three-month Treasury bill)

5%

U.S. recessions

4

3

2

1

0

-1

-2

1985

1990

1995

2000

2005

2010

2015

2020

the globe and mail, Source: federal reserve bank of st. louis

Calm down

An inversion of the yield curve – such as occurs when three-month

Treasury bills pay more than 10-year Treasury bonds – has been an

excellent indicator of past downturns. Right now, the curve is at its

most inverted point in decades. (Yield on 10-year Treasury bond

minus yield on three-month Treasury bill)

5%

U.S. recessions

4

3

2

1

0

-1

-2

1985

1990

1995

2000

2005

2010

2015

2020

the globe and mail, Source: federal reserve bank of st. louis

Calm down

An inversion of the yield curve – such as occurs when three-month Treasury bills pay more than 10-year

Treasury bonds – has been an excellent indicator of past downturns. Right now, the curve is at its

most inverted point in decades. (Yield on 10-year Treasury bond minus yield on three-month Treasury bill)

5%

U.S. recessions

4

3

2

1

0

-1

-2

1985

1990

1995

2000

2005

2010

2015

2020

the globe and mail, Source: federal reserve bank of st. louis

In Canada, total Consumer Price Index inflation was running at an 8.1-per-cent annual pace last June. It has since subsided to a 6.3-per-cent pace and is on track to slide below 3 per cent by the end of this year, according to the forecasters at Toronto-Dominion Bank.

A similar easing is taking place in the United States. “We can now say I think for the first time that the disinflationary process has started,” Federal Reserve chair Jerome Powell declared this week after bumping up the U.S. central bank’s key interest rate by a quarter percentage point.

If the disinflationary momentum sustains itself over the months ahead, central bankers won’t need to keep flogging their economies with high interest rates for that much longer. According to futures markets, policy makers are more likely to be cutting rates by year end than raising them.

All of this bodes well for the North American economy as a whole. Optimists can now construct a plausible “soft landing” scenario in which Canada and the U.S. escape a recession – or, at least, suffer recessions so mild that they hardly bear mentioning.

But do these happy thoughts justify the big market gains in January? That seems rather dubious.

For one thing, stocks still seem pricey, especially in the U.S., where shares are trading for about 33 times their average annual earnings over the past decade, according to Citigroup calculations. That is roughly double their historical average.

For another thing, despite all the talk about a soft landing – and despite some rip-roaring U.S. jobs numbers on Friday – a significant slowdown this year still seems to be the dominant possibility.

The yield curve, a measure of how short-term interest rates compare with long-term ones, has been a strikingly accurate predictor of past downturns. When the curve inverts – that is, when short-term rates move higher than their long-term counterparts – a recession typically follows. Right now, a deeply inverted yield curve is screaming recession ahead.

The remarkably strong U.S. jobs numbers on Friday add to the probability that the Federal Reserve will punish the economy by keeping short-term interest rates higher for longer. Policy makers will want to rule out any chance that the red-hot jobs market could reignite inflation.

Even if a downturn ultimately proves to be rather mild, share prices could still take a hit. That is because corporate profits soared during the pandemic. A reversion to the long-run trend – even without an economy-rattling recession – would entail significant pain.

Such a reversion may be already under way. Tech superstars Apple Inc. AAPL-Q, Alphabet Inc. GOOGL-Q and Amazon.com Inc. AMZN-Q all reported disappointing earnings this week. So did Ford Motor Co. F-N and Starbucks Inc SBUX-Q.

More pain could be in the works. Wall Street analysts have not yet marked down their earnings forecasts to the degree consistent with past recessions, according to a report this week from Oliver Allen, senior markets economist at Capital Economics. He argues that investors are putting too much faith in the dream scenario of a soft landing that would see inflation melt away harmlessly without any significant rise in unemployment.

“For now, we are sticking to our forecast that the S&P 500 will fall from around 4,150 at present to around 3,500 within the coming months,” Mr. Allen writes.

He isn’t the only observer to be skeptical about the current rally. Strategists at Morgan Stanley, BlackRock, GMO and Deutsche Bank sound equally glum. You may want to take a tip from them and refrain from betting too much on the market’s current giddiness.

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.