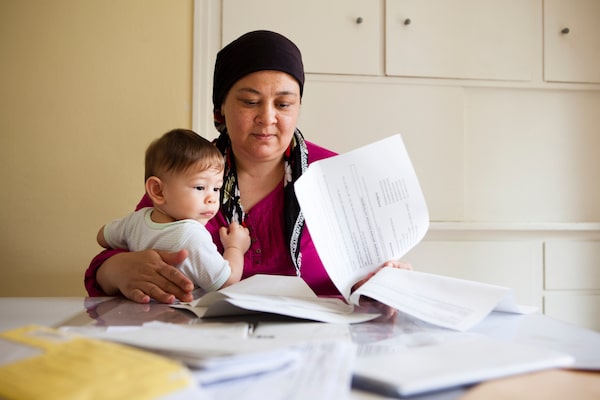

One expert says it’s important to talk about where these clients came from, what they experienced before coming to Canada, and how they feel about financial planning tools such as investments, insurance and mortgages.fotografixx/iStockPhoto / Getty Images

Sign up for the Globe Advisor weekly newsletter for professional financial advisors on our newsletter sign-up page. Get exclusive investment industry news and insights, the week’s top headlines, and what you and your clients need to know.

Many newcomers to Canada feel worried, overwhelmed and confused as they get their finances organized and navigate the banking system, according to a recent study from Bank of Nova Scotia. That makes it especially important for new immigrants to connect with financial advisors – and those who work with newcomers say they can become excellent long-term clients. The key is to earn their confidence.

That’s one reason why Peter Ficek, certified financial planner (CFP) at Terra Firma Financial Inc. in Calgary, says referrals are generally the best way to find clients who have recently arrived in Canada because some trust transfers from the person making the referral to the advisor.

“A good client is not necessarily a client who has a lot of money,” he says. “It’s simply a client with whom you have a meeting of the minds. The financial resources really should become a secondary factor.”

Mr. Ficek says people immigrating to Canada generally fall into one of two groups – those seeking asylum or better living conditions, whose initial priority is simply to sustain themselves and their families, and those who arrive, sometimes from the same countries, with substantial assets that may require sophisticated tax and estate planning advice.

Even within that first group, he says, there is an opportunity to start building a financial plan relatively soon after arrival as many newcomers are entrepreneurial, determined to find employment, committed to maximizing savings and looking ahead toward goals such as buying a home. However, getting clients invested appropriately may take some trust-building, too.

“Many come from countries that are either economically or politically challenged or both. Many of these countries have experienced currency defaults,” Mr. Ficek says. “So, a first hurdle is to convince them that in a triple-A economy they might have a more stable future.”

Once they learn the system, they do become good savers and are quite conservative when it comes to financial savings, he adds.

Beyond fact-finding, he says it’s important to talk about where these clients came from, what they experienced before coming to Canada, and how they feel about financial planning tools such as investments, insurance and mortgages.

Focus on building a credit score

In particular, there may be resistance to credit, says Tina Tehranchian, CFP and senior wealth advisor with Assante Capital Management Ltd. in Richmond Hill, Ont.

“In many countries, people live without any type of debt their whole lives,” she says. “Here, debt and credit are an accepted fact of life, and you need to actually build your credit score and establish credit.”

Ms. Tehranchian has advised affluent newcomers who can afford to buy a car outright to instead take out a car loan and pay it back on time so they can establish a credit record. The same goes for credit cards – even those who prefer to pay in cash can benefit from using one and paying the balance off in full every month.

When it comes to investing, Ms. Tehranchian echoes Mr. Ficek when she emphasizes that it’s important to explain the checks and balances that protect capital markets and how different securities work. It can be a big leap for people who come from a country where real estate is the primary investment vehicle to trust an asset that isn’t bricks and mortar.

“In a lot of old-world countries, people don’t take out nearly as much life insurance as we do here because the family system is very strong and people feel like if anything happens to them, their family will look after their children,” she says.

“But when they come here, their family doesn’t come with them. Usually, they’re on their own. Then, they’re in a much more precarious position actually than Canadians who were born here and do have some sort of network to fall back on.”

As a result, Ms. Tehranchian spends time educating newcomers on risk management.

Introducing education savings plans and insurance

Overall, new immigrants are often unaware of the need for a structured approach to their financial needs that includes a comprehensive financial plan, says Vikas Saida, financial advisor with Raymond James Ltd. in Mississauga. He makes a point of explaining the full range of options available for meeting specific goals because not all of those options may have been available in a newcomer’s home country.

A top priority is often saving for children’s education, so Mr. Saida introduces clients to registered education savings plans and the provincial student assistance program in case they need grants or loans. Like Ms. Tehranchian, he encourages clients to establish a credit rating in preparation for applying for a mortgage on a home that, with current housing prices, very few can afford to pay for in cash.

He also looks carefully at insurance needs and explains how the cost of goods and services here can differ from the value of such products in their previous home country. Initially, he finds a term policy is often the best life insurance solution because every dollar in expenses matters when a family is working to establish itself in a new country.

For Mr. Saida, setting newcomers up for financial stability and success is especially rewarding because he arrived in Canada as a new immigrant in 2003 and can relate to their challenges personally.

“In the long term, it becomes not only financially rewarding, but it’s a huge satisfaction that I can help somebody with the experience that I gained in the past 20 years,” he says.

For more from Globe Advisor, visit our homepage.