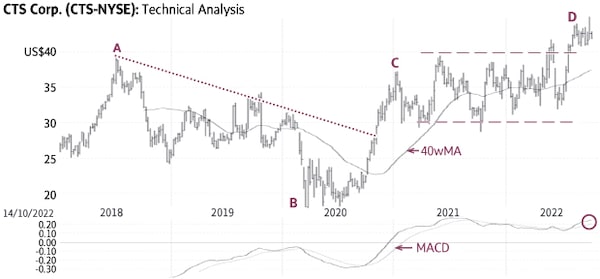

CTS Corp. declined from $39.20 in July, 2018, to $17.92 in March, 2020, (A-B) below a descending trendline (dotted line) and below a falling 40-week Moving Average (40wMA).

In late 2020 the stock moved above both of these indicators to signal a reversal of the negative trend. CTS (Friday’s close US$41.83) reached a high of $37.22 in January, 2021, (C) and then settled in a horizontal trading range mostly between $30 and $40 (dashed lines). The recent rise above this range signalled a breakout and the start of an uptrend toward higher targets (D).

Behaviour indicators including the rising 40wMA confirm the bullish status. There is good support near $39-40; only a sustained decline below ±$38 would be negative.

Point & Figure measurements provide targets of $49 and $54. The large trading range (dashed lines) supports higher targets.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com