Illustration by Sam Island

Welcome to the fourth week of the Retire Rich Roadmap newsletter, which is all about building a lifetime of wealth to set you up for a comfortable retirement – and maybe even have some left over to pass along to later generations. (Week one, week two and week three can be found here, in case you missed them. Was this forwarded to you? Sign up for the full course here.)

At the tender age of 14, rock hopeful Paul McCartney wrote the lyrics to what later became the Beatles hit When I’m 64. The famous chorus asks what will happen when a young lover reaches the titular age: “Will you still need me, will you still feed me?” For Canadians past 64, the answers to those questions are yes and yes, sort of.

Older Canadians are needed – and their votes are definitely needed by political parties. Seniors tend to turn out at the polls in greater numbers than any demographic, meaning politicians cater to them. As to “feeding” seniors, there is financial support when you turn 65 (or 64 or 60), although most of us will go through our working lives with only a vague idea of how much Ottawa is going to help us when we retire. Some of us will also benefit from pension plans offered through our employers, but keeping track of how much we’ll receive from those programs can be similarly challenging.

So just what financial programs are available for senior-aged Canadian retirees?

Illustration by Sam Island

Are you down with CPP?

For most of us, the biggest chunk of change we can expect from Ottawa to support our retirement will be the Canada Pension Plan, a monthly taxable benefit designed to replace part of your working income.

Whether you are eligible and just how much you are going to get each month depends on a few factors. Specifically your age when you start to receive CPP, your contributions and your average yearly income.

At the bare minimum, you need to have made at least one contribution to the CPP during your working years (a low bar) and you must be at least 60 to be eligible to collect it.

CPP is not an exclusive club. The vast majority of us are eligible for it by dint of having worked at any time in our adult lives, declared income, and filed taxes. No one asked whether you wanted to contribute the plan. CPP is mandatory, so you were never given a chance to opt out when you were young and knew better (which might be a good thing).

How much can you collect? While the payout formula is a bit complicated, finding out precisely what you are eligible to collect and at what age is pretty straightforward. You can find your total contribution to the plan in your annual Notice of Assessment or on your employer-supplied T4.

For 2023, CPP says the maximum monthly amount you could receive as a new recipient starting the pension at age 65 is $1,306.57. Most of us will not receive that much. CPP reports that the average monthly amount paid for a new retirement pension (at age 65) in April 2023 is $760.07.

A big swing factor for the size of your CPP payment is when you elect to take it. In addition to your total contribution, your monthly CPP payment will depend on whether you opt to take it “early” at age 60 or wait until 65 or even 70.

CPP benefit calculations are based on the assumption that you will select benefits at age 65. For those that elect to take it at early, they lose 0.6 per cent for every month prior to age 65. That comes out to a loss of 7.2 per cent per year or, for those who take it when they are first eligible at 60, a loss of 36 per cent. You can also elect to defer payments until age 70, which will result in a total increase of 42 per cent to your payment.

You can run your own scenarios to figure out what age you should begin to collect CPP with The Globe’s CPP calculator tool.

Experts generally agree that it is better to wait it out if you can and get the maximum benefit at 70. Reasons for taking CPP at 60 include the simple fact that you need the money right away or you are in declining health (“use it or lose it,” in other words). CPP is indexed to inflation.

CPP is considered by some experts as an anti-poverty measure, designed to provide the bare minimum or 25 per cent of a person’s income in retirement. The government, recognizing that or mindful of those millions of senior voters, has been raising annual CPP contribution rates since 2019. The so-called CPP “enhancement” will over time allow the plan to replace 33 per cent of a person’s average lifetime earnings rather than the current 25 per cent.

It will not make much difference for those close to retirement as it is taking effect over decades, but it will make a big difference for those just entering the work force.

Illustration by Sam Island

Understanding OAS

Ottawa’s other cornerstone for seniors’ retirement is the Old Age Security (OAS) payment. As with CPP, it is a monthly payment intended to support seniors in retirement.

Not everyone is eligible for OAS. To receive the max OAS payout, you must be a Canadian citizen or permanent resident and have lived 40 years of your adult life in Canada. Those who have lived here less than 40 years will get a reduced payout. People who have lived in Canada less than 10 years are not eligible for any OAS benefit.

Unlike CPP, you can’t take OAS early. You must be 65 or older. You can, however, elect to delay taking it up until age 70. For every month after 65 that you hold off taking OAS, your payments will increase.

