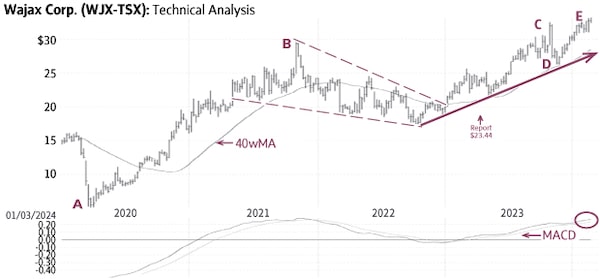

Wajax (WJX-T, Wednesday’s close $34.59) had a major rally from early-2020 to late-2021 (A-B), followed by a 50 per cent correction in the shape of a technical pattern known as a “declining wedge” (dashed lines). This pattern is invariably followed by a major up-leg as we projected in our April 5, 2023 report ($23.44), with a $28 target. Wajax reached a high of $32.57 in November (C) for a 39 per cent gain since our report in April.

The stock then pulled back to the rising 40-week Moving Average (40wMA) where it found good support (D) and now appears ready to resume the uptrend (E).

Behaviour indicators including the rising 40wMA and the rising trendline (solid line) confirm the bullish status. Only a sustained decline below the average (currently near $28) would be negative.

Point & Figure measurements provide targets of $37 and $39.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com

Monica Rizk

Monica Rizk