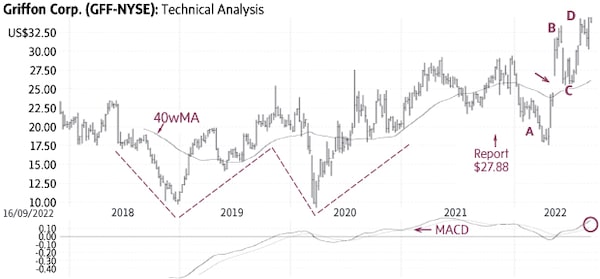

Our previous report (Nov. 5, 2021 - US$27.88) identified a breakout from a large “W” pattern (dashed lines) and provided an initial target of US$33. After a temporary reversal in early 2022 (A), it resumed the uptrend, had a bullish up-gap in May (arrow) and then reached US$33.38 to fulfill our target (B).

Subsequently, Griffon GFF-N had a minor correction to the 40-week Moving Average (40wMA) where it found good support near US$25.50 (C). The stock has since resumed the uptrend to a new all-time high to confirm the continuation of the uptrend (D).

Behaviour indicators including the rising 40wMA confirm the bullish status. A minor correction toward US$29-30 would provide a better entry level; only a sustained decline below US$26-27 would be negative.

Point & Figure measurements provide targets of US$36 and US$39. Higher targets are visible.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com

Be smart with your money. Get the latest investing insights delivered right to your inbox three times a week, with the Globe Investor newsletter. Sign up today.