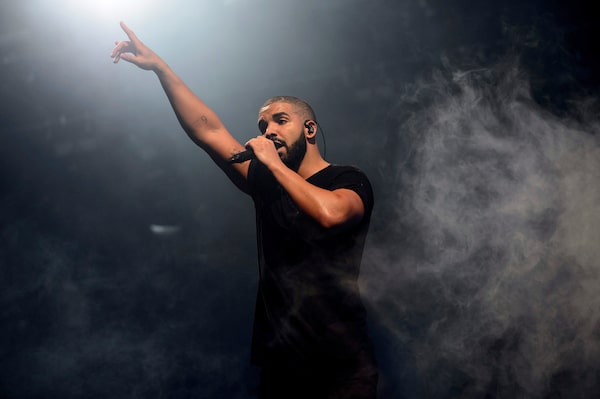

The portfolio of Toronto-based Music Royalties Inc., which plans to go public this year, includes songs from contemporary artists such as Drake, pictured in London in 2015, as well as legendary bands including the Rolling Stones, the Who and the Kinks. THE CANADIAN PRESS/AP, Invision - Jonathan ShortJonathan Short/The Associated Press

The Rolling Stones, Fleetwood Mac, Madonna, Drake, Justin Bieber and the Weeknd have topped music charts during different decades thanks to diehard fans. Now, their songs have struck a chord with yield-seeking investors, too.

Welcome to the music-royalty gold rush. Canadian investment funds and entertainment-focused firms have joined a global party in buying up rights to music catalogues that can generate royalty payments when songs are bought, streamed, performed or used in Peloton fitness classes.

“It’s an emerging trend driven by the growth of paid-streaming services and access to content from smartphones,” says David Vankka, portfolio manager with Calgary-based ICM Asset Management Inc., which manages a music royalty fund.

Investing in music royalties appeals to aging baby boomers seeking income amid low interest rates, but also millennials who grew up with streaming and see the potential for growth, Mr. Vankka says.

These assets offer diversification, but don’t have capital needs like an operating business, he says. “And streaming activity has demonstrated little correlation with economic cycles, equity markets or commodity price movements.”

Music royalties are paid to recording artists, songwriters, producers and other copyright holders for the right to use their intellectual property. The copyright is protected for the life of the author plus 70 years.

This space has gained attention recently as iconic artists including Bob Dylan, Stevie Nicks, Paul Simon and David Crosby have sold rights to their songs to record labels and other buyers. Estate planning or cash needs arising from a loss of touring income because of the COVID-19 pandemic may have spurred some deals.

Music streaming services, such as Spotify and Apple Music, have breathed new life into an industry ravaged by illegal downloading that sent CD sales plunging. Streaming now represents more than 62 per cent of worldwide recorded music revenue, according to the International Federation of the Phonographic Industry.

Furthermore, analysts at Goldman Sachs Group Inc. forecast that global music sales, which include live events that were cancelled or postponed because of the pandemic, would start to rebound this year and reach US$142-billion by 2030.

Pension funds are riding the streaming boom, too. Ontario Teachers’ Pension Plan Board recently raised its equity stake in Toronto-based Anthem Entertainment Inc., which owns rights to songs by artists such as Dan Hill and rock band Rush.

ICM Asset Management entered the space last autumn with ICM Crescendo Music Royalty Fund, which pays a monthly distribution and is available to accredited investors as well as certain eligible investors through an offering memorandum.

The fund, which is acquiring royalties in various genres, owns music rights to artists such as John Legend and Christian music/pop singer Lauren Daigle. Songs that are five to 10 years old are “the sweet spot for our fund,” Mr. Vankka says.

“We target paying under 10 times cash flow for the overall portfolio,” he says. “For larger, older catalogues, it’s common to see transactions well north of 20 times, such as for artists like Bob Dylan [who sold his catalogue in December].”

The industry growth has encouraged artists to sell their catalogues because they realize that valuations have gone up, says Michael McCarty, chief executive officer of newly formed Toronto-based Kilometre Music Group Inc.

Mr. McCarty and Rodney Murphy, both music-industry veterans, left their jobs with the Society of Composers, Authors and Music Publishers of Canada, or SOCAN, which collects and distributes music royalties in Canada, to start Kilometre Music Group as a music-rights management company because they saw a new opportunity.

“We have entered the greatest era of prosperity in the history of recorded music that is going to grow for many years,” Mr. McCarty predicts.

That growth is being driven not only by streaming services but also by online platforms such as TikTok or Snapchat, which have or are getting licensing deals to allow users to embed songs in their posts, he adds.

Kilometre Music Group teamed up with Toronto-based Barometer Capital Management Inc. to manage the recently launched Barometer Global Music Royalty Fund LP. The fund, which is available to accredited investors and pays a quarterly distribution, focuses on music rights by Canadian artists, songwriters and producers.

Music-royalty funds often have an exit strategy. Barometer Capital is now looking at selling its first music royalty fund, which launched in 2018, with a different strategy of owning Canadian and foreign-music rights.

Some foreign funds have gone public. Hipgnosis Songs Fund Ltd., which was co-founded by Canadian-born music executive and artist manager Merck Mercuriadis and musician Nile Rodgers, was listed on the London Stock Exchange in 2018. In January, it made headlines by buying the rights to songs by Neil Young and former Fleetwood Mac musician Lindsey Buckingham.

Round Hill Music Royalty Fund Ltd., which has songs by the Beatles and Rod Stewart in its portfolio, went public last autumn. The fund, which is also listed on the London Stock Exchange, is run by New York-based private equity firm Round Hill Music Royalty Partners.

In Canada, Toronto-based Music Royalties Inc., which owns 27 music-royalty catalogues, also plans to go public this year, but with a corporate structure. It now has a $20-million private placement offering through DealSquare, an online platform.

“In North America, there is no listed music royalty company paying a monthly dividend,” says Tim Gallagher, CEO of Music Royalties. The goal is to emulate an entity, such as gold-focused royalty company Franco-Nevada Corp. FNV-T, which is “a perpetual dividend story and a listed stock that trades like a gold bond.”

Music Royalties has more than 200 accredited investors who receive an annual dividend of 1.8 cents a share paid monthly, says Mr. Gallagher, a former CEO of Metalla Royalty & Streaming Ltd. MTA-X, a small-cap precious metals royalty play.

There are not even a thousand cash-flowing royalties in the mining world, but there are millions of music royalties – albeit smaller and fragmented – that are appealing given the industry’s double-digit growth, he says.

Music Royalties’ portfolio includes rights to songs from legendary artists such as the Rolling Stones, the Who and the Kinks, to more contemporary names, such as Drake, Eminem, Justin Bieber and Avril Lavigne.

Royalties from older songs can grow, he says, because they get re-recorded by new artists. His firm has rights to Dancing in the Moonlight, which was released by King Harvest in 1972, but there have since been versions by Toploader, Jubel with Neimy, and even by a K-pop band.

A risk in owning music royalties is the declining popularity of a song, but that can be mitigated by holding a diversified portfolio, he says. Rising interest rates are also potentially a risk as music royalties are “a yield play.”

“But the core of our proposition is that it is a new asset class that is certainly growing over the next decade,” Mr. Gallagher says. “In the past, the industry was totally private, but technology has made it more transparent. And streaming music has now become part of one’s utility bill.”

Editor’s note: An earlier version of this story stated incorrectly that Gavin Brown had left the Society of Composers, Authors and Music Publishers of Canada to start Kilometre Music Group. Rather, it was Rodney Murphy. We regret the error.