The math is the same as for CPP: By taking OAS at age 70, you increase final payments 0.6 per cent per month or by 36 per cent in total. Last year, the feds fulfilled a promise of boosting OAS payouts for those 75 and older by 10 per cent. That should encourage seniors to delay taking OAS until age 70 because it gives them an additional $13,000 in total.

OAS is subject to clawbacks based on your retirement income. The current maximum is $691 per month or $8,292 per year for those 65 to 74 and if you exceed a threshold ($82,000 in 2022), your payment will be partly reduced. For those 75 and older, the monthly maximum is $760.10.

Those with little or no retirement savings should choose to take OAS at 65 to take advantage of the Guaranteed Income Supplement (GIS). A tax-free monthly benefit added to OAS for pensioners with low incomes, it pays single retirees with incomes below $21,168 excluding OAS up to $1,043.45 per month, or 12,521 per year.

Illustration by Sam Island

Employee pensions

In addition to government programs, many Canadians will also have a pension through their employer. These fall into two major categories: defined contribution (DC) and defined benefit (DB). In planning your retirement, it’s important to know which kind of pension you have, and how to calculate how much money it will offer in retirement.

Defined contribution plans

With this type of pension, both the employee and employer make regular contributions to the plan, typically based on a percentage of your income. That money is then invested on the employee’s behalf and your eventual retirement income is determined by how well those investments perform.

Defined benefit plans

If you have a defined benefit pension, you are guaranteed a set monthly income in your retirement. The amount that you can expect is determined by a formula that takes into account your salary, your years of service at the company and often additional factors such as your age. It is your employer’s responsibility to ensure the pension fund has sufficient resources to pay its members’ benefits.

This article by Matthew Ardrey offers a deep dive into the benefits and drawbacks of DC and DB, along with the calculations for determining a pension’s value.

It’s well worth investigating whether your workplace pension, combined with government programs, will still feed you. And best to ask those questions before you’re 64.

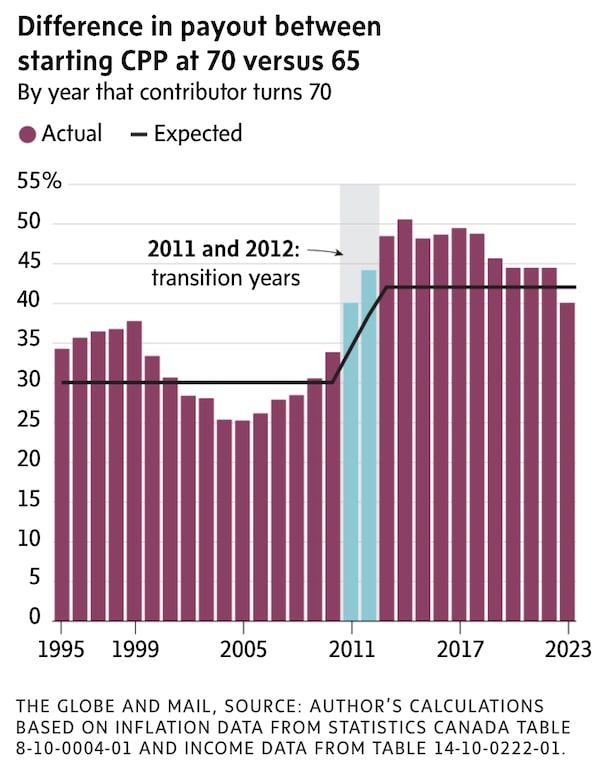

A graphic look

If you wait until 70 to start CPP pension, writes Frederick Vettese, former chief actuary of Morneau Shepell and author of Retirement Income for Life, the amount payable is adjusted upward. The adjustment factor – the “bump” – was just 30 per cent until 2010 but it has been 42 per cent since 2013 (2011 and 2012 were transition years). When you compare CPP pension starting at 70 with what you would be receiving if you started at 65, however, the bump has actually been more than 42 per cent between 2012 and 2022. (The reasons are technical and involve the difference between wage inflation and price inflation.) In 2023, the bump was less than 42 per cent, which is why he recommended that 69-year-olds in 2022 start their CPP that same year rather than waiting until 70. In another month or two, we will have a better idea of what to expect for 2024.The Globe and Mail

Try this at home

- Dig out your latest Notice of Assessment to determine your CPP payment and whether you can maximize it by waiting until 70 to collect it.

- Reduce your clawback. If your retirement income will exceed OAS income thresholds, there are some tactics to bring it down. Those include income splitting and shifting income-generating assets to TFSAs.

- Determine whether you have a DC or DB pension through your employer