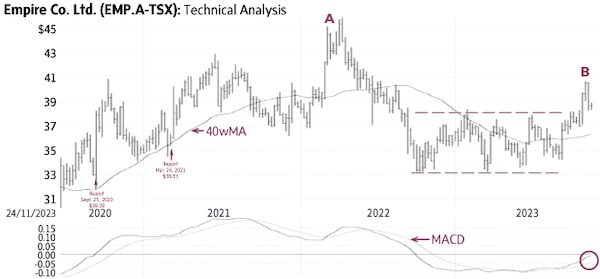

Empire (EMP-A-T, Tuesday’s close $38.28) started a long-term rising trend in 2017 (not shown). We recommended the stock on numerous occasions during this time, most recently in 2020 and 2021. The stock reached a high of $46.04 in 2022 (A) but reversed the trend during the second half of 2022 and settled in a horizontal trading range mostly between $33 and $38 (dashed lines). The recent rise above this range signaled a breakout and the start of a new up-leg toward higher targets (B).

Empire is currently in the midst of a minor correction for a better entry level. There is good support at ±$38 and then again near the 40wMA (currently at $36); only a sustained decline below the latter would be negative.

Point & Figure measurements provide an initial target of $43. Higher targets are visible.

stock

Monica Rizk is the Senior Technical Analyst of the Phases & Cycles publication (www.capitalightresearch.com). Chart source: www.decisionplus.com