Illustration by Sam Island

Hello,

Welcome back to Retire Rich Roadmap. Last week in the first instalment of this series “What is your retirement age, anyway?,” we briefly mentioned the idea of the retirement ratio, or what percentage of your working income you expect to live on when you leave the office for good.

Now, let’s dig deeper into determining your retirement cash-flow requirements by dissecting your lifestyle costs today and extrapolating those numbers into the future. The goal is to come up with an accurate picture of what it costs to keep you clothed, fed and sheltered (and all those taxes and fees paid) and forecasting what you will need every month when you take off your office wear for the last time.

Figuring out how much you are going to need every month in your post-work life is at the core of retirement planning. You can’t know how much you will need socked away in savings, investments and pensions if you have no idea how much you will realistically need month-to-month in retirement. (Knowing how long you will live would be useful information, too, but at best we can make some educated guesses on your departure date).

Figuring out how much you are going to need every month in your post-work life is at the core of retirement planning.

Financial types generally default to saying you’ll need 70 per cent of your current monthly expenses in retirement. Some people are frugal by nature and can live on far less, while others are determined to live large, an outlook best exemplified by those gleeful “We’re spending our kids’ retirement” bumper stickers.

For those with a faraway horizon, say age 35 right now, it’s safe to assume your peak earning years are ahead of you in your 50s and 60s.

If you are making $100,000 a year in your best earning years, you would need $70,000 annually in retirement income. That percentage could drop to 60 per cent or less if a couple were to retire with a paid mortgage and children who are out of the nest and no longer a financial burden. Assuming a 20-year retirement starting at 65, that works out to $1.4-million. The age 65 target is not arbitrary. It’s the age when you can receive full benefits from your Canada Pension Plan (CPP). It’s also pretty close to 64.5 years, which was the average retirement age in 2021.

Illustration by Sam Island

What are you getting from the government?

Government programs should be factored into any calculation. The maximum CPP payment in 2023 is $1,306.57 per month or $15,679 per year. Old Age Security (OAS) will provide a max of $698.60 per month for those over 65 and $768.46 per month for those over age 75, based on income eligibility. Those earning $137,331 or more annually are not eligible for OAS.

Complicating factors need to be addressed as well. If you want to retire earlier, say 55 or 60, your time in retirement will be longer and your savings pile will need to be larger because you will be drawing from it for longer. As well, many advisers warn that assuming 20 years in conventional retirement starting at 65 puts you at real risk of outliving your savings if you make it past 85. Mortality stats back that up. For a group of 1,000 men who retire this year at age 65, 918 will make it to 75, and more than half will make it to 89.

Other ways to size your retirement pile

Beyond the 70-per-cent retirement principle, other rough guides to calculate how much you will need in retirement reflect different aspects of financial goal setting, investing and portfolio construction.

There’s the 4-per-cent withdrawal-rate method. Often used in the financial services community, this principle means you build up a portfolio that will provide a set amount of annual income at a 4-per-cent withdrawal rate. So if you required an income of $60,000 annually, you would need $1.5-million in savings.

The rate of 4 is based on historical market returns of 7 per cent and annual inflation of 3 per cent. Those underlying assumptions show just how devastating the current combo of high inflation and shaky markets can be for retirees. Some experts, including the rule’s creator, now say 5 per cent is a better withdrawal-rate target.

The nice thing about the 4- (or 5-) per-cent rule is that it can be used just as well for those who want to retire early, say age 50 or 55, as those who retire at 65 or beyond.

Illustration by Sam Island

Multiples of 10 to 14

Much like the 70-per-cent rule, this approach rests on using your last few years of income as a guide for how much you’ll need to save in retirement. You multiply the amount made in those (presumably peak) earning years by between 10 and 14.

Fix today and your future self will thank you

Whether you expect to be a saver, big spender or that average 70-per-cent-er, it’s safe to assume costs in retirement are only going to rise in the future. Government-supported health care is already under strain so it’s wise to expect to be paying a greater share of your medical costs.

But the first step in the planning process is not looking forward but rather looking at your current costs.

What do you spend month to month currently? This list includes regular bills such as mortgage/rent, utilities, food and entertainment, clothing, transportation, insurance, taxes and maintenance.

The federal government optimistically states that Canadians spend 35 to 50 per cent of their income on housing and utilities, while conceding people living in big cities typically pay a larger percentage of monthly income on the basics.

Most people have a rough idea how much they spend each month. If you don’t, now is the time to dig out your credit card and bank statements to see what your money is spent on month to month. You also need to approximate those sneaky and less predictable expenses such as vehicle and home repairs.

Illustration by Sam Island

Fixed versus variable

Determining and tracking fixed expenses should be easy as they are regular monthly or annual charges that appear on your credit card/bank statements in roughly the same amount. They might include child-care bills, membership fees, loan repayments, phone/internet/TV bundles and insurance premiums. Variable expenses are not predictable from month to month and include food and entertainment, vacations, vehicle repair and home maintenance.

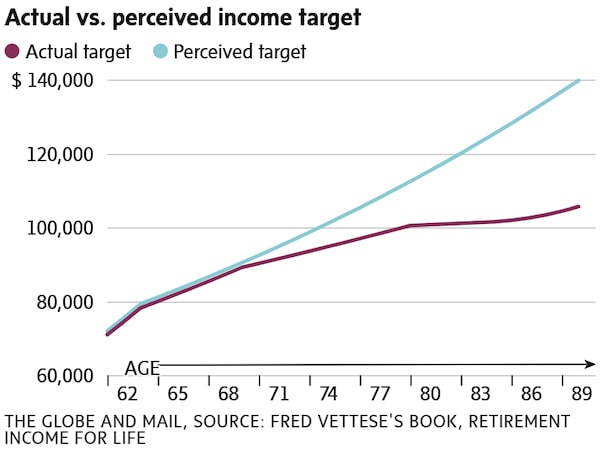

A graphic look

Most Canadians believe that a retiree’s income needs tend to increase with inflation, writes Frederick Vettese, former chief actuary of Morneau Shepell and author of the book, Retirement Income for Life. Academic studies from Germany and other countries indicate this is not true. Actual income needs do rise with inflation until age 70 but rise more slowly in one’s 70s and 80s. Once a retiree reaches age 90 or so, income needs once again rise with inflation. In the chart, inflation is assumed to be 5 per cent a year for 2023 and 2024 and then 2.2 per cent a year in future years.

Try this at home

- Run our retirement calculator to get a better handle on the costs you have today and compare them with what you can expect in retirement.

- How much is the government going to kick in? These tables will give you an idea of how much your CPP will be if you elect to take it early or at 65.

- Ask tough questions of your adviser. If you are like the roughly half of Canadians who don’t know how much they need to save for retirement, it’s time to find out what your trajectory might be. You may be pleasantly surprised – or you may need to buckle down.